Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Abstract:Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than whats mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

Fake FP Markets Overview: Markets, Trading Platforms & Account Types

FP Markets is an Australia-based brokerage house that offers trading opportunities across a wide range of assets such as forex, stocks, commodities, digital currencies, ETFs, bonds, metals, and indices. To enhance their trading experience, traders can leverage MetaTrader4 (MT4), MetaTrader5 (MT5), TradingView, cTrader, WebTrader, and Mobile Trading App. As a trader, you can explore trading through two accounts - Standard and Raw - with minimum deposits of USD 100 in each. Spreads begin from 1 and o pips in Standard and Raw accounts, respectively. While the Standard account features zero commission, the raw account has a commission of USD 3 per side. The maximum leverage offered in both accounts is 1:500.

Investigating the Top Forex Trading Complaints Against Fake FP Markets

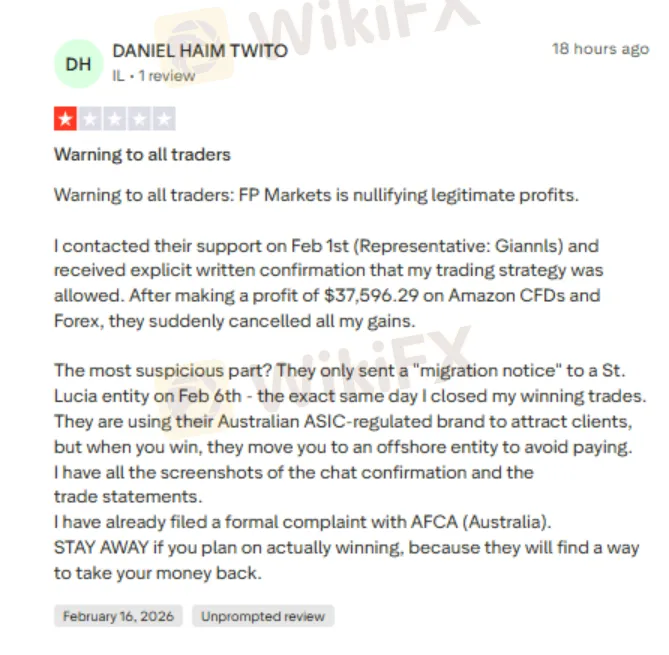

The Profit Cancellation Claim Against Fake FP Markets

A trader, after contacting the FP Markets customer support team, was notified of the trading strategy approval in writing. However, the trader was allegedly left stunned as the broker cancelled the $37,596.29 profit on the FP Markets login. The trader claimed that Fake FP Markets is using the supposedly ASIC-regulated status to attract clients globally. Further alleging, the trader revealed that, as you start winning trades, you will be moved to an offshore entity to avoid payment. This sharp Fake FP Markets review underscores the need for a thorough review of the broker before deciding to trade with it.

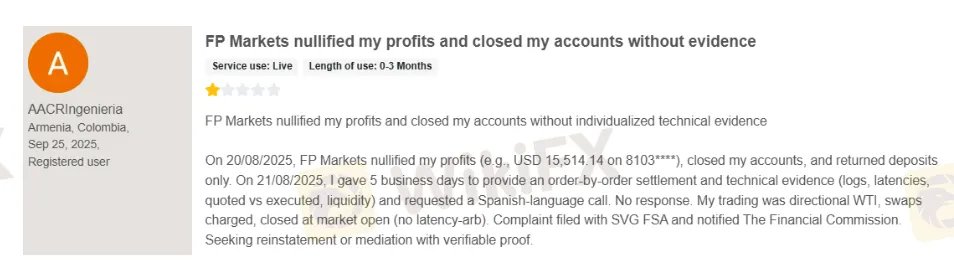

Another Stunning Profit Cancellation Claim That You Should Know About

Adding to the list of alleged illegitimate profit cancellation claims, a trader shared a negative Fake FP Markets review, highlighting how the broker nullified the profit and closed the account. The trader, as per the admission, could only receive the deposits. As the incident unfolded, the trader sought a reply from the broker on the order-by-order settlement backed by technical evidence through logs, latencies, quote vs execution, and a call in the Spanish language. However, the trader received no response. As per the trader, the trading remained directional WTI, swap charged, and closed at market open with no latency. Concerned by the alleged poor trading experience, the trader vented out with this bad Fake FP Markets review.

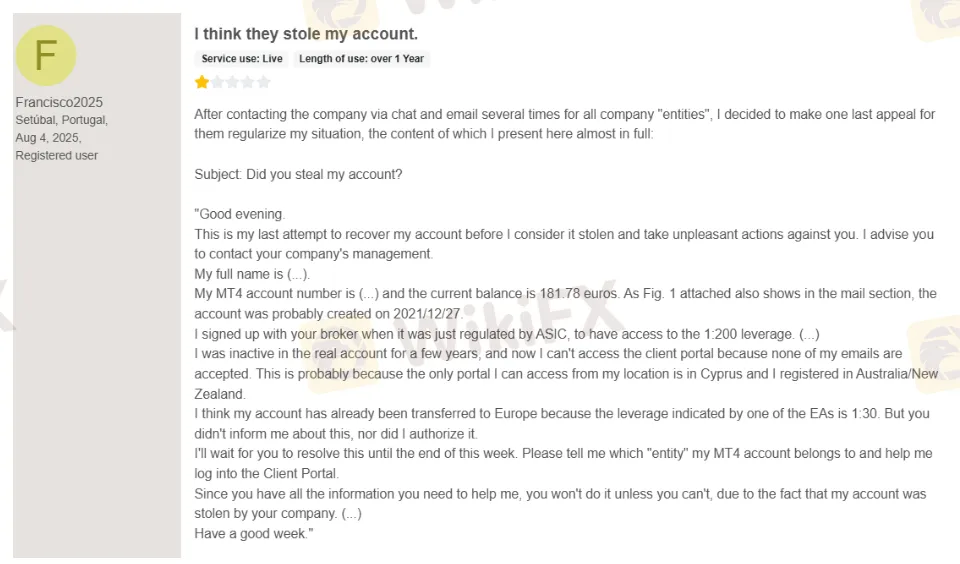

Account Access Block and Unauthorized Entity Transfer

A Fake FP Markets trader claimed to have been unable to access the MT4 trading account and client portal after a prolonged period of inactivity. The trader states that none of his registered email addresses are being accepted, preventing Fake FP Markets login access. The trader reckoned that the account may have been transferred from the ASIC-regulated entity (Australia/New Zealand) to a European/Cyprus entity without his knowledge or authorization, as the leverage appears to have changed from 1:200 to 1:30.

Despite contacting the company multiple times via chat and email, the user is said to have not received proper clarification regarding the entity where he currently holds an account. The trader suspected that the account may have been improperly handled or “stolen” due to the lack of communication and access restoration. The trader admitted having requested confirmation of the accounts regulatory entity and assistance in regaining portal access.

Sharing the review, where the Portugal-based trader made such statements against FP Markets.

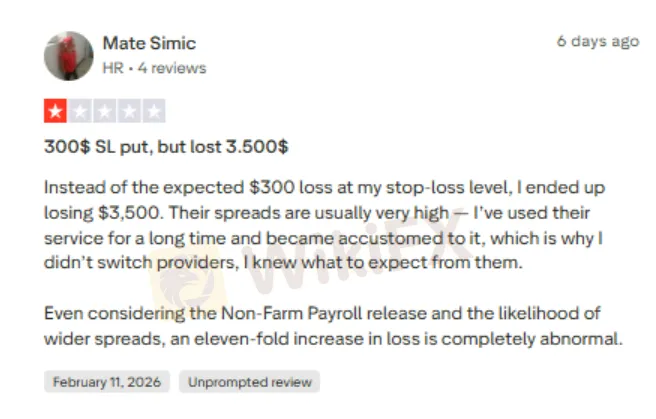

The Stop-loss Trade Manipulation Accusation Involving a Capital Wipe of $3,500

A trader, having set a stop-loss order at $300, was allegedly made to deal with a trade loss of $3,500, nearly 12 times the order quote. According to the trader, the spread charged by the broker was very high. The trader believed such a stunning rise in losses was abnormal despite factoring in wider spreads and non-farm payroll reports released by the USA. The screenshot below contains a sharp Fake FP Markets review that warrants your attention.

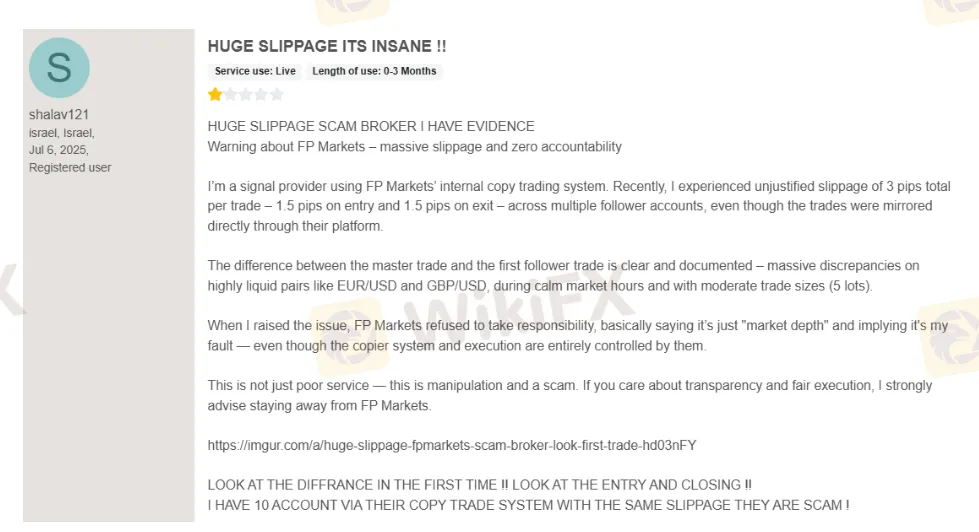

FP Markets Accused of Massive Slippage and Execution Irregularities

A signal provider using FP Markets internal copy trading system alleges experiencing significant slippage of approximately 3 pips per trade (1.5 pips on entry and 1.5 pips on exit) across multiple follower accounts. The user claimed discrepancies on highly liquid currency pairs, such as EUR/USD and GBP/USD, during stable market conditions and with moderate lot sizes. According to the complaint, the price differences between the master account and follower accounts were consistent and clearly documented.

Following the issue being raised, the broker reportedly attributed the slippage to market depth and denied responsibility. The complainant argued that since the copy trading system and execution were controlled by FP Markets, the broker should be accountable. The user considered the execution irregularities to be unfair and labeled the brokers response as evasive, warning others to exercise caution.

For more details, read this Fake FP Markets review.

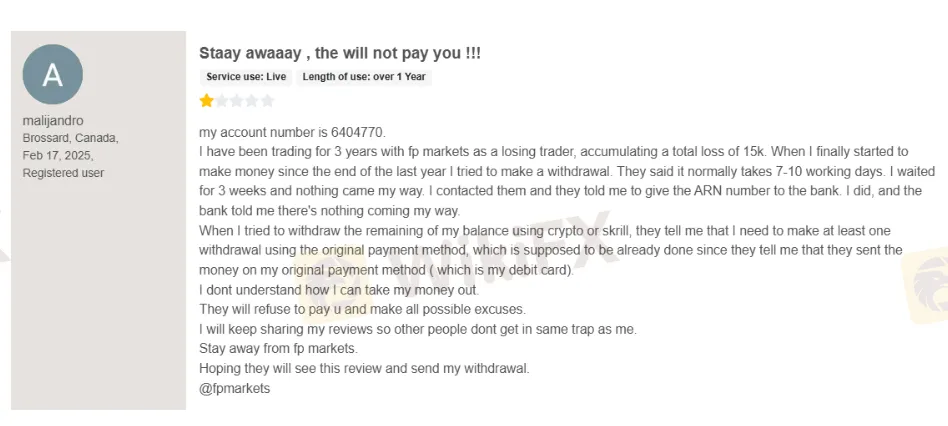

Withdrawal Denied as Profits Became Visible on the Fake FP Markets Login

A trader from Canada claimed to have lost for three straight years on the Fake FP Markets platform. The accumulated loss reached $15,000. Towards the end of 2024, the trader started earning and understandably requested withdrawals. The broker responded by saying that the withdrawal process would take 7-10 working days. However, the trader could not receive it even after three weeks. As the trader further enquired, the broker official told him to share the ARN number with the bank. The bank said that there was nothing coming to the trader.

The trader then attempted to withdraw some balances using Skrill or crypto, which was allegedly denied by the broker, citing a minimum of one withdrawal by the original payment method. Stuck by the procedural hassle, the trader reckoned that this should have been taken care of by Fake FP Markets itself. The screenshot below captures the essence of the problem and the confusion the trader allegedly had with the forex broker.

Fake FP Markets Review by WikiFX: Investigating the Brokers Regulatory Status

While on its official website, Fake FP Markets claims to have been regulated by the Australian Securities and Investments Commission (ASIC), a large number of user complaints concerning withdrawals and trade manipulation make for a thorough review of whether the broker deserves retention of this top regulation. As a user, you must evaluate every broker on an independent verification tool such as WikiFX, a renowned global broker inquiry app.

Read more

The Investment Trap: Key Suspect Identified

A Malaysian man was charged in Singapore for allegedly acting as a cash collector in a cross-border investment scam, after a victim lost substantial funds through a fake platform promoted via social media and WhatsApp. The case underscores the growing sophistication of scam networks and the importance of caution when dealing with unsolicited investment offers.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc