IUX Review: The Digital Mirage Where Capital Goes to Die

Abstract:IUX Markets presents a polished digital facade, but a mountain of unresolved withdrawal complaints and a critical CySEC warning reveal a broker that is effectively holding client capital hostage. Even with nominal FSCA and ASIC oversight, the internal rot suggests a high-risk operation where profits go in but rarely come out.

The retail trading world is littered with brokers that look the part. IUX Markets is no different, boasting a “B” influence rank and a slick MT5 integration. But behind the high-leverage marketing and the clean UI lies a grim reality documented by dozens of traders across Southeast Asia and India. The data doesn't lie: IUX is currently a black hole for withdrawals, and the regulatory authorities are beginning to take notice of the stench.

IUX Regulation and the CySEC Shadow

While IUX points to its licenses in South Africa and Australia as proof of legitimacy, the most telling piece of paperwork isn't a license—it's a warning. The Cyprus Securities and Exchange Commission (CySEC) has explicitly red-flagged IUX, listing their domain among unauthorized entities. This is a massive red flag. When a major European regulator warns the public about an entity, the “legal” status of their other offshore or secondary branches becomes secondary to the immediate risk of fraud.

| Regulator | License Type | Status |

|---|---|---|

| South Africa FSCA | Retail Forex License (53103) | Regulated |

| Australia ASIC | AR License (529610) | Regulated |

| Cyprus CySEC | Unauthorized Entity Warning | Blacklisted / Warning |

The duality of being “regulated” in one jurisdiction while being “blacklisted” in another is a classic shell game. It allows the broker to lure in victims with reputable logos while operating through unregulated or less stringent channels.

The Forex Nightmare: Profits Trapped in “Review”

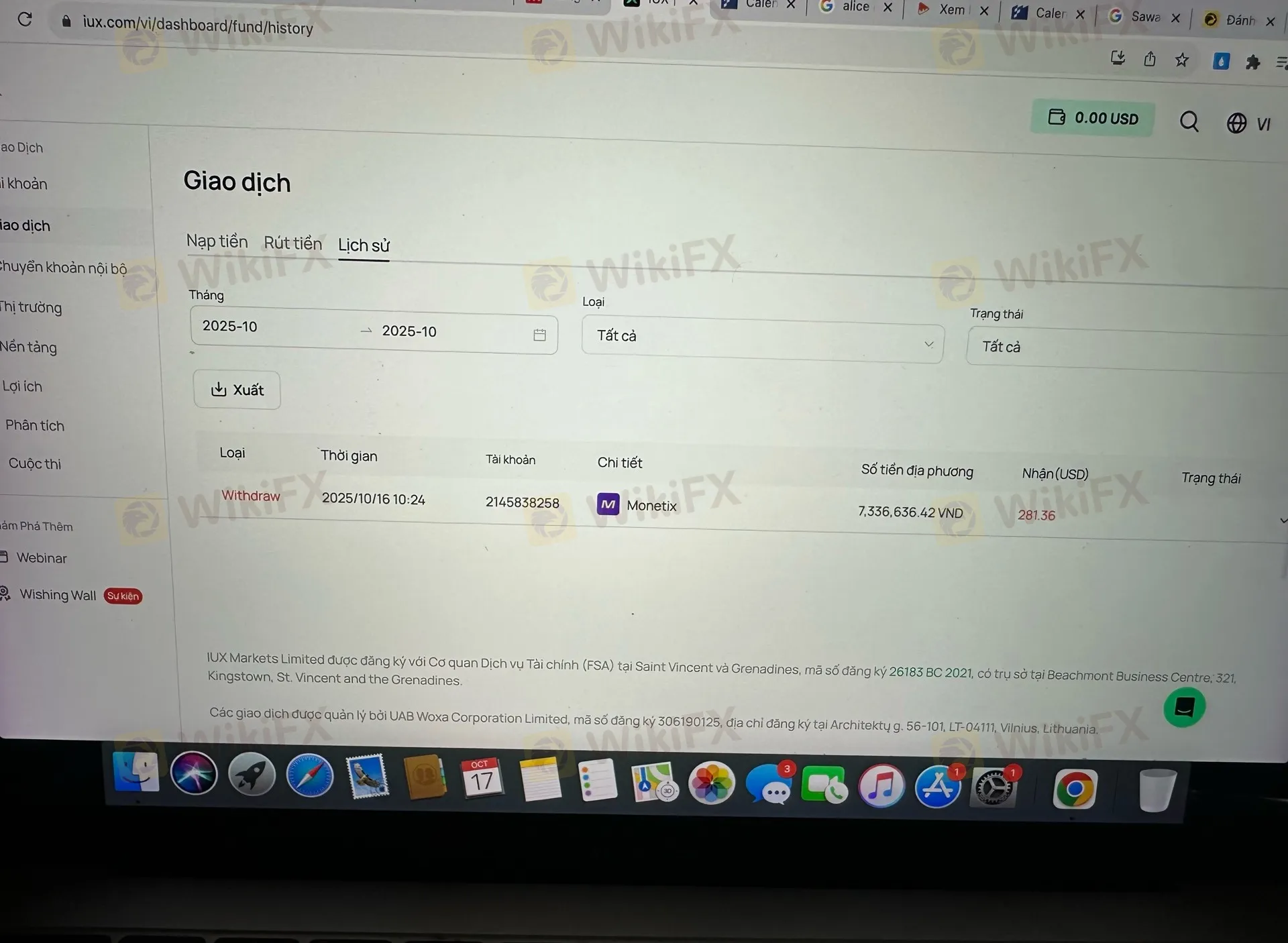

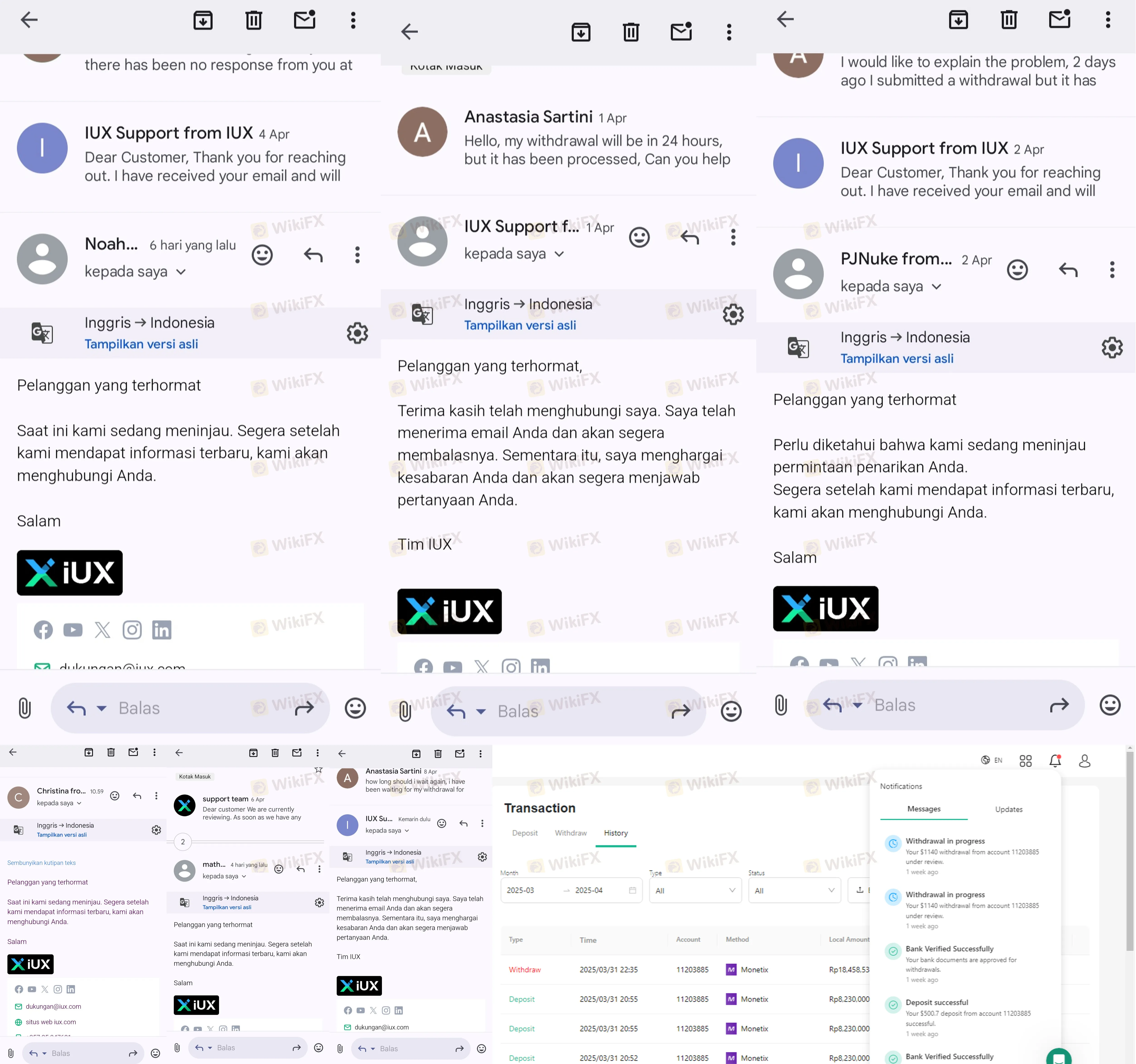

If you are looking for a reliable Forex partner, the case history for IUX should serve as a cold shower. Our investigation into recent user reports reveals a systemic pattern of withdrawal suppression. Traders from Vietnam, Thailand, and Indonesia all tell the same story: they hit “withdraw,” and the status stays “pending” or “under review” for weeks.

When confronted, IUX support offers a script of “wait 24 hours” followed by “we have escalated this to HQ.” This is stalling, plain and simple. In Case 2, a trader attempted to withdraw $2,666; six days later, despite multiple support tickets, the money remained in the broker‘s pockets. Even worse is Case 7, where the system sent a “success” notification for a withdrawal that never actually arrived in the client’s bank account.

Login and Platform Instabilities

While the broker advertises an “easy and fully digital” experience, the actual stability of the login process and trade execution is under heavy fire. In Case 9, a trader reported total platform failure during an active trade. Worse still, Case 20 highlights the ultimate nightmare: the broker simply locking the login credentials of a user “without any reason,” citing a vague “company decision.”

When a broker review reveals that a firm can unilaterally terminate your access to your own funds without a breach of terms, you aren't trading; you're gambling against a house that owns the exit.

The $10 Trap and 1:3000 Leverage

IUX targets low-capital traders with an entry condition of just $10 and extreme leverage of 1:3000. These are not features; they are bait. High leverage at this level is designed to wipe out accounts quickly, and for those who actually manage to make a profit, the “IP duplication” excuse (as seen in Case 22) is used to void gains and close accounts.

The professional-looking review of their software mentions a “Perfect” rating for their MT5 qualification, but software is irrelevant if the entity behind it is predatory. The lack of standard security features like two-factor authentication (2FA) for the login portal further confirms that IUX is more interested in speed of acquisition than the security of client assets.

Final Verdict: Excessive Risk

The IUX Markets review ends where it began: with a warning. A broker that ignores withdrawal requests for over 15 days (Case 10) and operates in the shadow of a CySEC warning is not a place for serious capital.

Risk Warning: Trading involves significant risk. The evidence suggests that with IUX, the greatest risk is not the market, but the broker itself. If you're still considering that IUX broker link, look at the 20+ recent complaints and ask yourself if you're prepared to lose not just your profits, but your entire deposit.

Traders are advised to stick to brokers with top-tier (Tier-1) regulation and a clean record of withdrawal processing. IUX fails both tests miserably.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Grand Capital Review 2026: Is this Broker Safe?

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc