Floss Spreads, leverage, minimum deposit Revealed

Abstract:Floss is an unregulated brokerage company registered in Hong Kong. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Note: Floss's official website: https://flossfx.com/zh-cn/ is currently inaccessible normally.

Floss Information

Floss is an unregulated brokerage company registered in Hong Kong. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Is Floss Legit?

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

Downsides of Floss

- Unavailable Website

Floss's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Floss does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Floss is not regulated by other institutions, which increases the possibility of scams.

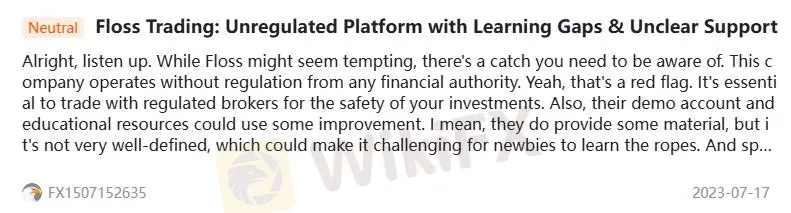

Floss Reviews on WikiFX

Even though this is a natural review, the user meant it negatively. He said he was concerned about the brokers lack of regulation and the lack of features on the platform. You may visit: https://www.wikifx.com/en/comments/detail/Co202307165791374945.html.

Conclusion

Floss Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

What Is a Forex Expert Advisor and How Does It Work?

Rate Calc