Finq Spreads, leverage, minimum deposit Revealed

Abstract: Finqgroup is an online CFD and forex trading services broker founded in 2017. Finq .com is operated by dilna investments ltd which is the main payment provider and operator of the website. dilna investments ltd acts on behalf of its parent company, Leadcapital Corp Ltd is regulated as a securities dealer by the seychelles financial services authority under registration number sd007.

general information and regulation of Finq

Finqgroup is an online CFD and forex trading services broker founded in 2017. Finq .com is operated by dilna investments ltd which is the main payment provider and operator of the website. dilna investments ltd acts on behalf of its parent company, Leadcapital Corp Ltd is regulated as a securities dealer by the seychelles financial services authority under registration number sd007.

In the following article, we will analyze the characteristics of this merchant in all its dimensions, offering you easy and well-organized information. If you're interested, read on. Reading this article will take you approximately 5 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

market instruments

Finqgroup offers traders over 2,000 popular tradable financial instruments, primarily currencies, stocks, commodities, bonds, cryptocurrencies and ETFs.

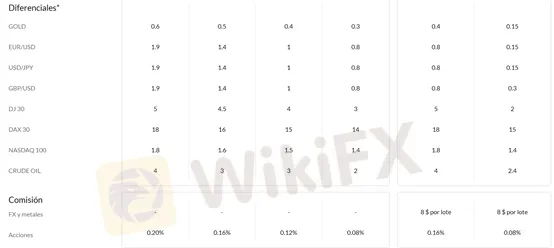

spreads and commissions to trade with Finq

Spreads vary across account types, and as a general rule, the unique account with the highest threshold has the lowest spreads.

Regarding the commission, all accounts have a commission between 0.08% and 0.2% for shares. Only the classic account and ECN account have a commission of $8 per lot for Forex and metals.

trading accounts available at Finq

Demo Account: Offers a demo account for you to try a little on the financial market without the risk of losing money. The virtual fund will be $10,000.

real account: Finq offers a total of 6 types of account: silver, gold, platinum, exclusive, classic and ecn. the minimum deposit to open an account is respectively $100, $10,000, $50,000, $100,000, $1,000 and $50,000. If you are still a beginner and did not want to invest too much money in forex trading, the silver or classic account will be the most suitable option for you. but we must also be aware that having too little capital not only reduces losses, but also returns. therefore, it may seem “unexciting” or unprofitable to you. Furthermore, accounts with smaller initial deposits tend to have less favorable trading conditions.

trading platform that offers Finq

MT4 Even though a lot of time has passed since the launch of MT4 and the subsequent upgrade to MT5, MT4 is still a major player in the market and is loved by traders all over the world. Access from different devices also makes trading easier for users.

Leverage monximo of Finq

on the website of Finq We did not find information regarding commercial leverage. There are forex brokers that offer leverage up to 1:500, but new users are advised to trade with caution with such large leverages.

Deposit and Withdrawal: methods and fees

traders can withdraw and deposit funds to their pool account Finq through visa, mastercard, maestro, skrill, neteller, fasapay, and many other methods. the minimum deposit is $100.

education in Finq

A number of educational resources are available at Finq . We have an economic calendar, news, frequently asked questions, and so on.

We cannot deny its importance, but the best teacher for you to know more about Forex trading is always the actual operations. It is impossible to progress by relying solely on tools.

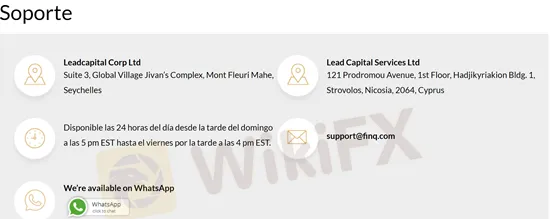

customer service of Finq

Here are more details about customer service

Languages: English, Spanish, Arabic, Chinese, Russian, Thai, etc.

Hours of Service: 24 hours a day from Sunday afternoon at 5 pm EST to Friday afternoon at 4 pm EST.

Address: Suite 3, Global Village Jivans Complex, Mont Fleuri Mahe, Seychelles

121 Prodromou Avenue, 1st Floor, Hadjikyriakion Bldg. 1, Strovolos, Nicosia, 2064, Cyprus

email: support@ Finq .with

Social networks: WhatsApp

complaints against Finq that we have received in wikifx

We have not received any complaints for the moment.

pros and cons of Finq

Pros: Well regulated, MT4, educational resources, many traded products, demo account

Cons: Lack of information, few deposit and withdrawal methods, no MT5, no Islamic accounts, no copy trading.

frequently asked questions about Finq

Can I trade cryptocurrencies in Finq ?

Yeah, Finq offers some popular cryptocurrencies like bitcoin and ethereum.

Does this broker offer demo accounts?

of course. like most brokers, Finq offers demo accounts where you can try trading without risk.

Latest News

Simulated Trading Competition Experience Sharing

Neex Secures UAE License, Expands Middle East Ops

Exness Redefines Forex Trading Standards

Robo Trading Explained: What It Is and How It Works?

Robinhood Sues Massachusetts Over Sports Bet Rules

Forex Pips Explained: Definition, Importance & Key Insights for Traders

CySEC Updates CFD Restrictions to Enhance Retail Investor Protection

Top 5 Forex MAM Brokers for 2025: A Complete Comparison Guide

Chase-Plaid Deal Sets Banking Fee Precedent

Uncovering! The Real Problems with "Fair Markets"

Rate Calc