Robinhood Sues Massachusetts Over Sports Bet Rules

Abstract:Robinhood files federal suit to block Massachusetts from enforcing state sports betting laws on its event contracts trading with Kalshi.

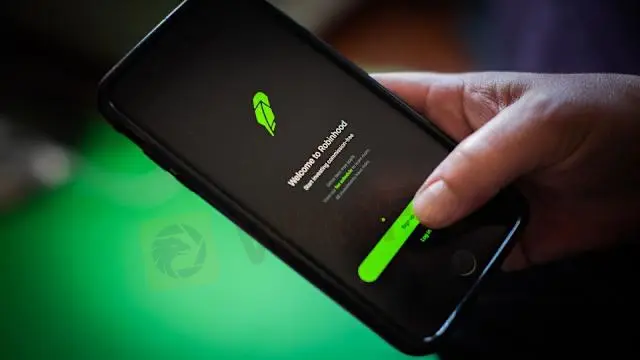

Robinhood Challenges Massachusetts Over Event Contracts

BOSTON, Sept. 15, 2025 — Robinhood Derivatives, LLC has filed a federal lawsuit seeking to prevent Massachusetts regulators from applying state gambling laws to its facilitation of sports-related event contracts. The move follows the state‘s recent legal action against KalshiEx LLC, Robinhood’s trading partner, for allegedly offering sports wagering without a license.

The complaint, lodged in the U.S. District Court for the District of Massachusetts, names Attorney General Andrea Joy Campbell and all five commissioners of the Massachusetts Gaming Commission (MGC) as defendants. Robinhood argues that its operations fall under federal oversight via the Commodity Exchange Act and the Commodity Futures Trading Commission (CFTC), making state-level enforcement a case of state gambling law preemption.

Link to Kalshi Lawsuit

On September 12, 2025, Massachusetts sued Kalshi in Suffolk County Superior Court, claiming the platforms sports-related event contracts amounted to unlicensed sports wagering in violation of state law. The state is seeking monetary damages and a permanent injunction to halt such activity.

Massachusetts‘ complaint specifically referenced Robinhood, alleging that Kalshi’s contracts are also available through the Robinhood platform. The filing claimed that approximately $1 billion in Kalshi wagers were traded via Robinhood in Q2 2025, generating an estimated $10 million in revenue for Kalshi.

Robinhoods Legal Position

Robinhood maintains that while it facilitates the placement and liquidation of event contracts trading for approved customers, all transactions occur on Kalshi‘s federally regulated exchange. The company warns that without court intervention, it faces an “imminent threat” of civil and criminal penalties, reputational damage, and disruption to Massachusetts customers’ access to sports-related event contracts.

The lawsuit seeks a preliminary injunction trading platform order to block the MGC and Attorney General from enforcing state laws that Robinhood contends are preempted by federal regulation.

Broader Regulatory Context

Kalshi has previously secured preliminary relief in other states against similar enforcement attempts, highlighting ongoing tensions between federal derivatives regulation and state-level gaming commission regulatory enforcement. Massachusetts officials, however, argue that sports wagering — whether through traditional sportsbooks or event contracts — must comply with state licensing, taxation, and responsible gambling requirements.

Attorney General Campbell emphasized that “sports wagering comes with significant risk of addiction and financial loss and must be strictly regulated to mitigate public health consequences.”

Read more

My Forex Funds Charts Path for 2025-2026 Revival After Legal Wins

My Forex Funds unveils 2025-2026 roadmap post-CFTC win: asset recovery, data analysis, and team rebuild.

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Amillex Global Secures ASIC Licence for Expansion

Amillex Global gains ASIC AFSL licence, boosting FX and CFDs credibility. Expansion targets Asia, Australia, and institutional trading growth.

WikiFX Broker

Latest News

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

Admirals Cancels UAE License as Part of Global Restructuring

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Exness Broker Expands in South Africa with Cape Town Hub

Rate Calc