Citadel Securities Spreads, leverage, minimum deposit Revealed

Abstract:Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

| Citadel Securities Review Summary | |

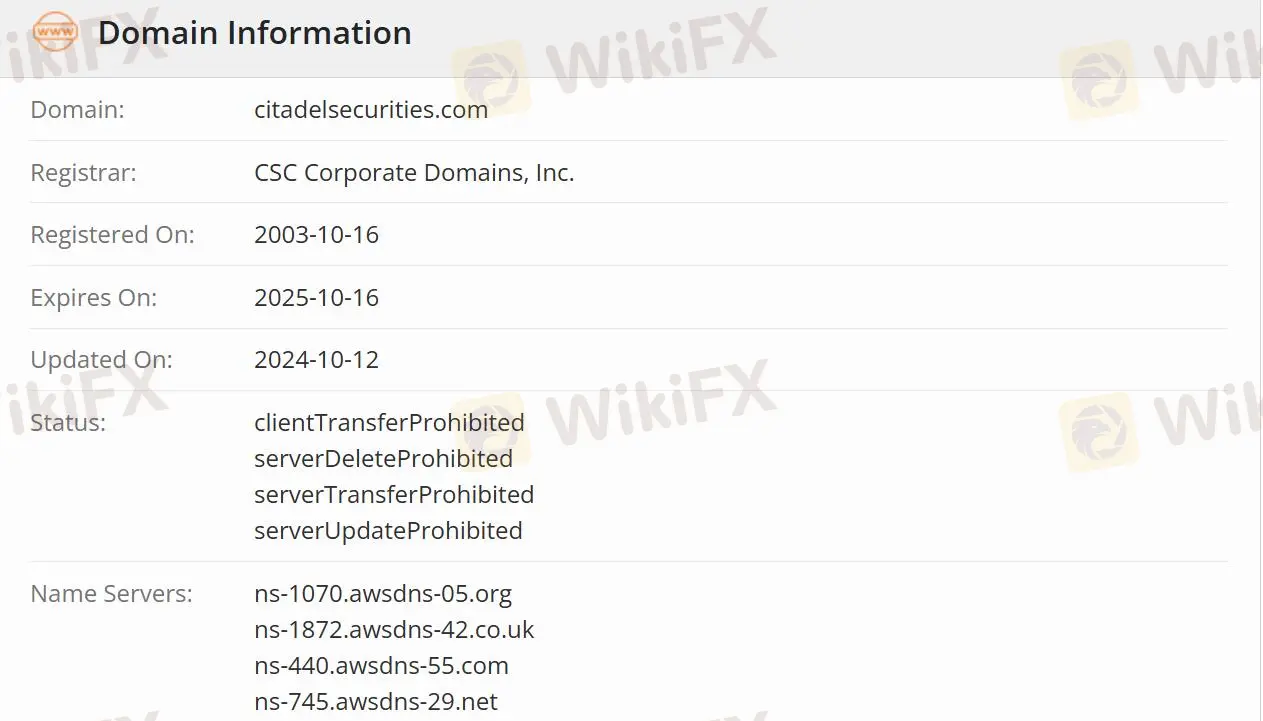

| Founded | 2003-10-16 |

| Registered Country/Region | United States |

| Regulation | Regulated |

| Services | Equities/Options/Fixed Income & FX/Corporate Solutions |

| Customer Support | LinkedIn/Facebook/Instagram/YouTube |

Citadel Securities Information

Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

Is Citadel Securities Legit?

Citadel Securities is authorized and regulated by the Securities and Futures Commission of Hong Kong(SFC), making it safer than an unregulated company.

What services does Citadel Securities provide?

One of Citadel Securities' functions is market making, which provides liquidity to investors by purchasing securities from sellers and selling them to buyers. Citadel Securities Enterprise Solutions also helps investors make decisions.

Bringing together financial services firms, including major banks, brokers, and even other market makers, to lead the creation of an exchange founded and operated by its members to launch the MEMX fully electronic stock exchange.

Asset-related businesses include equities, options, and fixed income & FX.

Latest News

AI Fraud Awareness Campaign: "We're Not All F**ked"

Crypto.com Delists USDT and 9 Tokens to Comply with MiCA Regulations

How to Use Financial News for Forex Trading?

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

Rate Calc