Zero Markets Forex Scam Alert News

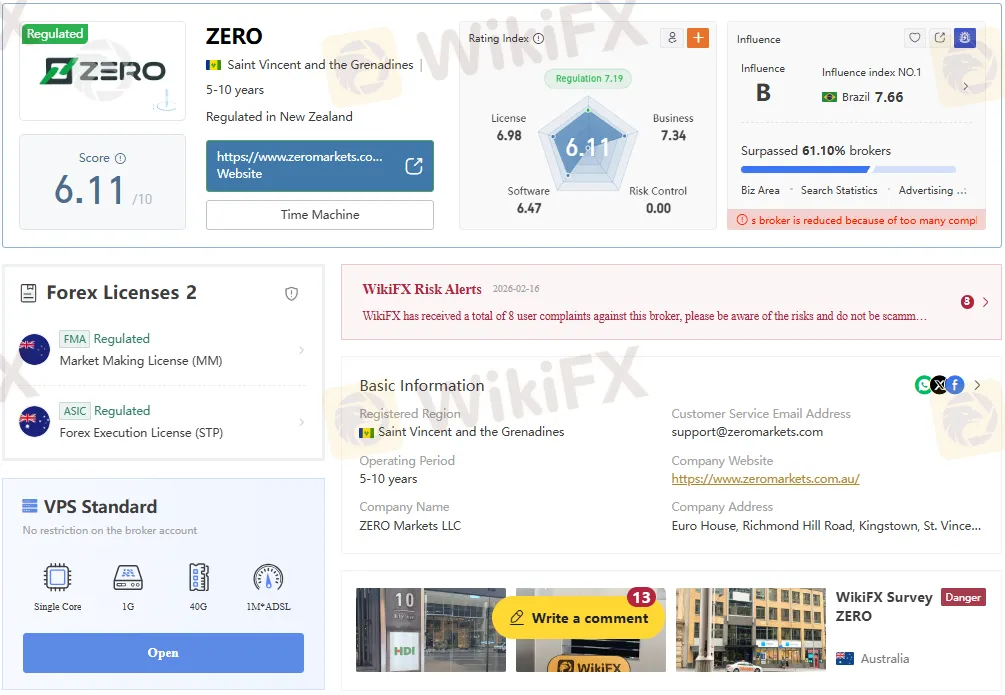

Abstract:Zero Markets faces allegations of scamming after blocking a $116K withdrawal from a South Korean trader (Dec 2025). FMA-regulated, but with red flags. Verify forex scams now!

Introduction: Why Zero Is Under Fire

Zero Markets, often shortened to Zero, presents itself as a regulated forex and CFD broker with global reach and modern trading tools. Yet a serious complaint involving a blocked withdrawal of about $116,111 from a South Korean client in December 2025 has raised urgent scam alert concerns. This exposure article examines those red flags and explains how the WikiFX App helps traders evaluate such forex scams before committing funds.

Brief Overview of Zero Markets

Zero Markets was founded in 2016 and is part of a group of entities that includes Zero Financial Pty Ltd and Zero Markets LLC. The broker is registered in Saint Vincent and the Grenadines, while its New Zealand arm, ZERO MARKETS (NZ) LIMITED, holds a Market Making license with the Financial Markets Authority (FMA), license number 569807. On paper, Zero offers access to forex, share CFDs, indices, commodities, metals, and cryptocurrencies via MT4 and MT5, with leverage up to 1:500 and a minimum deposit of 100 AUD.

Trading Conditions That Attract Investors

Zero offers several account types, including Standard, Islamic Standard, Islamic Raw, and Super Zero, designed for different trading styles. Spreads start from around 1.0 pips on the Standard account with no commission, while the Super Zero and Islamic Raw accounts advertise spreads from 0 pips but add commissions starting at about $2.50 per side or per 100,000 volume. Combined with instant deposits via cards, e-wallets, online banking, and crypto, plus social trading and demo accounts, these features can easily attract retail investors who may overlook potential risks of forex investment scams.

Deposit and Withdrawal Setup vs. Reality

On its profile, Zero lists multiple deposit methods like Neteller, Skrill, online banking, crypto options, and regional solutions, often highlighting “no deposit fee” and instant funding. Withdrawal methods include e-wallets, online banking, crypto channels, and local systems, with processing times of around 1 business day and clearly stated fees. At first glance, this structure suggests a professional operation, but the South Korean case shows how a forex trading scam pattern can emerge when promised withdrawal times are not honored.

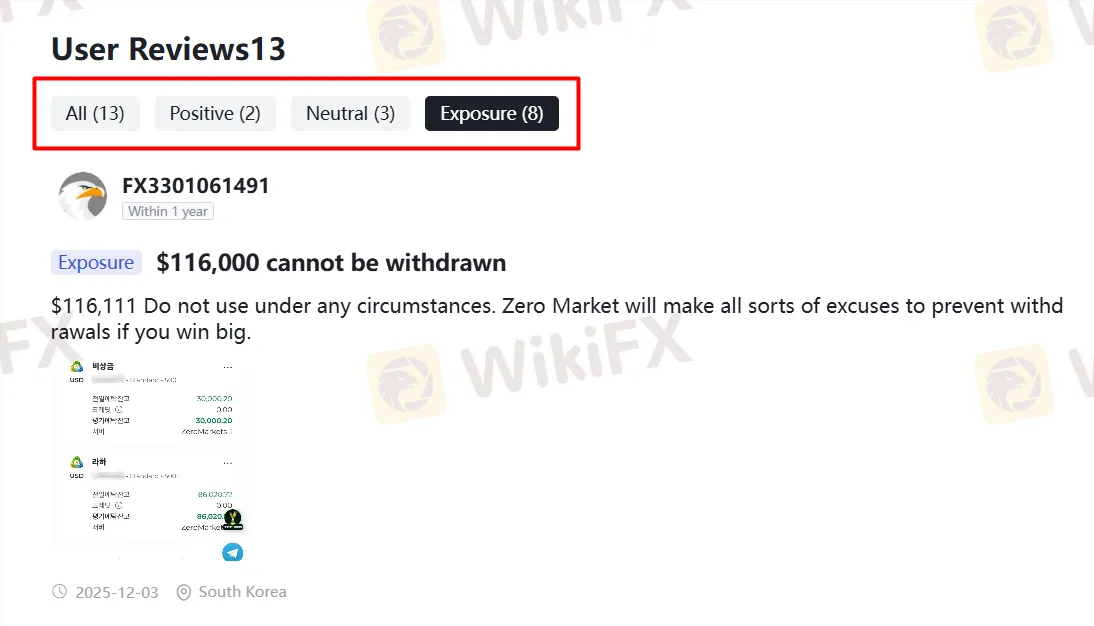

The $116,111 South Korea Case

A South Korean trader reported that after achieving significant profits, Zero Markets refused to process a withdrawal of approximately $116,111. According to the complaint, the broker allegedly made “all sorts of excuses” once the account showed large gains, turning a routine request into a prolonged battle. The user ultimately warned others not to use Zero under any circumstances, describing the experience as a forex scam where profits become effectively unreachable.

Why This Pattern Looks Like a Forex Scam

Many forex scams follow a similar script: deposits are smooth, trading platforms function normally, and problems only start once traders request sizable withdrawals. In the reported Zero Markets case, the large profit triggered repeated justifications and delays instead of a straightforward payout, fitting the classic forex trading scam pattern. When a regulated broker behaves this way, it undermines trust and suggests that regulatory status alone does not guarantee safe or fair treatment.

Regulation vs. Investor Safety

Zero Markets emphasizes that its New Zealand entity is regulated by the FMA as a market maker, which might reassure inexperienced traders at first glance. However, regulation can be limited by jurisdiction, group structure, and the specific entity holding the license, meaning that not all clients may enjoy the same level of protection. Traders facing blocked withdrawals may find that enforcement is slow or difficult across borders, which is why independent exposure reports and user reviews remain crucial for spotting a potential forex investment scam early.

Technical Strengths That Can Mislead

The brokers offering of MT4 and MT5 across Windows, macOS, iOS, Android, and web platforms creates the impression of a sophisticated, legitimate trading environment. Tight spreads, high leverage, and social trading features can attract active traders focused on strategy rather than counterparty risk. Yet even well-built platforms cannot compensate for a broker that allegedly refuses to release funds, so technical strengths should never overshadow withdrawal reliability.

How the WikiFX App Helps Expose Zero

The WikiFX App compiles regulatory information, broker profiles, and user complaints in one place, allowing traders to review both licenses and real-world experiences. By checking Zeros page on the WikiFX App, users can see that, while the broker is marked as regulated, there are also exposure posts describing serious withdrawal issues, such as the South Korea $116K case. This combination of official data and client feedback makes the WikiFX App a practical tool for distinguishing regulated brokers from those exhibiting scam alert behavior.

Using the WikiFX App Before You Deposit

Before sending any funds to Zero or similar firms, traders can search the brokers name inside the WikiFX App and scan its rating, regulatory details, and complaint history. Reading exposure articles and user comments there helps reveal whether withdrawal complaints are isolated or part of a pattern. Taking a few minutes to review those warnings in the WikiFX App can prevent months of stress trying to recover blocked capital from a potential forex scam.

Red Flags to Watch With Zero

Several red flags emerge from the available information: the large blocked withdrawal, the reported excuses after big wins, and the inaccessibility of the official website URL mentioned in the profile. High leverage up to 1:500, aggressive trading conditions, and complex group structures spanning different jurisdictions also increase the risk profile for retail clients. When red flags pile up around a single broker, cautious traders should treat it as a strong scam alert rather than a small operational glitch.

Final Thoughts: Treat Zero With Extreme Caution

Zero Markets combines regulated status, advanced platforms, and attractive trading conditions, but the serious South Korean complaint about a blocked $116,111 withdrawal cannot be ignored. When a broker allegedly pays smoothly on small accounts but resists large payouts, the risk of a forex trading scam becomes too high for prudent investors. Anyone considering Zero should review its exposure page on the WikiFX App, verify all details, and think carefully before entrusting funds to a broker already facing forex scam alerts.

Read more

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

ZarVista Regulatory Status: A Complete Guide to Its Licenses and Company Information

When choosing a trading broker, every trader asks the same important question: "Will my capital be safe?" To answer this question about ZarVista, we need to look at the facts carefully. While the broker does have licenses, our first look shows that all of its regulation comes from offshore locations. This fact alone creates serious concerns about how well traders are protected. When we look deeper into ZarVista regulation and license details, we find a complicated situation with many warning signs. Read on for more updates.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc