ROCK-WEST Regulation: Understanding Its License and Company Information

Abstract:For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

What is ROCK-WEST's Current Status?

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand.

The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before investing on the brokers platform. Our review aims to give you the information you need to make a smart decision.

Breaking Down the ROCK-WEST License

Understanding a broker's license means more than just checking if it has one. The quality and location of the regulator are very important. In ROCK-WEST's case, its offshore license is very different from the protections offered by top-level financial authorities.

The Details of License SD044

The license connected to ROCK-WEST is held by a specific company. Public records show the following details:

· Licensed Company: MAIV LIMITED

· Regulatory Body: Financial Services Authority (FSA) of Seychelles

· License Type: Derivatives Trading License (EP)

· License Number: SD044

This license officially allows MAIV LIMITED to work as a securities dealer. However, the place where this license is given—the Seychelles—is a key part of understanding the risks.

Offshore vs Top-Level Regulation

The word “regulated” can be confusing. A license from an offshore place like the Seychelles offers a very different level of safety compared to a license from a top-level regulator like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

Offshore regulation has looser rules. This often means lower money requirements for the broker, less careful watching, and most importantly, weaker protections for the client. The key differences are clear and directly affect a trader's financial safety.

| Feature | Seychelles FSA (Offshore) | Top-Level Regulator (FCA/ASIC) |

| Investor Protection | No required compensation program. If the broker goes out of business, client funds are at high risk. | Strong protection often includes compensation funds (like FSCS in the UK) that protect client funds up to a certain amount. |

| Fund Separation | Weaker requirements. Rules for keeping client funds separate from company operating funds may be less strict or poorly enforced. | Strict, legally required separation of client funds in top banks, making sure they are not used for company operations. |

| Dispute Resolution | Often difficult, expensive, and complex. Taking legal action against an offshore company can be a legal and practical nightmare. | Formal, accessible, and fair dispute resolution services (like Financial Ombudsman Service) are available to clients. |

| Leverage Limits | High leverage is allowed (ROCK-WEST offers up to 1:2000). This increases profit potential but also dramatically increases loss risk based on a market scenario. | Strict limits are placed on leverage for regular clients to protect them from too much risk and huge losses. |

The Seychelles FSA provides basic regulatory rules, but it lacks the strong enforcement and client safety nets that are standard in top-level places. For a trader, this means taking on much higher risk.

A Closer Look at Company Registration

Beyond the license itself, a broker's company structure and history give important clues about its stability and trustworthiness. A deep look into the companies connected to ROCK-WEST shows a major red flag that should not be ignored.

The Official Seychelles Company

The company holding the regulatory license is `MAIV LIMITED`. According to public records, this company is registered at `IMAD Complex, Office 4, Unit 208, 1st Floor, Ile Du Port, Mahe, Seychelles`. This address matches the information given to the Seychelles FSA and serves as the official, regulated face of the operation. This offshore registration is the basis for their global business, but it is not the complete story.

The Worrying UK Connection

Research into the broker's company history uncovers a troubling link. A related company, `MAIV LTD`, was registered in the United Kingdom with Registration No. `07291053`. However, the current status of this UK company is listed as “Deregistered.”

A “Deregistered” or “Dissolved” status for a UK company means it has been removed from the official register at Companies House and has stopped legally existing. This can happen for various reasons, including failure to file required documents or choosing to close the company. Regardless of the reason, having a now-closed company in a major financial center like the UK, connected to the active offshore operation, is a major red flag.

This raises important questions about the group's operating history, transparency, and long-term stability. Why was the UK company closed? What was its purpose? The lack of a clear, transparent history and the presence of a failed company in a respected place casts doubt over the trustworthiness of the entire operation.

This kind of information, connecting an active offshore company to a deregistered company in a major financial center, is a critical piece of the puzzle. It shows the importance of using complete checking tools, such as WikiFX, which track the companys history, to help you make informed trading decisions.

User Experience vs Reality

While regulatory and company details show structural risk, real-world user complaints show the practical results. The feedback on ROCK-WEST shows a disturbing pattern of problems, especially around the most important functions of a brokerage: depositing and withdrawing.

A Troubling Complaint Pattern

A review of user complaints on checking platforms shows a clear trend of serious problems. These are not minor complaints about customer service response times; they are claims that hit at the core of a broker's duty to clients.

· Deposit & Withdrawal Problems: One of the most alarming complaints comes from a user in Malaysia. They describe a situation where a deposit was delayed specifically when their account had a negative floating position, leading to a stop-out. The user claims the deposit was only processed after the account was wiped out, leading them to warn: “they target users to lose money first and deposit will be added after you lose all money. DON'T USE THIS STUPID COMPANY”. This claim suggests possible manipulation of the deposit process to hurt the client.

· Profit Withdrawal Problems: A trader from Vietnam reported that after making a profit, the funds were “automatically withdrawn” by the broker. Their conclusion was clear: “if you win, they won't let you withdraw your profits.” Similarly, a user from South Africa claimed their account was blocked entirely when they tried to withdraw profits and a deposit made in relation to a bonus offer. Another complaint from 2021 claims a loss of 170,100 pesos that the broker refused to pay out.

· Blocked Accounts: The repeated theme of accounts being blocked or restricted following profitable trading or during withdrawal requests is a classic red flag associated with untrustworthy brokers. It suggests that while the platform may work smoothly when a client is losing, it can become difficult when the client tries to secure their gains.

Recognizing Positive Feedback

To present a complete picture, it is important to note that some positive reviews for ROCK-WEST do exist. Users have praised the low minimum deposits, with some reporting fast and easy withdrawals, and good customer support. These reviews often focus on the ease of getting started and the accessibility of the platform.

Understanding the Real Risk

While positive feedback might seem reassuring, it must be weighed against how serious the negative complaints are. Positive experiences with low entry barriers or responsive support are less important than the main function of a broker: to keep client funds safe and honor withdrawal requests. The repeated, serious complaints about deposit delays, profit taking, and blocked accounts match perfectly with the risks identified in our analysis of ROCK-WEST regulation and questionable company history. When a broker operates in a light-touch regulatory environment, clients have little to no options when such problems occur.

Looking at Trading Offerings

A broker's trading conditions, such as leverage and account types, can look attractive on the surface. However, these features must be looked at within the context of the broker's regulatory and operational risks. With ROCK-WEST, seemingly appealing offerings may hide significant dangers.

High Leverage and Its Dangers

ROCK-WEST offers extremely high leverage, up to 1:2000 on its Standard account. For many traders, especially those new to the market, this can seem like a powerful tool to amplify small investments. However, leverage is a double-edged sword. While it magnifies potential profits, it also magnifies potential losses at the same rate.

When combined with an offshore, lightly regulated broker, high leverage becomes exceptionally risky. A small market movement against a highly leveraged position can wipe out an entire account in seconds. In a well-regulated environment, strict leverage caps are in place to protect retail clients from this exact scenario. The absence of such protections at ROCK-WEST means traders are exposed to a level of risk that many professional bodies consider unacceptable for non-professional clients.

Account Types and Fees

ROCK-WEST provides several account options, mainly the Standard and Raw accounts. The key differences are in their fee structures and minimum deposit requirements, serving different types of traders.

| Account Feature | Standard Account | Raw Account |

| Minimum Deposit | $50 | $250 |

| Spread | From 1.4 pips | From 0.0 pips |

| Commission | $0 | $8 per lot |

| Max Leverage | 1:2000 | 1:1000 |

The Standard account is designed for easy access with a low entry point and zero commission, but with wider spreads. The Raw account targets more experienced or high-frequency traders with tighter spreads but a fixed commission per trade. While this structure is common, the high leverage offered on both remains a point of high risk.

Trading Platforms and Instruments

The broker provides access to the industry-standard MetaTrader 5 (MT5) platform, as well as its own mobile and web trading applications. It offers a range of trading instruments, including Forex, Indices, Commodities, and a wide selection of Cryptocurrencies. The availability of MT5 and a diverse product range are positive features, but they do not reduce the fundamental regulatory and safety concerns.

A Final Decision on ROCK-WEST

After a detailed examination of ROCK-WEST regulation, company background, user feedback and trading conditions, a clear and cautious conclusion emerges. The broker's profile is defined by significant risks that potential clients must not overlook.

Summary of Key Findings

Our deep dive has uncovered several critical points of concern that, when combined, paint a high-risk picture:

· Offshore Regulation: The Seychelles FSA license provides minimal client protection, lacking investor compensation schemes and robust enforcement mechanisms common in top-level places.

· Company Red Flag: The connection to a “Deregistered” UK company, MAIV LTD, raises serious questions about the company's operational history, stability, and transparency.

· Severe User Complaints: There is a documented pattern of serious user complaints regarding the most critical broker functions—depositing and, most importantly, withdrawing funds and profits.

· High-Risk Offerings: The provision of extremely high leverage (up to 1:2000) in a lightly regulated environment creates a recipe for rapid and catastrophic losses with little to no help for the trader.

The Final Word for Traders

Given the combination of these factors, we cannot advise engaging with this broker. The combination of weak offshore regulation, a questionable company history, and a significant volume of severe user complaints regarding fund access creates an unacceptably high-risk profile for any trader. The potential for financial loss due to operational issues, rather than trading decisions, is substantial.

Your financial security is most important. The information presented here, sourced from WikiFX, highlights significant risks. We strongly urge every trader, before engaging with *any* broker—including ROCK-WEST—to conduct their own independent and thorough investigation. Visiting a trusted checking platform, such as WikiFX, to review a broker's complete, up-to-date profile should be a non-negotiable first step in your research process.

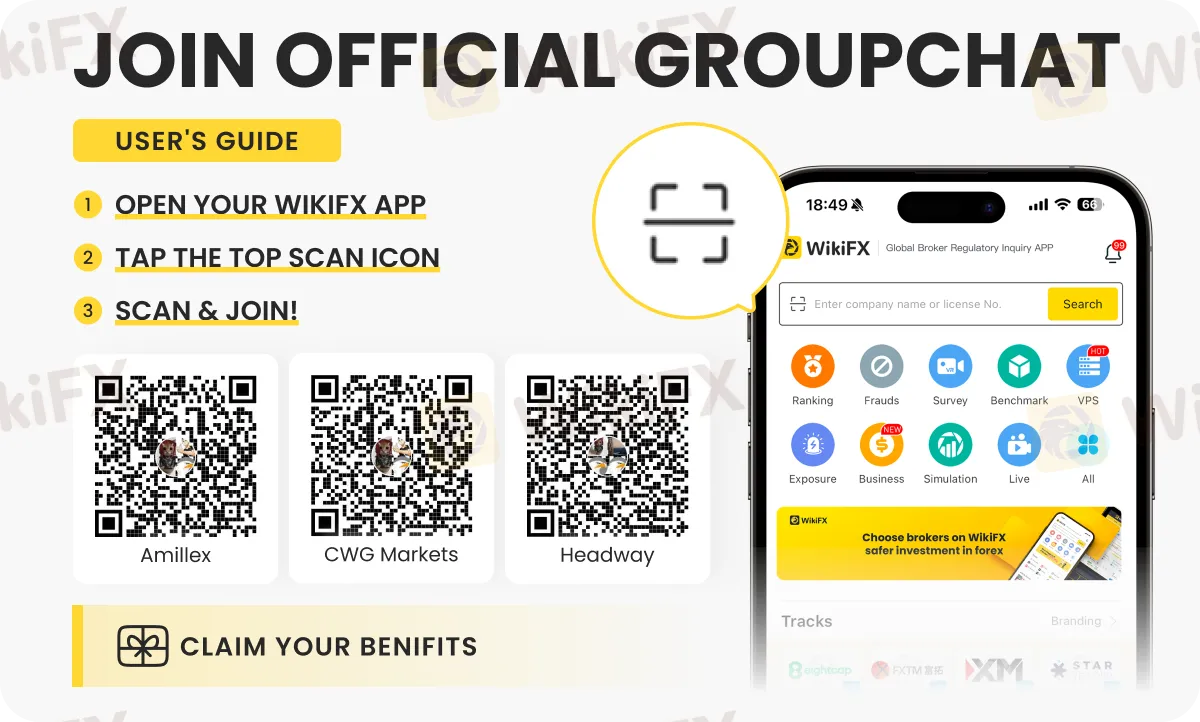

Check the latest forex updates and insights on these expert-led special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Read more

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

Alpari Review: Reputation Under Scrutiny Amid Fund Scams & Withdrawal Complaints

Have you been subject to intense manipulation by the chart provided on the Alpari forex trading platform? Have you faced losses due to inefficient stop-loss and take-profit executions by the broker? Does the forex broker constantly reject your withdrawal applications? Is the Alpari customer support too slow to respond to your withdrawal queries? Is your deposit not reflecting or showing less than your invested capital on the trading platform? These issues are trending on many review platforms. In this Alpari review article, we have investigated these complaints. Take a look!

NinjaTrader Launches Futures Trading in Europe via MiFID Broker

NinjaTrader launches futures trading in Europe through MiFID‑regulated Payward Europe Digital Solutions (CY) Limited, starting in the Netherlands and Germany, with plans for France and Italy.

WikiFX Broker

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Rate Calc