Doctor loses RM285k in phone scam

Abstract:The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

A 31-year-old doctor in Pahang has lost RM285,000 after falling victim to a phone scam syndicate that carefully impersonated multiple authorities to gain his trust.

According to Pahang police chief Datuk Seri Yahaya Othman, the incident began on December 31 when the victim, who works at a hospital in the state, received several phone calls from unknown individuals. The callers first posed as officers from Tenaga Nasional Berhad (TNB), before transferring the call to another person claiming to be a police officer.

The fake “police officer” alleged that the doctor was linked to serious offences, including electricity meter tampering, money laundering and digital fraud. To make the story more convincing, the victim was told that he was under investigation and instructed to stay in constant contact with the suspect, even being asked to report his daily movements.

Over time, the scammers pressured the victim into taking out a loan from a financial institution, claiming the money was required as part of the investigation process. He was then instructed to transfer funds to seven different bank accounts. In addition, the victim was told to purchase 35 Razer Gold top-up cards and hand over the PIN numbers to the suspects.

By the time he realised something was wrong, the damage had already been done. The doctor had lost RM285,000, made up of his personal savings and bank loans. He only became suspicious when the suspects demanded even more money and subsequently became unreachable.

Police have classified the case under Section 420 of the Penal Code for cheating. Authorities have once again reminded the public to be extremely cautious of phone calls involving alleged investigations, especially those that demand secrecy, money transfers or prepaid vouchers.

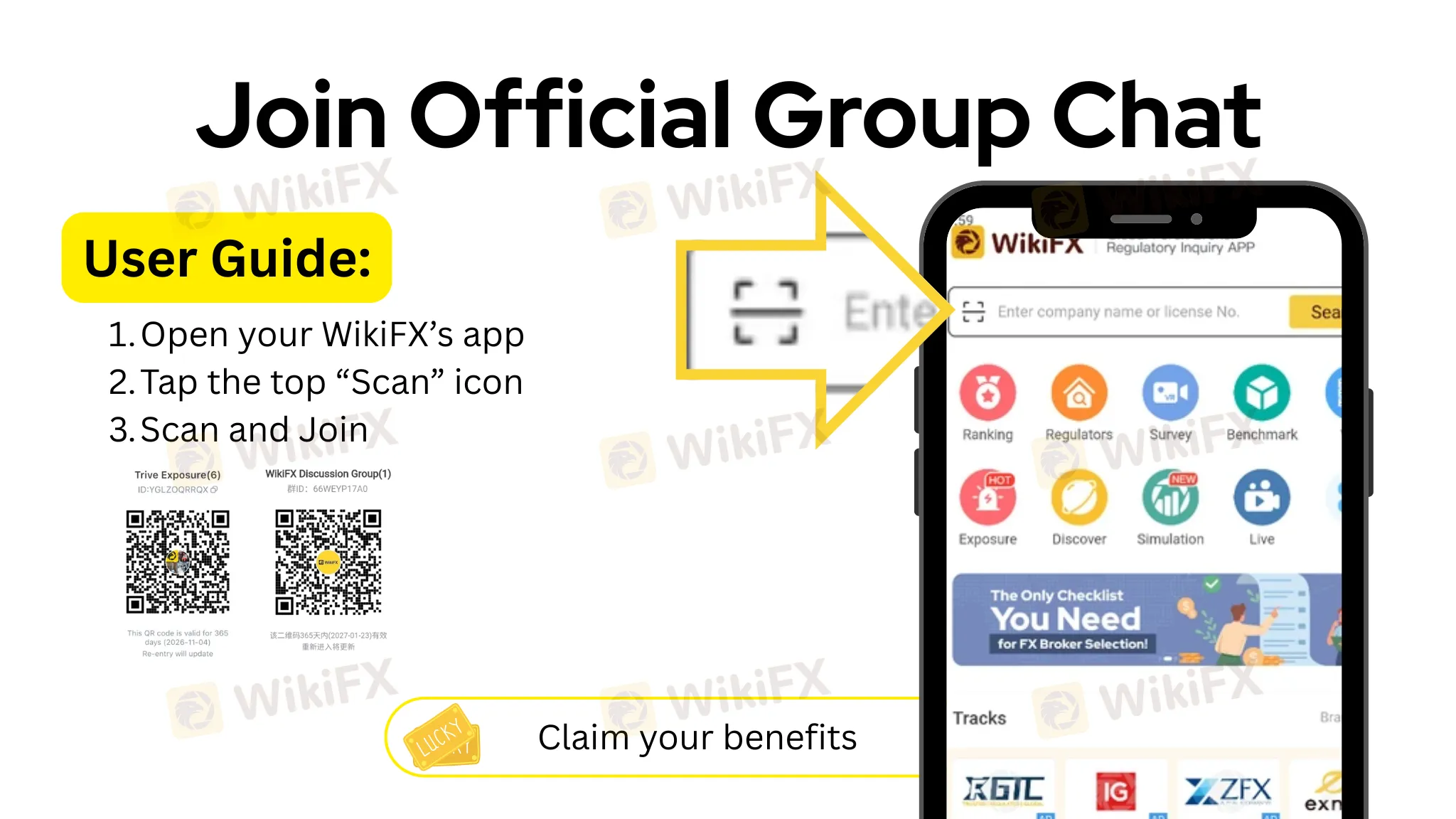

To reduce the risk of falling victim to financial scams, tools like WikiFX can help users verify the legitimacy of brokers and financial platforms before making any investment decisions. By checking regulatory status, risk alerts and user feedback, individuals can better protect their savings and avoid becoming the next target of increasingly sophisticated fraud schemes.

Read more

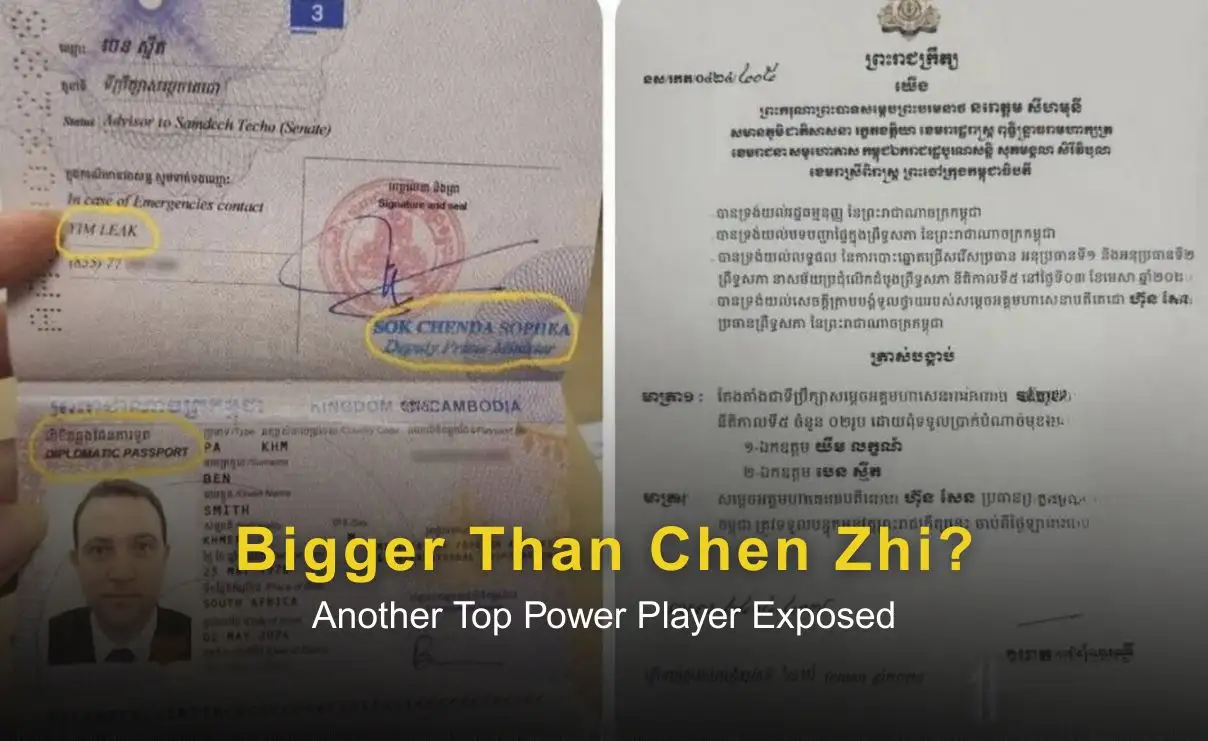

Bigger Than Chen Zhi? Another Top Power Player Exposed

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.

RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

A Kuching woman lost RM91,000 after being lured into a fake investment scheme advertised on Telegram, where scammers promised high returns but disappeared after receiving multiple bank transfers. Police are investigating the case under Section 420 for cheating and have warned the public to stay alert to online investment scams.

Tan Sri Arrested in RM300 Million Investor Scam Probe

A Tan Sri was among two individuals detained by the MACC over an alleged RM300 million investment scam in Kuala Lumpur. Authorities say the unapproved schemes promised high returns and caused millions in losses nationwide, prompting renewed warnings for the public to verify investments and avoid offers that seem too good to be true.

He Was Promised RM1.45 Million in Return, But He Lost RM742000 Instead

A civil servant in Dungun lost RM742,000 after responding to a Facebook investment advertisement that promised returns of RM1.45 million, only to be drawn into a scheme involving dozens of transactions across multiple bank accounts with no payout.

WikiFX Broker

Latest News

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

Rate Calc