BFX Spreads, leverage, minimum deposit Revealed

Abstract:BFX presents itself as a Chinese broker that provides its customers with supreme trading platforms. It also hypes that it offers up to 500:1 leverage and over low spreads.

| Aspects | Information |

| Broker Name | BFX |

| Regulation | Not regulated |

| Account Types | Classic, Business, Premium |

| Minimum Deposit | Classic: $250 Business: $5,000 Premium: $50,000 |

| Maximum Leverage | Classic: Up to 500:1 Business: Up to 200:1 Premium: Up to 100:1 |

| Trading Platforms | MetaTrader 5 (MT5) |

| Spreads | Start from 1 pip |

| Customer Support | Email: support@bfxpro.io Website: www.bfxpro.io Social Media: Facebook, Twitter |

Overview

BFX, operating within a regulatory gray area, lacks explicit oversight from a specific governing body, raising concerns about investor protection and market integrity. While it offers a variety of account types including Classic, Business, and Premium, the broker's minimum deposit requirements are relatively high, with the Classic account starting at $250 and escalating to $50,000 for the Premium account. Furthermore, the maximum leverage ratios, though seemingly advantageous, could pose significant risks for inexperienced traders, with the Classic account offering up to 500:1 leverage. The platform's limited transparency on fees and commissions beyond baseline spreads, coupled with observed website downtime, further detracts from its appeal. Additionally, the lack of comprehensive information on regulatory compliance status adds to the uncertainties surrounding BFX. Overall, these factors suggest caution when considering BFX as a trading platform.

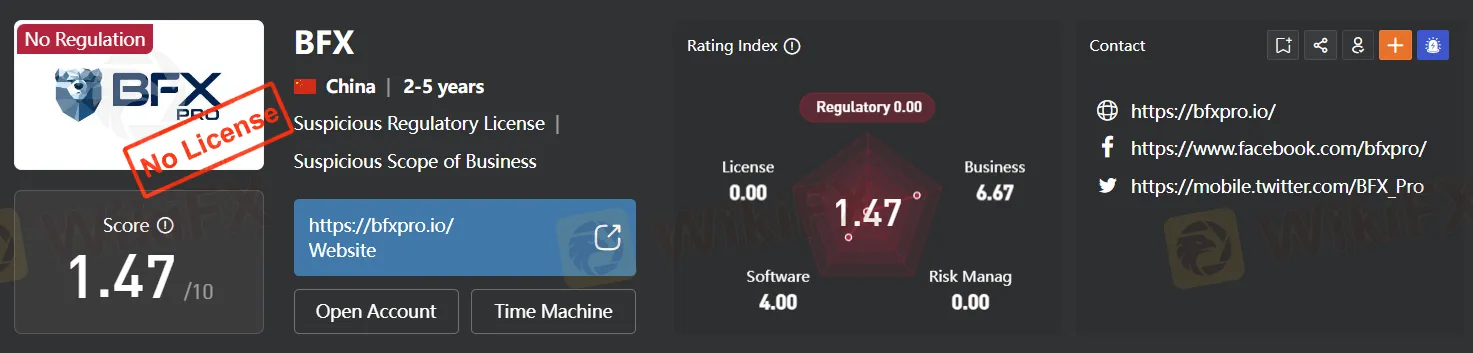

Regulation

BFX operates within a regulatory gray area, lacking explicit oversight or regulation from a specific governing body. This absence of regulatory framework raises concerns about investor protection and market integrity. Without regulatory supervision, BFX may lack the stringent standards and accountability mechanisms typically enforced in regulated financial markets, potentially exposing investors to higher risks such as fraud, manipulation, and operational failures. Moreover, the lack of oversight could hinder transparency and transparency in the platform's operations, making it challenging to address issues related to security, compliance, and customer recourse. As a result, participants in BFX should exercise caution and conduct thorough due diligence before engaging in transactions on the platform, understanding the inherent risks associated with operating in an unregulated environment.

Pros and Cons

Trading with BFX offers several advantages, including diverse account types, accessible customer support, the MetaTrader 5 platform, competitive spreads, and leverage options. However, traders should be aware of potential drawbacks such as operating within a regulatory gray area, lack of transparency on fees, and occasional website downtime. It's essential for traders to weigh these factors carefully and conduct thorough due diligence before engaging in transactions on the platform.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Account Types

BFX provides a range of trading account options to accommodate varying investor needs and preferences. The three main account types offered by BFX are the Classic, Business, and Premium accounts. The Classic account is the entry-level option, requiring a minimum initial deposit of $250. This account type is suitable for novice traders or individuals with limited capital. It provides basic trading features and access to essential markets, making it an accessible choice for those who are new to trading or prefer to start with smaller investments.

In contrast, the Business account is geared towards small to medium-sized businesses or experienced traders. With a minimum initial deposit of $5,000, this account offers enhanced features such as advanced trading tools, market analysis, and research resources. It caters to businesses seeking to hedge their positions or individuals looking for more comprehensive trading capabilities. The Business account also provides access to a wider range of financial instruments and markets, making it suitable for those with a deeper understanding of the financial markets.

The Premium account is the highest-tier option, requiring a minimum initial deposit of $50,000. This account type is designed for high-net-worth individuals, institutional investors, or seasoned professionals. It offers premium services, personalized support, and exclusive benefits to clients. The Premium account provides access to advanced trading platforms, dedicated account managers, and customized investment strategies. It is ideal for sophisticated investors seeking tailored solutions, priority service, and premium trading conditions.

Leverage

BFX offers varying levels of leverage depending on the type of trading account held. The maximum trading leverage provided by BFX ranges from 100:1 to 500:1. The leverage ratio represents the amount of capital a trader can control relative to their initial investment. For instance, with a leverage ratio of 100:1, a trader can control $100 in positions for every $1 of capital invested. On the other hand, with a leverage ratio of 500:1, a trader can control $500 in positions for every $1 of capital.

It's important to note that while leverage can amplify potential profits, it also magnifies potential losses. Therefore, traders should exercise caution and employ risk management strategies when utilizing leverage. Inexperienced traders, in particular, are advised to be cautious with high leverage ratios, as they can increase the risk of significant losses. By understanding the implications of leverage and employing responsible trading practices, traders can effectively manage their risk and optimize their trading strategies.

Spreads and Commissions

At BFX, the spreads across all account types begin at 1 pip. However, specific details regarding spreads and commissions beyond this baseline are not readily available on the broker's website at the time of writing. Spreads refer to the difference between the buying and selling prices of a currency pair, representing the broker's fee for executing trades. Typically, spreads can vary depending on factors such as market liquidity, volatility, and the specific currency pair being traded.

In addition to spreads, brokers may also charge commissions on trades, particularly for certain account types or trading instruments. Commissions are separate from spreads and are usually a fixed or variable fee charged per lot traded. While the absence of detailed information on spreads and commissions on BFX's website may make it challenging for traders to assess the full cost of trading, prospective clients can reach out to the broker's customer support or consult with account managers for clarification on fee structures and trading costs.

Overall, while the starting spread of 1 pip offers a general indication of trading costs at BFX, traders should seek further information from the broker to fully understand the extent of spreads and commissions applicable to their trading activities. By obtaining comprehensive details on fees and charges, traders can make informed decisions and effectively manage their trading expenses.

Trading Platforms

BFX offers traders the popular MetaTrader 5 (MT5) platform, providing a robust and versatile solution for forex trading. MT5 stands out as one of the most successful, efficient, and competent trading software in the industry. Renowned for its advanced features, user-friendly interface, and comprehensive analytical tools, MT5 empowers traders with the tools they need to make informed decisions and execute trades with precision. The platform's extensive range of technical indicators, charting capabilities, and customizable trading strategies make it a preferred choice for both novice and experienced traders alike. With access to real-time market data, multiple order types, and automated trading options, MT5 offered by BFX enables traders to navigate the forex markets efficiently and effectively. Whether executing trades on desktop, web, or mobile devices, traders can rely on MT5's reliability and performance to meet their trading needs.

Customer Support

BFX provides accessible customer support channels for traders seeking assistance or guidance. Traders can reach BFX's customer support team via email at support@bfxpro.io or visit the broker's website at www.bfxpro.io for additional information and resources. Furthermore, BFX maintains a presence on popular social media platforms such as Facebook and Twitter, where traders can stay updated on the latest news, announcements, and developments from the broker. By leveraging these communication channels, traders can easily connect with BFX's support representatives, access helpful resources, and stay informed about important updates, enhancing their overall trading experience.

Conclusion

BFX operates in a regulatory gray area, lacking explicit oversight, which may raise concerns about investor protection. It offers a variety of account types tailored to different investor needs, leverage ratios ranging from 100:1 to 500:1, and spreads starting from 1 pip. The broker provides the MetaTrader 5 platform for trading, renowned for its advanced features and user-friendly interface. Customer support is accessible via email and the broker's website, though its website is currently down. Additionally, BFX maintains a presence on social media platforms like Facebook and Twitter for updates and communication with traders.

FAQs

Q1: What is the minimum initial deposit for opening a Classic account?

A1: The minimum initial deposit for a Classic account is $250.

Q2: What is the maximum leverage offered by BFX?

A2: BFX offers varying levels of leverage depending on the type of account held, ranging from 100:1 to 500:1.

Q3: What trading platform does BFX provide?

A3: BFX offers the MetaTrader 5 (MT5) platform for trading, known for its advanced features and user-friendly interface.

Q4: How can I contact BFX's customer support?

A4: You can reach BFX's customer support team via email at support@bfxpro.io or through their website at www.bfxpro.io.

Q5: Are there different account types available on BFX?

A5: Yes, BFX offers three main account types: Classic, Business, and Premium, each catering to different investor needs and preferences.

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc