Commodities Rout: Silver Crashes 7% as Trump Scraps 'Critical Mineral' Tariffs

Silver plunges over 7% as the US administration scraps blanket tariffs on critical minerals, triggering a massive liquidation of speculative long positions.

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold prices climb above $4,600 after rebounding from recent losses. US jobless claims reinforce Fed rate-hold expectations, while easing geopolitical tensions limit safe-haven demand.

China Policy Watch: PBoC Cuts Structural Rates by 25bps; Signals Further Easing

The People's Bank of China cuts structural policy rates by 25 basis points and signals further easing, marking a divergence from global central banks that supports the yuan's stability.

USD Resurgent: Strong Labor Data and "Trump QE" Squeeze EUR/USD Below 1.1600

The US Dollar strengthens as initial jobless claims hit lows and mortgage rates dip, complicating the Fed's path despite political pressure.

Aussie Dollar Falters: Fed-RBA Policy Divergence Widens on Resilient US Data

Outperforming US retail data and cooling Australian inflation expectations widen the policy divergence between the Fed and RBA, sending AUD/USD lower. Technical markers suggest a potential test of 0.6590 if support at 0.6660 fails.

Washington Outlook: Shutdown Averted as Market Focus Shifts to Fed Independence

Congress passes critical spending bills to avert a government shutdown, removing immediate fiscal headwinds for the USD. Meanwhile, JPMorgan CEO Jamie Dimon underscores the critical importance of Federal Reserve independence amid political pressure.

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Silver prices experienced extreme volatility, plunging over 5% after the US delayed new tariffs on critical minerals. Long-term bulls face headwinds as the solar industry accelerates 'thrifting' to reduce silver consumption.

Bursa Malaysia buoyed by improved investor appetite

Bursa Malaysia extended its rally to a fresh seven-year high, supported by stronger global earnings, continued buying in banking stocks and sustained foreign fund inflows, although analysts caution that near-term volatility may persist amid limited domestic catalysts.

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

When you start looking into the Castle Market review, the first question that usually comes to mind is whether it is safe to trade with the castle market broker. To find the answer, you then examine the Castle Market Regulation to confirm if the broker is legitimate or not. This process represents the complete journey of a broker hunt. Let’s take this research further and explore the Castle Market Forex Broker Review by covering all the essential details.

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

Metals Volatility: Silver crashes 7% on Tariff Pause, Geopolitics Floor Gold

Silver prices crashed over 7% following a pause in US tariff threats, while Gold retains a geopolitical premium amidst escalating tensions involving Iran and Greenland. Volatility in precious metals highlights the market's sensitivity to the shifting US policy stance on trade and global order.

Currency Defender: Bank of Korea Threatens Capital Controls to Save the Won

Bank of Korea Governor Rhee has signaled drastic measures to stabilize the Won, threatening to block outward capital flows as the currency faces intense depreciation pressure.

Orbex Review 2025: Regulatory Status and Safety Analysis

Orbex is a forex and CFD broker headquartered in Cyprus, established in 2010. With over a decade of operation, the broker has established a presence in regions such as the UAE, Argentina, and DACH countries (Germany, Austria, Switzerland). While Orbex holds a decent WikiFX Score of

STRIKE PRO Review 2025: Safety, Features, and Reliability

STRIKE PRO (Strike ProFX) is an online brokerage established in 2019, with its headquarters located in Saint Vincent and the Grenadines. The broker focuses on providing a fully digital account opening experience and utilizes the MetaTrader 5 (MT5) platform. Despite its operational history, STRIKE PRO currently holds a WikiFX Score of

Grand Capital Investigation: The "Seychelles" Broker That Seychelles Denies Knowing

The smoking gun for Grand Capital isn't hidden in fine print; it is pasted on the official notice board of the Seychelles Financial Services Authority (FSA). While this broker’s marketing materials proudly claim an address at "Aarti Chambers" in Victoria, Mahe, the very regulator governing that jurisdiction has publicly disavowed them.

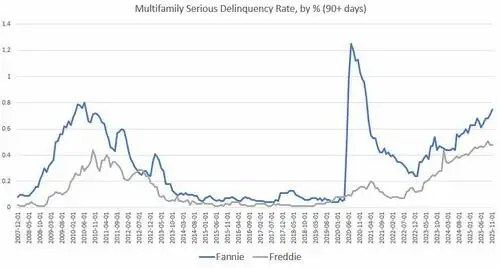

Multifamily Delinquencies Rise Again, Hit New Post-Great Recession High

Fannie Mae and Freddie Mac (also known as “GSEs”) have released their November reports on their mort

Common Questions About BOLD PRIME: Safety, Fees, and Risks (2025)

If you are currently looking at BOLD PRIME, you might be tempted by their promises of ultra-high leverage and easy account openings. It is common for newer traders to look for brokers that lower the barrier to entry. However, beneath the surface of slick marketing layouts lies a complex reality that requires serious caution.

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Did your forex trading experience with FXNovus become bad after a short profitable spell on small trades? Did you make tax payments on your failed withdrawal request, as the funds did not arrive? Did the customer support team fail to return your hard-earned profits on the FXNovus trading platform? Feel that the South Africa-based forex broker debited illegitimate fees from your trading account? You are not alone! Many traders have voiced these trading concerns while sharing the FXNovus review. In this article, we have highlighted these concerns in greater detail. Read on!

Alpari Review 2025: Safety, Fees, and User Complaints

Alpari, a brokerage established in 2016 and headquartered in Comoros, presents a complex profile for traders. While it offers high leverage and a low barrier to entry, its regulatory status and safety score raise significant questions. With a

KIRA Review for GCC Traders

Key services include access to over 10,000 CFD trading instruments, which covers many different types of investments. Traders can use two different platforms, MetaTrader 5 (MT5) and CQG, from one account. Understanding what its customers need, KIRA offers dedicated Arabic language support and Islamic accounts that follow Sharia law. This article aims to give you a complete and balanced review of KIRA's trading conditions, platform features, regulatory status, and overall suitability for traders in the GCC, helping you make a smart decision.