M4Markets Integrates Centroid Bridge to Expand Liquidity Access

Abstract:Retail FX and CFDs broker M4Markets has entered into a partnership with Centroid Solutions, a technology provider renowned for its advanced broker connectivity and execution systems.

Retail FX and CFDs broker M4Markets has entered into a partnership with Centroid Solutions, a technology provider renowned for its advanced broker connectivity and execution systems. The collaboration has brought Centroid Bridge, an institutional-grade liquidity management and execution engine, into M4Markets trading framework.

This integration strengthens M4Markets capacity to provide clients with deeper liquidity, more efficient execution, and stable pricing across multiple asset classes. For both companies, the move represents a shared vision of blending advanced technology with operational excellence to elevate the trading experience worldwide.

M4Markets Offering

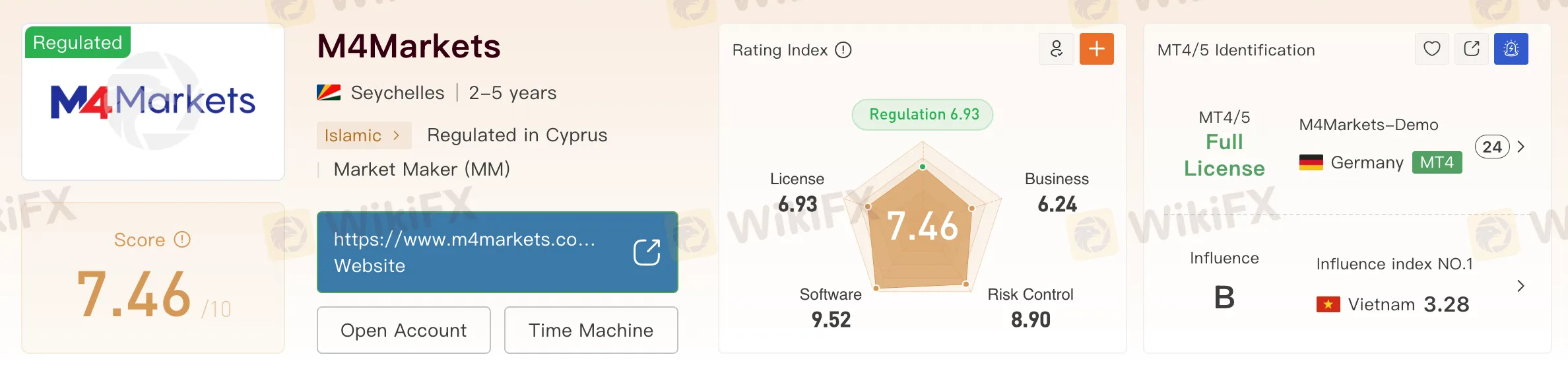

Founded in 2019, M4Markets has positioned itself as a multi-regulated broker offering CFD trading across forex, indices, commodities, shares, and cryptocurrencies. The broker provides access to the widely used MT4 and MT5 platforms, offering both retail and professional traders ultra-competitive spreads and execution speeds.

M4Markets holds regulatory licences from leading authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. This regulatory framework allows the broker to serve clients globally while adhering to internationally recognised industry standards.

According to data published on WikiFX, M4Markets supports a minimum deposit of just US$5, provides spreads from 0.0 pips on certain accounts, and offers leverage up to 1:5000. It also maintains a strong focus on speed, with average execution times of around 30 milliseconds. These conditions are designed to appeal to a wide spectrum of traders, from beginners to seasoned professionals.

View WikiFX‘s M4Markets’ full review here: https://www.wikifx.com/en/dealer/2668159034.html

The Role of Centroid Bridge

Centroid Solutions is widely recognised for building reliable institutional connectivity infrastructure capable of handling high volumes of trading activity with precision. Its flagship platform, Centroid Bridge, connects brokers to over 300 multi-asset liquidity venues. Among its features are liquidity aggregation, flexible execution routing, risk management tools, and detailed reporting capabilities.

The system is supported by hosting infrastructure in major financial hubs, including London, New York, Singapore and Tokyo, ensuring low-latency access to markets around the globe. For M4Markets, this translates into the ability to deliver faster execution, improved order routing and a more resilient trading environment, even in periods of high volatility.

Strategic Benefits of the Partnership

By integrating Centroid Bridge into its systems, M4Markets gains a centralised solution to manage liquidity provider connections, monitor execution quality, and maintain price stability. This allows the broker to accommodate a variety of trading styles and account types without compromising execution standards.

For traders, the benefits are direct: improved order fill rates, stable pricing even during market turbulence, and access to a wider pool of liquidity sources. The goal is to ensure every order, regardless of size or market condition, is handled with consistent precision and speed.

M4Markets‘ leadership has underlined that liquidity and execution quality are central to a trader’s overall experience, and that this partnership provides a powerful platform to strengthen these pillars further. Similarly, Centroid Solutions has described the alliance as fully aligned with its mission of delivering top-tier technology and trading conditions to clients worldwide.

About Centroid Solutions

Centroid Solutions is a global capital markets technology provider specialising in multi-asset connectivity, risk management, and execution solutions for brokers and financial institutions. Its solutions are designed to help firms optimise operations, expand product offerings, and deliver superior trading performance.

With a client base spanning over 50 countries, including brokers, banks and proprietary trading firms, Centroid has established itself as a trusted partner in the industry. Its team brings decades of expertise in brokerage technology, enabling it to continuously innovate and deliver infrastructure that meets the demands of fast-changing financial markets.

Conclusion

The partnership between M4Markets and Centroid Solutions is a significant step towards institutional-grade trading conditions in the retail FX and CFDs market. By combining M4Markets‘ multi-jurisdictional regulation, competitive spreads, and fast execution speeds with Centroid’s robust technology, traders are set to gain from deeper liquidity, sharper order execution, and stable pricing.

As both firms continue to invest in innovation and infrastructure, this collaboration marks a decisive move in raising the standard of retail trading and positioning M4Markets as a broker capable of delivering truly global, technology-driven services.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc