WARNING: Fortrade Successive Withdrawal Issues Reported

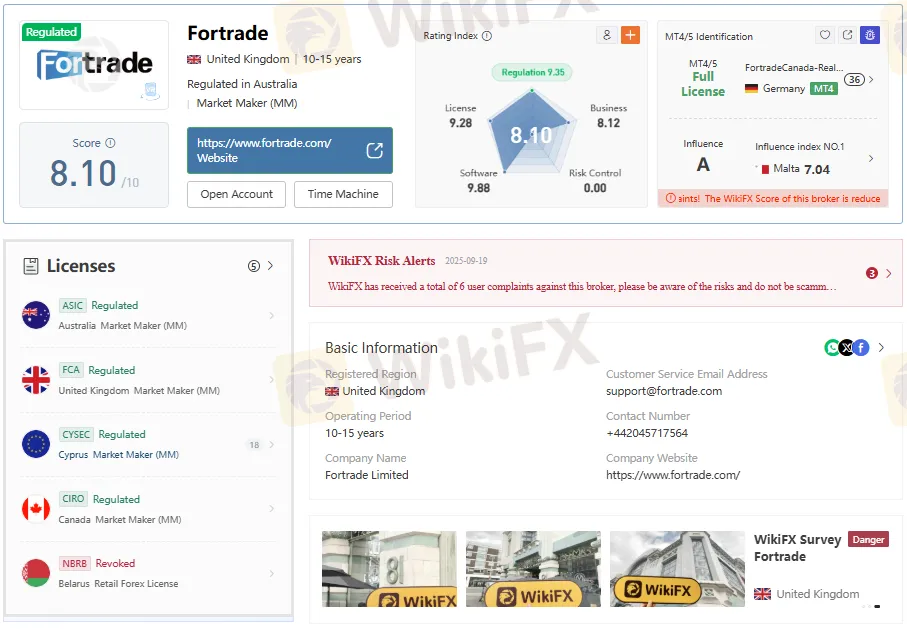

Abstract:Fortrade broker faces multiple withdrawal complaints, allegations, regulatory fines, and office verification issues. Recent $2M CIRO penalty highlights ongoing problems.

Introduction

Multiple recent user reports allege successive withdrawal issues at Fortrade, including deposits not reflecting in account balances and difficulty accessing funds after payment confirmation, despite the brokers multi-jurisdictional regulation status. Several exposure posts describe accounts showing a $0 balance after deposits and persistent prompts to add more capital, followed by delays or refusals when withdrawals are requested, raising concerns about operational controls and customer fund accessibility.

Regulatory status and why it matters

Fortrade entities appear to be regulated in the UK (FCA), Australia (ASIC), Cyprus (CySEC), and Canada (CIRO), with a previously revoked retail forex license in Belarus—an arrangement that typically imposes client money rules, disclosures, and complaints pathways. However, field “surveys” published by a third‑party outlet also claim “no office found” at a listed UK address on several dates, a discrepancy that, while not definitive, underscores the need to verify corporate details directly through official registers.

What users are reporting now

Recent exposure entries describe deposits of around $100 that did not appear for trading, with platforms allegedly urging further top‑ups while balances remained unchanged and withdrawals were not processed as requested. Another account outlines months of repeated calls, initial deposit approval followed by missing funds, eventual balance appearance after lengthy back‑and‑forth, and refusal to refund to the original card—patterns that align with perceived withdrawal delays.

How successive withdrawal issues unfold

Based on reported patterns, alleged issues often begin with a deposit that fails to credit the trading balance, escalate to additional deposit prompts, and culminate in stalled or blocked withdrawal attempts even after payment confirmations. These sequences suggest potential internal reconciliation lags, compliance holds, payment processor errors, or dispute‑driven restrictions, but they also warrant careful evidence preservation and formal complaint escalation when responses are inadequate.

Immediate steps to document and escalate

- Capture proof: Save deposit confirmations, bank/card statements, platform balance screenshots, chat logs, and ticket IDs from every interaction.

- Reconcile identifiers: Match gateway approval codes, transaction IDs, and timestamps with platform ledger entries to show missing or delayed postings.

- Use formal channels: Submit a dated complaint to the brokers compliance email(s) listed for the regulated entities, referencing the regulatory license and requesting a written resolution timeline.

- Escalate externally: If unresolved, file to the relevant national dispute body or regulator linked to the contracting entity, attaching the full evidence pack and the brokers written replies or lack thereof.

Which regulator to approach first

Select the authority that supervises the exact legal entity named in the account agreement—Fortrade Limited (UK) for FCA oversight, Fort Securities Australia Pty Ltd for ASIC, Fortrade Cyprus Ltd for CySEC, or Fortrade Canada Limited for CIRO. If the account is serviced cross‑border, confirm the passporting or authorization status and use the regulator that has jurisdiction over the entity holding client funds and approving withdrawals.

Signals that increase risk

- Balance shows $0 after a confirmed deposit, with repeated prompts to add more funds before withdrawals are enabled.

- Long gaps between payment confirmation and ledger credit, followed by refusal or delay to return funds to the original payment method.

- Inconsistent office presence claims compared with published corporate addresses, prompting extra verification via official registers.

How to request a withdrawal that sticks

- Mirror the deposit rail: Most regulated brokers remit back to the source method up to the deposited amount before alternative payout methods are allowed—submit requests accordingly.

- Provide KYC updates early: Pre‑empt holds by supplying current ID, proof of address, and source‑of‑funds documents with transaction references.

- Time‑bound follow‑ups: If the brokers stated processing window lapses, send a dated chaser to compliance referencing the original ticket, then prepare a regulator complaint with the full chronology.

Understanding “regulated but disputed”

Regulation is not a guarantee against service failures; it provides rules for client money, conduct, and redress, giving traders documentation pathways when withdrawals stall. The Belarus license revocation for a related entity also shows that authorization statuses can change over time by jurisdiction, so monitoring license registers remains essential.

When to pause activity

If a deposit is uncredited beyond the providers normal settlement window, pause further funding until reconciliation is confirmed in writing and visible on the ledger. If withdrawals remain blocked after required verifications, escalate rather than re‑deposit, and avoid increasing exposure during unresolved compliance checks.

What to include in a formal complaint

- Account identifiers, entity name, and jurisdiction.

- Transaction IDs, approval codes, timestamps, and amounts for each deposit or withdrawal.

- Screenshots of balance and status pages showing $0 post‑deposit or withdrawal pending/declined.

- Copies of all emails, chats, and call logs with agent names and dates.

Choosing alternatives and comparisons

Some users compare the experience unfavorably with platforms like ThinkorSwim or TradeZeroPro, citing execution and funding standards as benchmarks when assessing reliability. While platform quality varies by product set and region, consistent, timely fund access is a baseline expectation under most retail brokerage compliance frameworks.

Bottom line

Public user posts describe successive withdrawal challenges—from uncredited deposits and zero balances to delays and refund refusals—despite Fortrades regulated footprint. The most effective protection is disciplined documentation, method‑matched withdrawal requests, and prompt escalation to the competent regulator when broker responses fail to resolve the issue.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc