GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

Abstract:GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

Swiss financial authorities have issued a warning against GmtFX (gmtfx1.io), drawing attention to a platform that claims a Zurich presence but shows no evidence of being authorised to provide financial services. Independent risk data and platform analysis further reinforce concerns that investors may be exposed to significant financial risk.

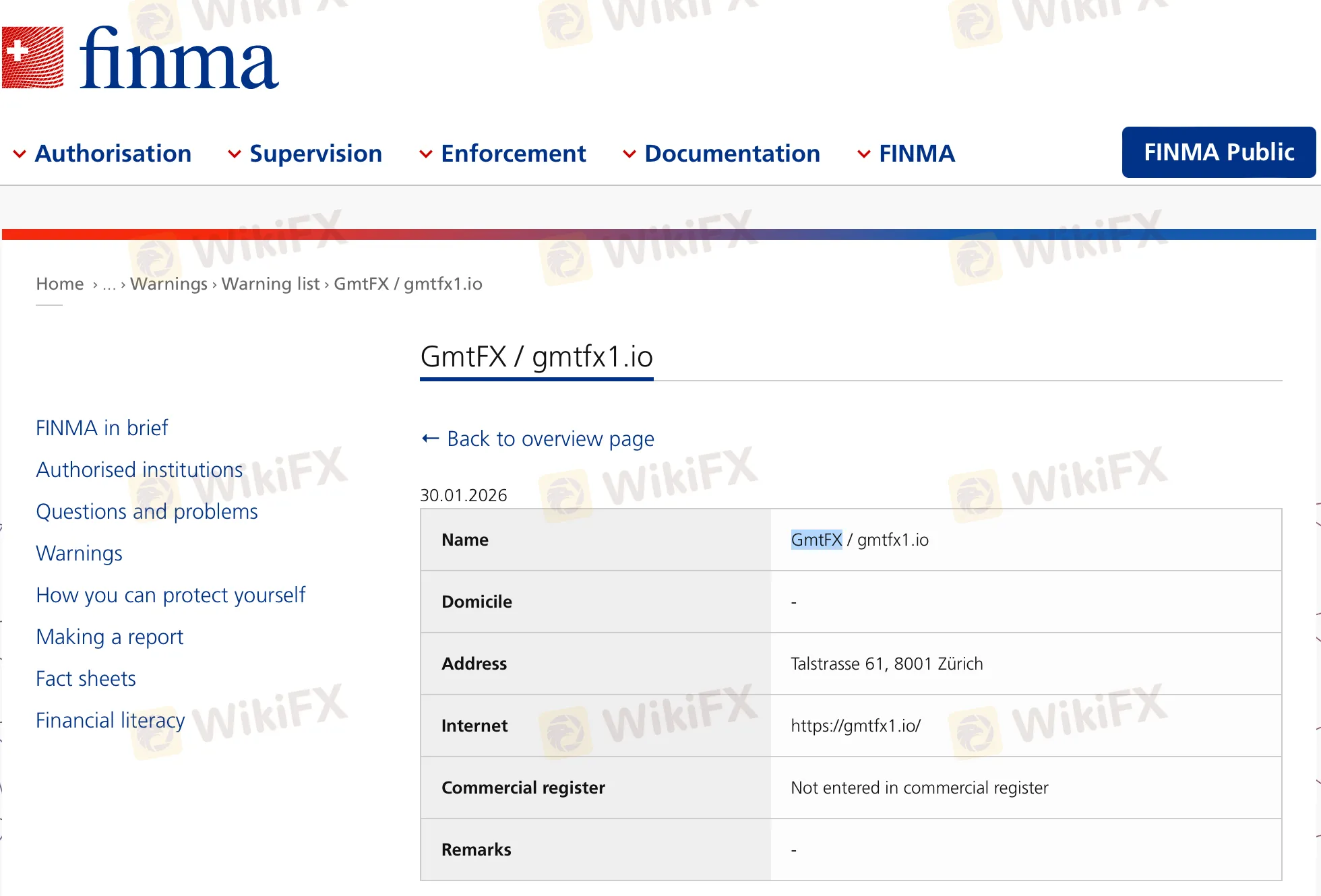

FINMA Warning: No Authorisation, No Registration

On January 30, 2026, the Swiss Financial Market Supervisory Authority (FINMA) added GmtFX / gmtfx1.io to its official warning list. According to the notice, the entity is not entered in the Swiss commercial register and has no licence to offer financial or investment services in Switzerland.

The platform presents a Zurich address — Talstrasse 61, 8001 Zürich — but FINMAs disclosure confirms that this address does not correspond to any authorised or registered financial institution. This discrepancy alone is a critical red flag, as Swiss law requires financial service providers to be properly registered and supervised.

Marketing Claims Raise Further Concerns

Beyond its regulatory status, GmtFX has attracted scrutiny for the way it promotes its services. The platform frequently uses phrases such as “AI-driven trading” and “high-yield automated strategies” to appeal to retail investors. Industry observers have repeatedly warned that such narratives are commonly used by unregulated platforms to create an illusion of technological sophistication and consistent profitability.

Without regulatory oversight, there is no independent verification of how these systems operate — or whether they exist at all. In similar cases, investors often report difficulties withdrawing funds, sudden account restrictions, or pressure to deposit additional capital under the guise of “margin requirements” or “system upgrades.”

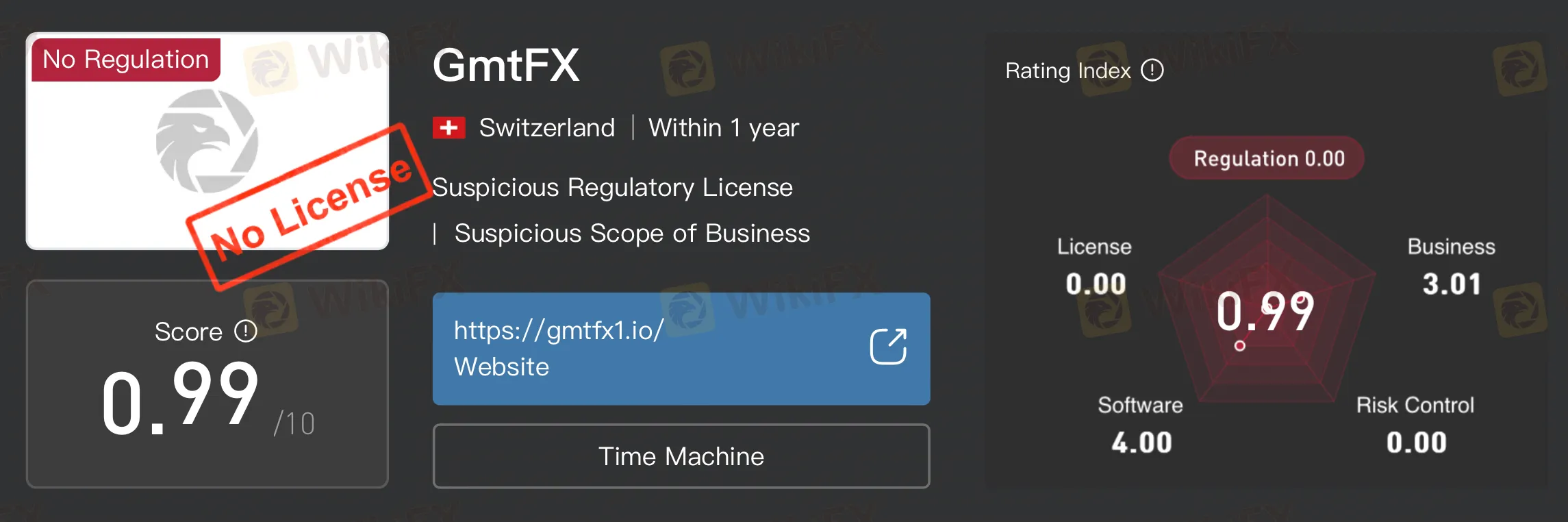

WikiFX Data: No Licence, Low Safety Score

Independent broker intelligence platform WikiFX also flags GmtFX as a high-risk entity. According to WikiFX records, the platform holds no valid regulatory licence and currently carries an extremely low safety score of 0.99/10, reflecting weaknesses across regulation, risk control, and operational transparency.

WikiFX data further shows that the domain gmtfx1.io is less than one year old, a pattern frequently observed among short-lived, high-risk trading websites that disappear once user complaints accumulate.

More details can be found on the WikiFX broker page:

https://www.wikifx.com/en/dealer/3445577306.html

Why the Risk Is Structural, Not Accidental

What makes cases like GmtFX particularly concerning is not a single isolated issue, but the combination of warning signs:

- No authorisation from any recognised financial regulator

- Use of a prestigious financial address without registration

- Aggressive marketing focused on AI and high returns

- A newly registered domain with no verifiable operating history

- Independent risk platforms assigning extremely low credibility scores

When these factors appear together, they point to a structural risk profile rather than temporary compliance gaps.

A Cautionary Note for Investors

In todays market, professional-looking websites and advanced-sounding technology claims are no longer reliable indicators of legitimacy. Regulatory verification and independent risk checks remain essential steps before engaging with any trading platform.

Platforms operating outside regulatory frameworks leave investors without legal protection if disputes arise. As seen in many similar cases, once problems surface, recovery options can be extremely limited.

About WikiFX

As a global broker information and risk-monitoring platform, WikiFX helps investors verify regulatory status, assess operational risk, and identify warning signs before committing funds. By combining official regulatory data, technical analysis, and user feedback, WikiFX enables traders to make more informed decisions — particularly when encountering unfamiliar or aggressively promoted platforms.

In an environment where unlicensed entities increasingly mimic legitimate brokers, independent verification remains one of the most effective tools for investor protection.

Read more

Hundreds Detained: Scam Workers Fleeing Cambodia and Myanmar Caught in Malaysia Crackdown

Malaysian authorities have carried out a sudden, large-scale crackdown in Kuala Lumpur, detaining hundreds of undocumented foreigners and suspected online scam workers. The operation signals a tougher enforcement stance, with frontline operators targeted amid a broader regional push against scam networks.

LONG ASIA Exposure: Traders Report Fund Losses & Long Withdrawal Blocks

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

MY MAA MARKETS Review: Are Withdrawal Blocks and Regulation Gaps Real?

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

20 Arrested as Selangor Police Smash Online Scam Rings

Selangor police arrested 20 suspects after dismantling three online scam syndicates operating fake job and investment scams across Kajang, Seri Kembangan and Puchong, with multiple devices seized and investigations ongoing.

WikiFX Broker

Latest News

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

Rate Calc