80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

Abstract:The Trump administration's crackdown on illegal immigration has resulted in an 80% collapse in net i

The Trump administration's crackdown on illegal immigration has resulted in an 80% collapse in net immigration to the USA, and has fundamentally altered the mathematics behind the nation's labor supply to the point where the level of job growth needed to maintain economic stability is now far lower, according to a new Goldman analysis.

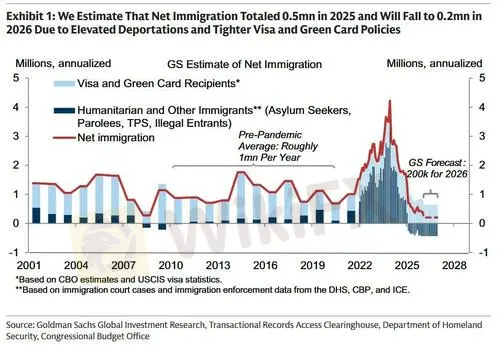

After a flood of more than 10.8 million illegal immigrants (official figure) entered the United States under Biden, net immigration - both legal and illegal - has gone from roughly one million people per year in the 2010s to around 500,000 in 2025, with a further drop to just 200,000 projected by Goldman for 2026. This has sharply reduced labor-force growth and lowered the economy's “breakeven” pace of job creation, the bank opines.

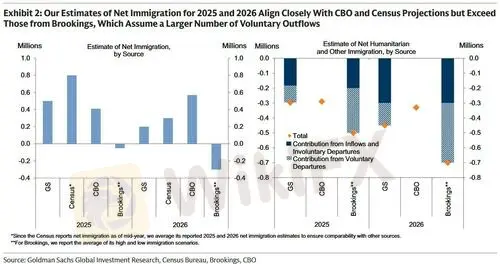

Here's Goldman vs. Brookings vs. the Congressional Budget Office on net immigration:

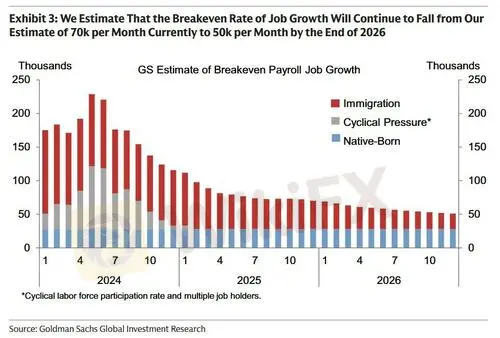

Now, the US will only need around 50,000 new jobs per monthby the end of this year to keep the unemployment rate from rising, down from roughly 70,000 today.

At the same time, Goldman says labor demand still looks “shaky” because job growth is narrowand job openings are trending lower - with the main downside risk being a faster, more disruptive AI-driven adjustmentthat could tamp down hiring or raise job losses beyond current estimates.

Elevated deportations, tighter visa / green-card policies, a pause in immigrant visa processing that affects dozens of countries, and the loss of Temporary Protected Status for some groups, Goldman suggests there is additional downside risk to the workforce.

A shakier demand picture

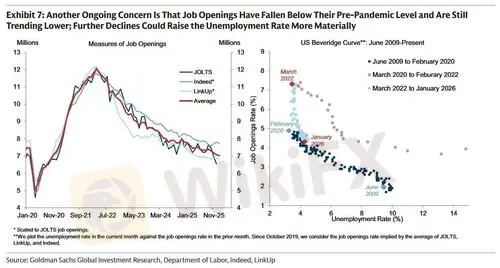

Of course, new math on the labor supply doesn't mean the labor market is strong (duh)... In fact, Goldman describes demand as “shaky,” writing that job growth has become increasingly narrow - dominated by healthcare - and that job openings have continued to fall. Openings are now around seven million, below pre-pandemic levels and still declining.

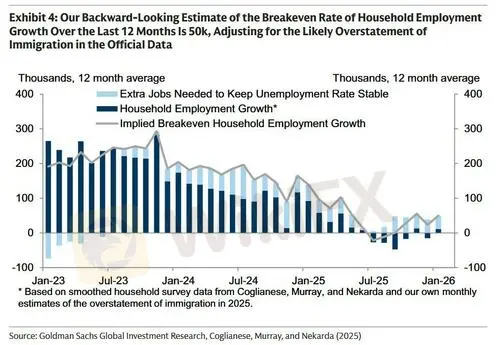

Because fewer new workers are entering the economy, hiring no longer needs to run as hot to prevent unemployment from drifting higher. “A small pickup is all that should be needed to sustain job growth at the breakeven pace,” according to the report, arguing that weaker-looking payroll numbers may increasingly mask a labor market that is merely treading water rather than deteriorating.

Official data from the Bureau of Labor Statisticsshow a similar trend, with job openings drifting toward the mid-six-million range late last year. A continued slide in openings, Goldman warns, would increase the risk that unemployment rises more meaningfully, even with slower labor-force growth.

There is also a risk that tighter immigration enforcement is pushing more workers into informal or off-the-books employment. If so, official payroll data could understate the true level of labor-market activity, complicating the Federal Reserves task of gauging economic momentum.

AI looms as the wildcard

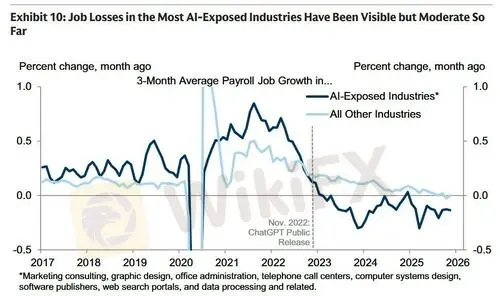

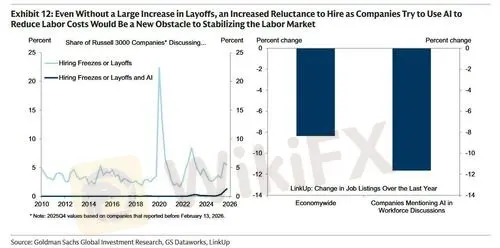

Goldman sees artificial intelligence (AI) as the largest downside risk to the labor outlook - not because it has already triggered mass layoffs, but because it may restrain hiring at the margin. So far, the firm estimates that AI-related substitution has shaved only 5,000 to 10,000 jobs from monthly growth in the most exposed industries. But a faster or more disruptive deployment could weigh more heavily on demand.

The bank shows that job growth has slowed and turned slightly negativein several subindustries where AI is most ready to deploy, while company-level anecdotes indicate that AI is already reducing the need for workers. The impact, while visible, remains 'moderate' so far.

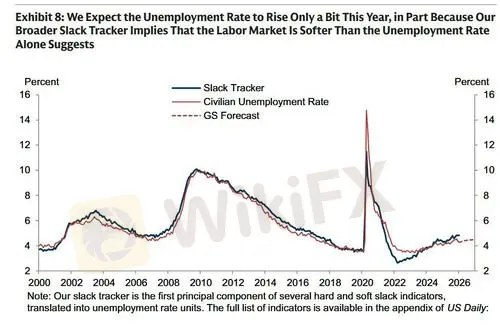

For now, the bank expects the unemployment rate to drift only modestly higher, toward 4.5%, while Goldman chief economist Jan Hatzius said in a separate note (available to Pro subs)that the probability of a recession next year is “moderate” at 20%. The labor market, in the firms words, is taking “early steps toward stabilization.”

The paradox is that stability may increasingly look like weakness. As immigration slows and the workforce grows more slowly, payroll gains that once signaled trouble may soon be enough to keep the labor market steady - at least on paper.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc