Accountant Loses RM460,888 to PFOU Syndicate’s UVKXE App Crypto Scheme

Abstract:A 61-year-old accountant has lost RM460,888 after falling victim to a fraudulent crypto investment scam named “PFOU”.

A 61-year-old accountant has lost RM460,888 after falling victim to a fraudulent Bitcoin investment scheme promoted on Facebook.

The woman, who was nearing the end of her professional career, lodged a police report after realising that the investment platform she had joined was not genuine. The scheme operated under the name “PFOU” and was advertised through social media in July last year.

According to Seri Alam District police chief ACP Mohd Sohaimi Ishak, the victim clicked on a link in the Facebook advertisement and was subsequently added to a Bitcoin investment group. Within the group, several individuals presented what appeared to be detailed explanations of the platforms operations. They described opportunities for fast and substantial returns through cryptocurrency trading.

The approach was structured and persuasive. Over time, confidence was built through continuous communication and apparent transparency.

Towards the end of December, the woman decided to invest. With retirement approaching, she was looking to strengthen her financial position. She was instructed to download a mobile application known as “UVKXE”, which she was told would allow her to monitor her investments and track profits in real time.

Between 30 December and 16 January, she transferred a total of RM460,888 in three separate payments to two different bank accounts. The transactions represented a significant portion of her savings.

Through the UVKXE application, she was able to view records of her investment activity. The platform displayed profits amounting to 1,219,907.6624 USDT — a cryptocurrency value equivalent to roughly RM5.5 million. The figures suggested that her investment had multiplied within a short period.

However, the profits existed only on screen.

When she attempted to withdraw the funds, she was informed that she needed to pay RM550,152.35 as a so-called management fee before any money could be released. The demand exceeded her original investment. It was presented as a routine administrative requirement.

At that point, she began to suspect that the platform was fraudulent. She refused to make any further payments and proceeded to file a police report.

Authorities are now investigating the case under Section 420 of the Penal Code for cheating. The offence carries a maximum prison sentence of 10 years, along with caning and a fine upon conviction. Investigations will also examine the use of mule bank accounts under Section 424 of the Penal Code, which provides for penalties including a fine of up to RM100,000, imprisonment of up to seven years, or both.

Importantly, this does not appear to be an isolated case. WikiFX has previously reported complaints and victim accounts linked to the same UVKXE platform. In earlier cases, investors described similar patterns: recruitment through social media, instructions to download the UVKXE application, the display of large unrealised profits, and sudden demands for additional fees before withdrawals were permitted. Links to these prior reports will be included to provide readers with further context and to underline the recurring structure of the scheme.

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam: https://www.wikifx.com/en/newsdetail/202501072364255426.html

UVKXE Crypto Scam Cost a Company Manager RM2.56 Million: https://www.wikifx.com/en/newsdetail/202502106774832385.html

RM1.7 Million Vanished: Trading 'Experts' from UVKXE Turned into Scammers: https://www.wikifx.com/en/newsdetail/202502178994985537.html

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam:

These cases reflect a broader trend in online investment fraud, particularly involving cryptocurrencies. Fraudsters often use social media advertisements to attract victims. Once contact is established, individuals are moved into private messaging groups where detailed but false explanations are provided. Victims are encouraged to download applications that simulate legitimate trading platforms. These apps display fabricated profits to create trust and urgency.

Withdrawal requests typically trigger additional payment demands, often labelled as management fees, taxes or processing charges. Once victims refuse or run out of funds, communication ceases.

For individuals nearing retirement, such schemes can be especially damaging. Savings accumulated over decades can be lost within weeks. The emotional impact is often severe, compounded by the fear of financial insecurity in later life.

Police have urged the public to remain cautious of investment opportunities that promise quick and guaranteed returns, particularly those linked to cryptocurrency. Investors are advised to verify platforms with relevant financial regulators and to treat any request for upfront fees with extreme suspicion.

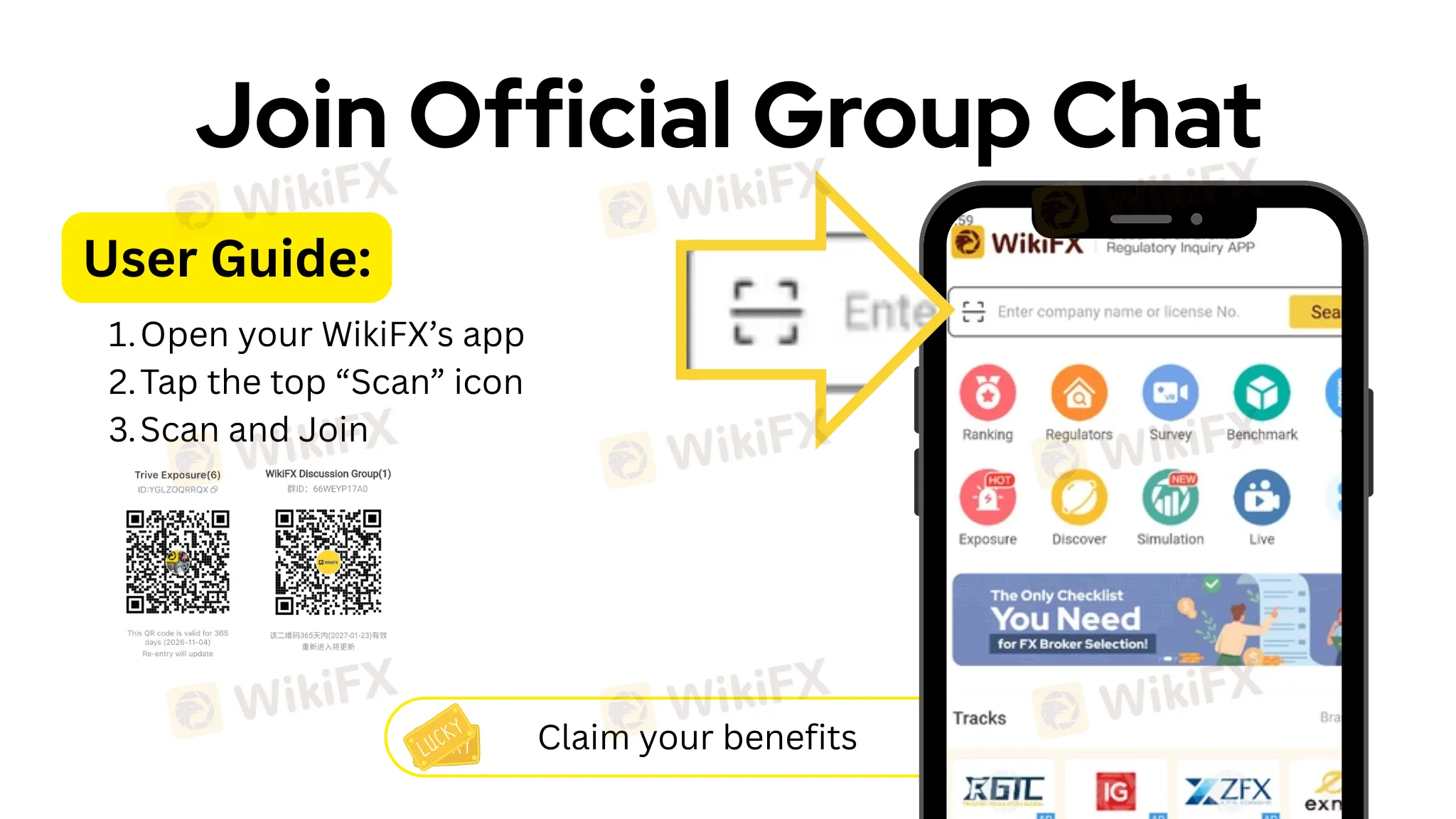

To help protect individuals from falling prey to unauthorised investment schemes, WikiFX offers essential tools and resources for verifying the legitimacy of brokers and financial platforms. With an extensive database of global broker profiles, regulatory status updates, and user reviews, WikiFX empowers users to make informed decisions before committing to any financial investment. The apps risk ratings and alerts for unlicensed or suspicious entities enable investors to easily spot red flags and avoid potential scams. By checking a broker's background on WikiFX, users can better safeguard their hard-earned savings and steer clear of fraudulent schemes, making WikiFX an indispensable resource for safer investing.

Read more

Hundreds Detained: Scam Workers Fleeing Cambodia and Myanmar Caught in Malaysia Crackdown

Malaysian authorities have carried out a sudden, large-scale crackdown in Kuala Lumpur, detaining hundreds of undocumented foreigners and suspected online scam workers. The operation signals a tougher enforcement stance, with frontline operators targeted amid a broader regional push against scam networks.

20 Arrested as Selangor Police Smash Online Scam Rings

Selangor police arrested 20 suspects after dismantling three online scam syndicates operating fake job and investment scams across Kajang, Seri Kembangan and Puchong, with multiple devices seized and investigations ongoing.

Sarikei Online Scams Exposed: Police Trace Bank Account Owners

Police in Sarikei identify four bank account owners linked to online scams, with victims losing over RM475,000 in investment and tender frauds.

Over 30 Chinese nationals charged with operating investment scam in Port Dickson

Thirty-six Chinese nationals were charged in a Malaysian court for allegedly running an online call centre that scammed victims into non-existent investment schemes, with bail denied due to flight risk and ongoing investigations.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc