AEGON ASSET MANAGEMENT

Abstract:Aegon Asset Management was established in 1988 and headquartered in the United Kingdom. With a team of 385 investment professionals managing assets totaling USD 337 billion as of December 31, 2023, Aegon is regulated by the Financial Conduct Authority (FCA), however, with an "exceeded" status.

| Aegon Asset Management Review Summary | |

| Founded | 1988 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Demo Account | N/A |

| Fees | N/A |

| Trading Platform | Fixed Income Platform, Real Assets Platform, Equities Platform, Multi-asset & Solutions Platform |

| Minimum Deposit | N/A |

| Customer Support | Tel: +44 (0)7740 897 181/+1 (877) 234-6862, Email: adrian.cammidge@aegonam.com, Social Media: LinkedIn |

| Company Address | Head Office - 1201 Wills Street, Suite 800 Baltimore, MD 21231 USA |

What Is Aegon Asset Management?

Aegon Asset Management was established in 1988 and headquartered in the United Kingdom. With a team of 385 investment professionals managing assets totaling USD 337 billion as of December 31, 2023, Aegon is regulated by the Financial Conduct Authority (FCA), however, with an “exceeded” status.

Pros & Cons

| Pros | Cons |

|

|

Pros:

Established in 1988: Aegon Asset Management has a long-standing history, having been founded in 1988. This extensive experience provides investors with more confidence and trust in the company's stability and expertise in managing assets over the years.

Cons:

Exceeded Regulation: Aegon Asset Management is regulated by FCA, however the status is “exceeded”, which is an abnormal one.

Is Aegon Asset Management Safe or Scam?

Regulatory Sight: Aegon Asset Management is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The company holds an Investment Advisory License, however,its regulatory status is categorized as “Exceeded.” The FCA license number for Aegon Asset Management is 144267.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Trading Platform

Fixed Income Platform: This platform provides investment solutions across the quality and yield spectrum within fixed income securities. It emphasizes active management, fundamental research, and downside risk management. It includes alternative fixed income options such as private debt, residential mortgages, asset-backed securities, and private loans to companies.

Real Assets Platform: Aegon's Real Assets platform focuses on delivering yield-oriented debt and equity strategies across various risk/return profiles. With a 40-year track record, it offers cycle-tested strategies, broad market access, and long-term relationships. The platform employs research-intensive processes, combining top-down analysis with bottom-up analysis by a multidisciplinary team.

Equities Platform: This platform provides actively managed portfolios that blend qualitative and quantitative analysis to identify undervalued companies. The emphasis is on high-conviction stock selection to drive portfolio returns.

Multi-Asset & Solutions Platform: Aegon's Multi-Asset platform employs a thematic multi-asset approach, emphasizing asset allocation as a primary driver of investment returns. The platform aims to diversify portfolios across a wide range of lowly-correlated investments to reduce risk and capture opportunities based on conviction views.

Customer Support

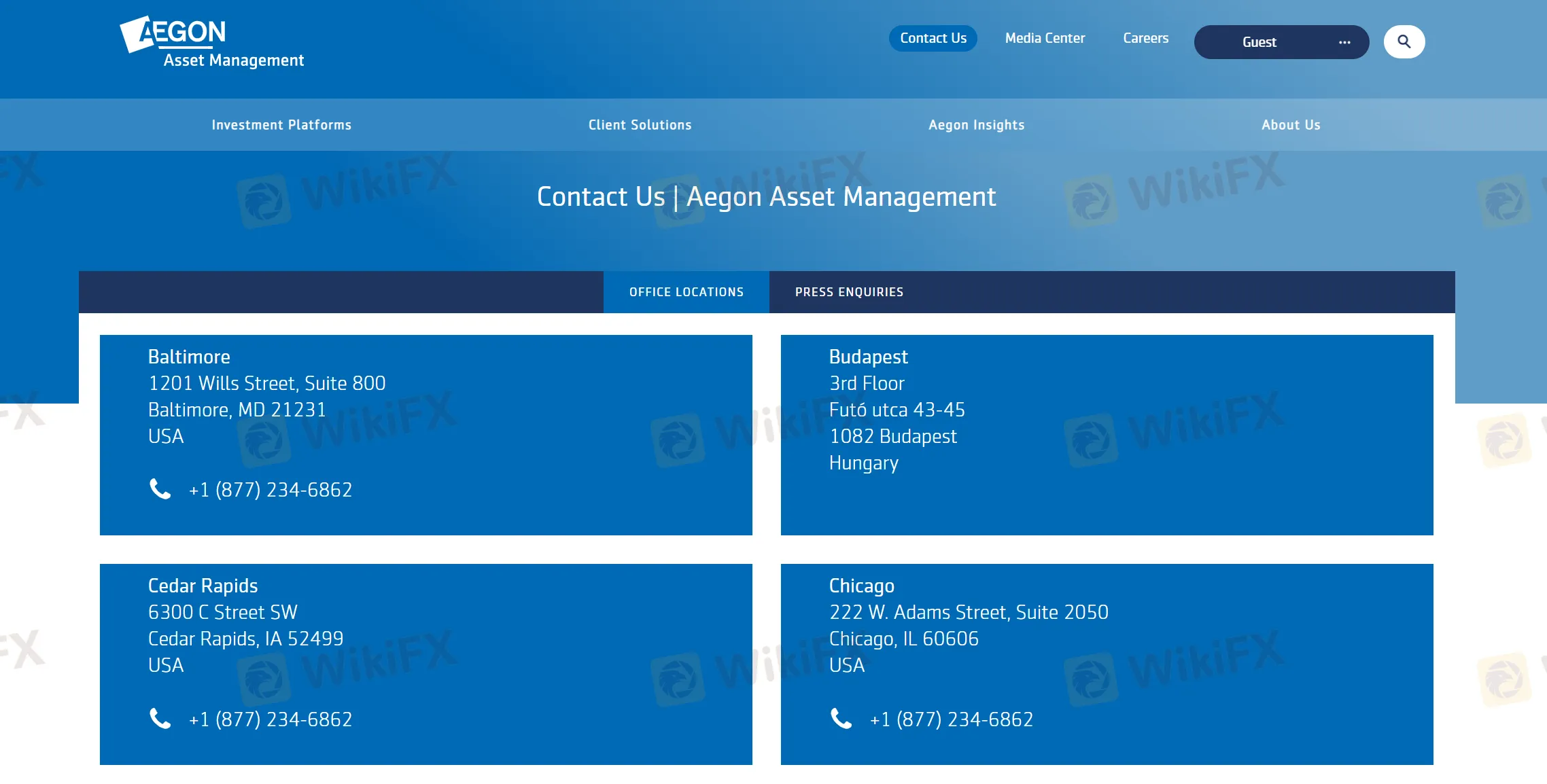

Telephone: Clients can reach customer support via telephone at +44 (0)7740 897 181 for international inquiries and +1 (877) 234-6862 for U.S.-specific inquiries. This allows for direct communication and assistance with any questions or concerns.

Email: Clients can also contact customer support via email at adrian.cammidge@aegonam.com. This provides an alternative method for reaching out with inquiries, feedback, or other matters.

Social Media: Aegon Asset Management maintains a presence on LinkedIn, allowing clients to connect and engage with the company. While this platform may not be as immediate as phone or email, it provides an additional avenue for communication and updates.

Company Address: The head office address is provided for clients who prefer traditional mail correspondence or need to visit the office in person. Its head office is located at 1201 Wills Street, Suite 800 Baltimore, MD 21231 USA. This allows for physical interaction and support if required.

Conclusion

Aegon Asset Management is a regulated company, well-established, allowing users to enjoy their services on multiple platforms. However its regulation has exceeded. In this way, users should be more cautious about investing.

Frequently Asked Questions (FAQs)

Q: Is Aegon Asset Management regulated?

A: Yes, it is, however, with an “exceeded” status.

Q: Does this company have presence on social medias?

A: Yes, it does have presence on LinkedIn, but not on other social media.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

ACY SECURITIES Legitimacy Check: A Regulated Broker or a High-Risk Partner?

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities Complete Review 2026: A Trader's Guide to Trading Terms, Risks and Warning Signs

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc