Another Broker Has Been Added To The CNMV's Watch List

Abstract:WikiFX has discovered that the forex broker FXPACE was one of the aforementioned fraudulent firms.

As forex trading becomes more popular among traders, many unlicensed brokers attempt to entice investors with their self-proclaimed excellent appealing information as a kind of deception. When you think so, you will be readily swayed by the concept of “easy money” and will invest much more money in order to obtain higher returns. Finally, you will lose your money and realize it was all a hoax.

WikiFX has discovered that the forex broker FXPACE was one of the aforementioned fraudulent firms.

WikiFX is monitoring one of the aforementioned fraudulent brokers, FXPACE, in order to halt their unlawful operations and to make other traders aware of them. Over 38,000 brokers, both legal and unregistered, are listed on the WikiFX website. The data in the WikiFX database is sourced from legitimate regulatory bodies like the FCA, ASIC, and others. Fairness, impartiality, and facts are also emphasized in the released information. WikiFX does not charge public relations fees, advertising costs, ranking fees, data cleaning fees, or any other unreasonable expenses. WikiFX will do everything possible to keep the database consistent and synchronized with authoritative data sources such as regulatory bodies, but cannot promise that the data will always be up-to-date.

Here are the findings of the WikiFX team's preliminary study.

Registration and Regulation of FXPace

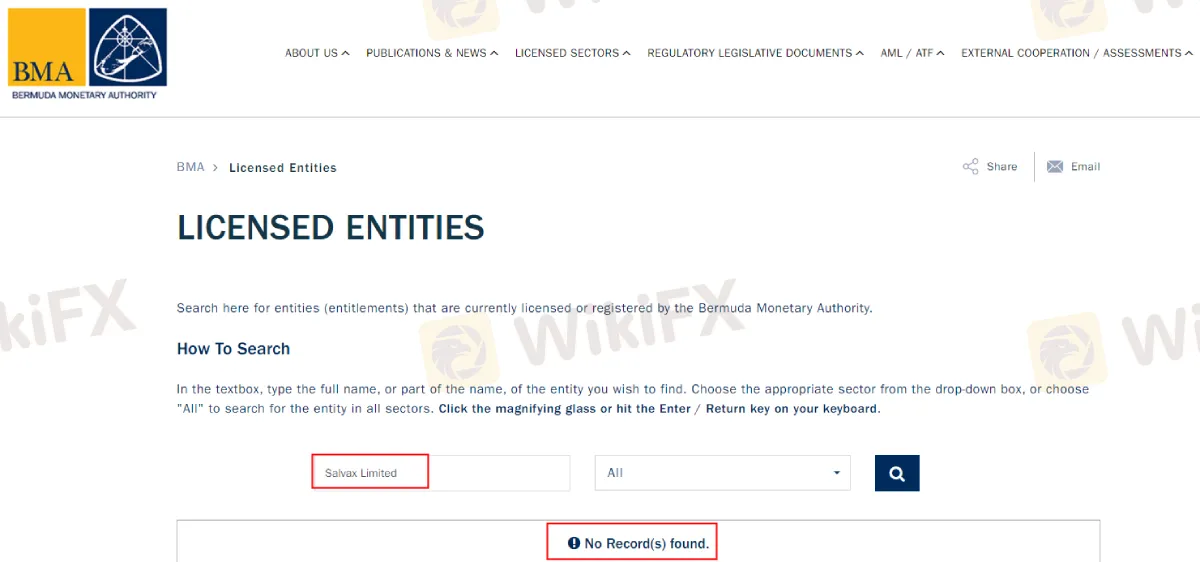

FXPace claims to be the trade name of Salvax Limited, a Bermuda corporation with the registration number 53275.

However, we were unable to locate any matching results for the firm name or registration number in the Bermuda regulator, the Bermuda Monetary Authority (BMA).

For naïve traders, the registration information this broker states is a fraudulent assertion. The reality is that FXPACE is not regulated by any authorities.

FXPACE Leverage Restrictions

The platform provides a variety of account types with leverage up to 1:500.

It has high leverage and will undoubtedly appeal to many traders, despite the increased danger that such large leverage implies. It should be noted that the Financial Conduct Authority (FCA) in the United Kingdom has capped the maximum leverage in major currencies to 1:30. Because it claims to be registered in Bermuda, a British island territory, it must follow the FCA's laws and limits. To a degree, this confirms that FXPace is nothing more than a dodgy broker.

FXPACE Has Been Warned By CNMV.

Furthermore, on January 13, 2020, the Spanish financial regulator CNMV issued a warning that FXPace is not permitted to provide investment services or operations in Spain. Clients who invest in the company are unlikely to receive their money back if things go wrong.

As a result, we may infer that FXPACE is a fraud.

You should be much more cautious when dealing with an unregulated broker than when dealing with a registered broker. You may verify your broker's regulatory status by visiting our Regulators page and following the procedures.

On the other hand,

WikiFX may be of great assistance to traders who have seen unlawful activity with their traders. WikiFX constantly advises traders to contact customer support as soon as possible so that the situation may be resolved by the financial authorities. Traders may report their negative experiences by contacting WikiFX customer service directly or by using the WikiFX App. Visit the official website at www.wikifx.com or just download the app from the App Store or Google Play Store for free.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc