IG Review: Regulation, Licences and WikiScore Overview

Abstract:This IG review provides a factual examination of the regulatory standing, licensing framework and WikiScore of the IG broker, based on publicly available data from the WikiFX platform.

This IG review provides a factual examination of the regulatory standing, licensing framework and WikiScore of the IG broker, based on publicly available data from the WikiFX platform. Regulation remains one of the primary considerations when assessing a global trading provider, and this article focuses specifically on IG regulation and the financial authorities that supervise the broker across multiple jurisdictions.

Overview of IG on WikiFX

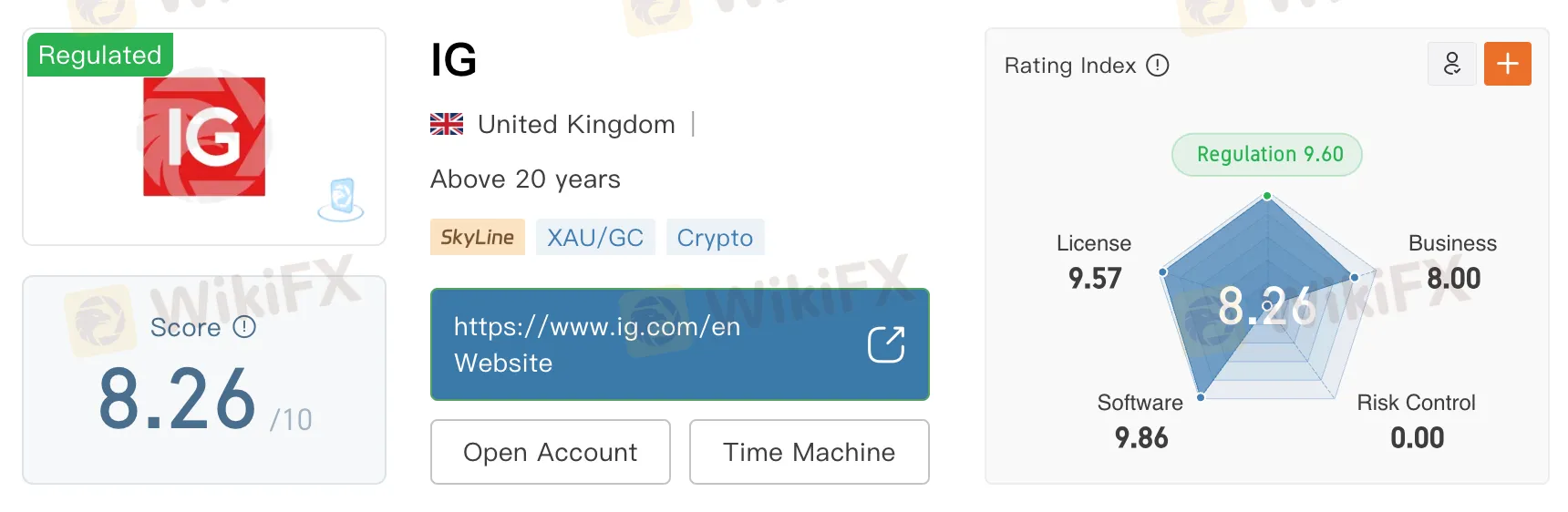

According to WikiFX, the IG broker holds a WikiScore of 8.26 out of 10. This places IG within the higher tier of brokers listed on the platform. The WikiScore is calculated using criteria such as regulatory strength, licence credibility, operational history, business scale, platform performance and exposure indicators.

View WikiFX's full review on IG here: https://www.wikifx.com/en/dealer/0001473583.html

A score above eight generally reflects a broker with substantial regulatory coverage and a stable operational record. For IG, the score is supported by a wide network of licences issued by established financial authorities in major global financial centres.

IG Regulation Structure

IG regulation spans multiple jurisdictions across Europe, Asia Pacific, the Middle East and Africa. The broker holds market making and derivatives trading licences issued by recognised regulators, many of which are considered leading authorities within their respective regions.

Australia Securities and Investments Commission

IG is authorised by the Australia Securities and Investments Commission under a Market Making Licence with licence number 515106. ASIC is the corporate, markets and financial services regulator in Australia. It enforces strict conduct standards, capital requirements and client money protection rules for licensed firms.

ASIC regulated brokers must meet compliance obligations relating to transparency, reporting and operational risk management. The presence of an ASIC licence contributes to IG regulation within the Asia Pacific region.

Financial Conduct Authority of the United Kingdom

IG holds two separate authorisations from the Financial Conduct Authority of the United Kingdom. The first is a Market Making Licence under licence number 195355. The second is a Derivatives Trading Licence under licence number 114059.

The FCA is widely regarded as one of the most stringent financial regulators globally. It supervises financial institutions operating in the United Kingdom and imposes detailed requirements regarding capital adequacy, segregation of client funds and consumer protection. FCA authorised firms are subject to continuous regulatory oversight and must comply with strict reporting obligations.

Within this IG review, the dual FCA authorisations represent a significant component of IG regulation and support the brokers strong regulatory profile in the United Kingdom.

Japan Financial Services Agency

IG is authorised by the Japan Financial Services Agency under a Market Making Licence with licence number 255. The FSA is Japans primary financial regulator and oversees banks, securities firms and derivatives providers operating within the country.

The Japanese regulatory framework is known for its detailed supervisory standards and leverage restrictions designed to protect retail investors. Authorisation by the Japan FSA allows IG to operate within one of Asias most tightly regulated financial markets.

Federal Financial Supervisory Authority of Germany

IG holds a Forex Trading Licence issued by Germanys Federal Financial Supervisory Authority under licence number 10148759. BaFin, as it is commonly known, regulates financial institutions operating in Germany and enforces European Union financial regulations.

BaFin supervision includes requirements relating to conduct of business, client asset protection and compliance with European financial directives. This licence further strengthens IG regulation within the European market.

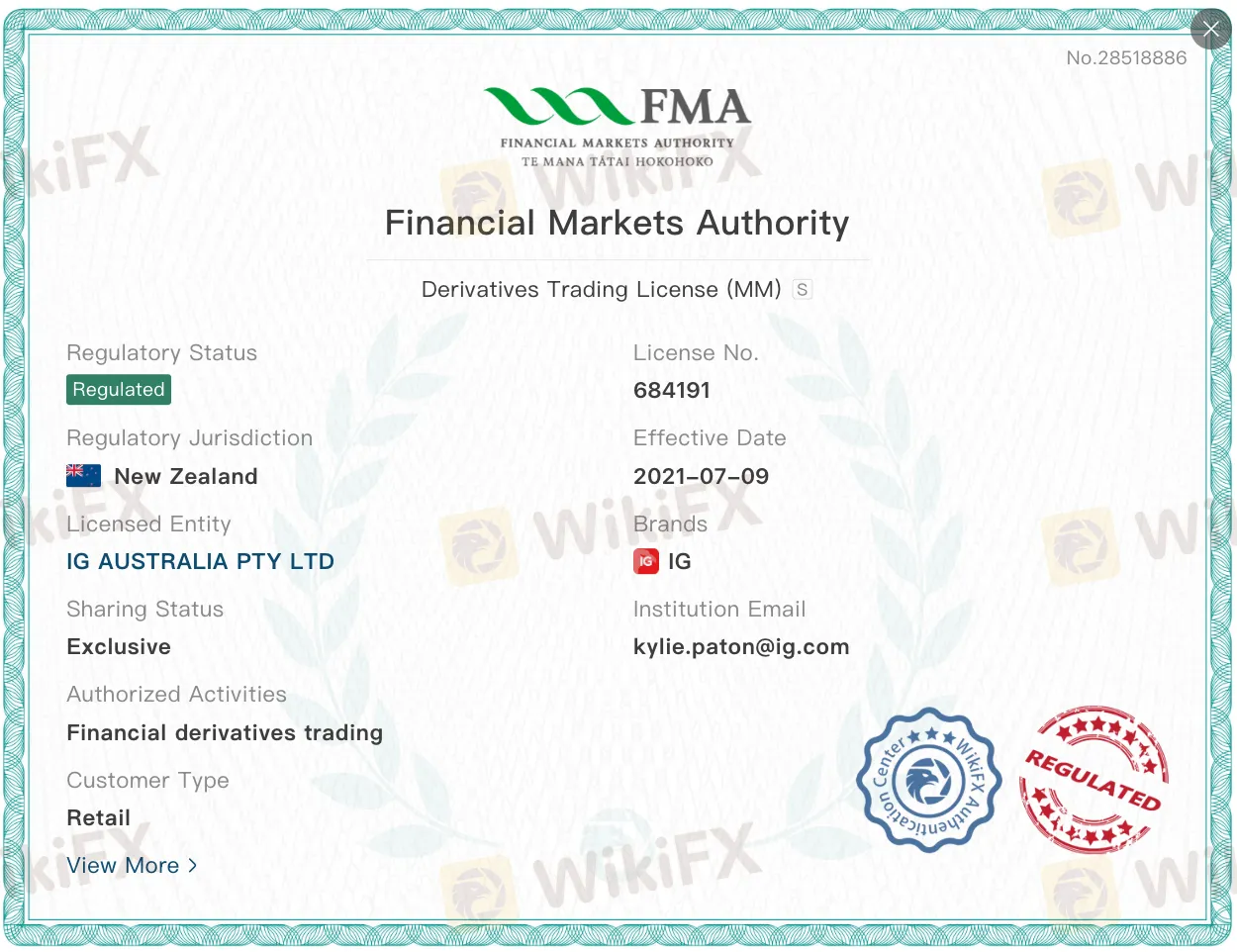

Financial Markets Authority of New Zealand

IG is authorised by the Financial Markets Authority of New Zealand under a Derivatives Trading Licence with licence number 684191. The FMA oversees financial service providers operating in New Zealand and focuses on market integrity and investor protection.

Licensed firms must comply with disclosure requirements and operational standards established under New Zealand financial legislation.

Dubai Financial Services Authority

IG holds a Derivatives Trading Licence issued by the Dubai Financial Services Authority with licence number F001780. The DFSA regulates financial services conducted in or from the Dubai International Financial Centre.

The DFSA applies a regulatory framework aligned with international standards and supervises firms for compliance with prudential and conduct requirements.

Financial Sector Conduct Authority of South Africa

IG is authorised by the Financial Sector Conduct Authority of South Africa under a Derivatives Trading Licence with licence number 41393. The FSCA oversees market conduct and consumer protection within South Africas financial sector.

This licence adds regulatory coverage within the African region and reflects IGs presence in that market.

Monetary Authority of Singapore

IG also holds a Derivatives Trading Licence issued by the Monetary Authority of Singapore. MAS functions as both the central bank and financial regulator of Singapore. It supervises banks, insurers and capital markets intermediaries, enforcing robust prudential and conduct standards.

Authorisation by MAS places IG within one of Asias major financial centres and contributes to its broad regulatory footprint.

Regulatory Scope and WikiScore Context

The combination of licences from ASIC, the FCA, the Japan FSA, BaFin, the FMA, the DFSA, the FSCA and MAS demonstrates that IG regulation spans several major financial jurisdictions. Many of these authorities are regarded as tier one regulators due to their established supervisory frameworks and enforcement powers.

The WikiScore of 8.26 reflects this extensive regulatory coverage and the brokers standing across multiple markets. While the score does not constitute an endorsement, it indicates a comparatively strong regulatory profile when assessed against other brokers listed on WikiFX.

Conclusion

This IG review highlights a broker with a comprehensive global regulatory structure. IG regulation includes authorisations from leading financial authorities in the United Kingdom, Australia, Japan, Germany, New Zealand, Dubai, South Africa and Singapore.

The breadth of regulatory oversight contributes significantly to IGs WikiScore of 8.26 and positions the IG broker among the more highly rated firms on the WikiFX platform. As always, traders are encouraged to consider regulatory information alongside other factors when assessing any broker.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Grand Capital Review 2026: Is this Broker Safe?

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc