Pinnacle Pips Forex Fraud Exposed

Abstract:Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

Introduction: Why Pinnacle Pips Is Under Fire

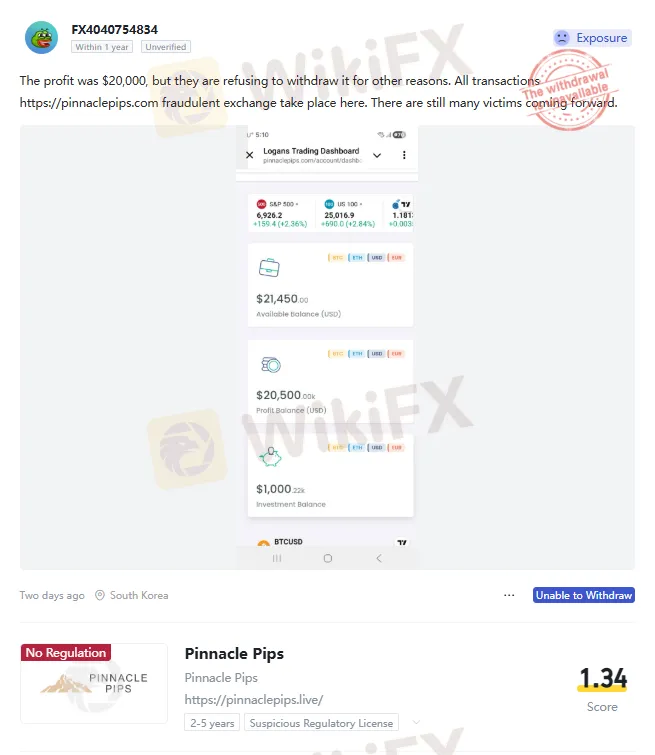

Pinnacle Pips has come under serious scrutiny after a victim reported being unable to withdraw 20,000 USD in profits from their trading account. The complaint states that all transactions were conducted on the site pinnaclepips.com and were later alleged to be fraudulent, with similar victims continuing to come forward from South Korea and other regions.

This exposure article examines how this broker operates, highlights the red flags on its WikiFX profile, and explains why traders should treat Pinnacle Pips as a high‑risk forex trading scam. The goal is to help readers recognize the warning signs before depositing funds and to use tools like the WikiFX App to verify brokers in advance.

Brief Overview of Pinnacle Pips

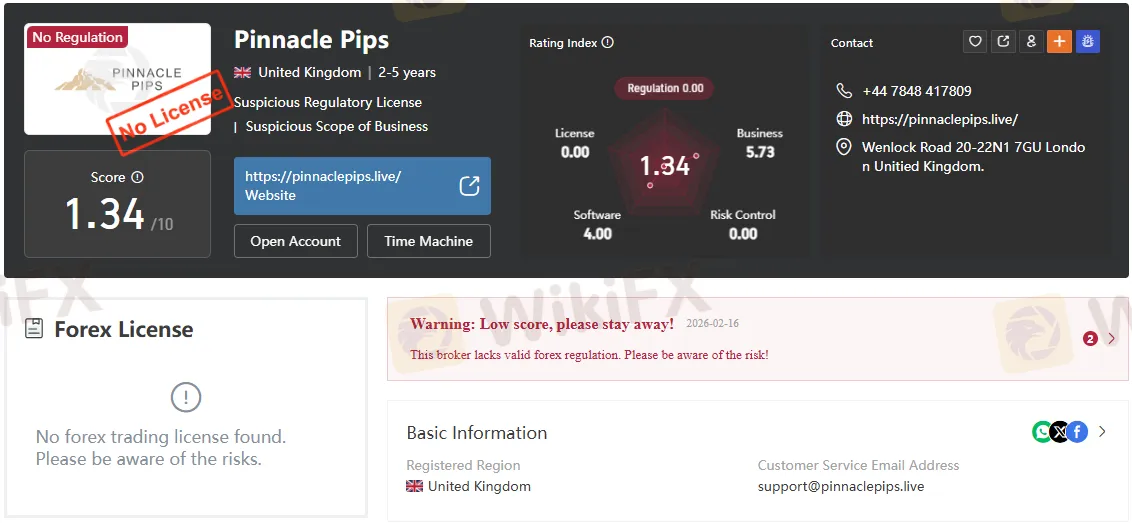

On its WikiFX page, Pinnacle Pips is listed as a forex broker connected to PINNACLE PIPS INC., with a founder named Kabri Irving and a registered address in Georgia, United States. The profile links to the trading website pinnaclepips.live and lets users click “Open Account” or check the brokers historical data using the time‑machine tool.

Crucially, the same page displays a warning that no forex trading license has been found for Pinnacle Pips, urging users to be aware of the risks of trading on an unregulated platform. This lack of regulatory oversight already places the broker in a dangerous category for retail traders who rely on clear rules and investor protections.

Unregulated Status and High‑Risk Warning

One of the strongest red flags around Pinnacle Pips is its explicitly stated regulatory status: “No forex trading license found. Please be aware of the risks.” When a broker operates without authorization from any recognized financial regulator, clients have no formal avenue to challenge unfair practices, frozen accounts, or withheld withdrawals.

Unregulated forex brokers can change terms at will, delay payouts, or invent vague “compliance issues” to justify blocking client funds. In the case of Pinnacle Pips, this unregulated status complements allegations of a forex investment scam, in which profits appear on-screen but never reach the traders bank account.

Victim Case: $20,000 Profit But No Withdrawal

The most striking exposure involves a trader who reportedly generated a 20,000 USD profit through Pinnacle Pips but was later blocked from withdrawing the money. The complaint explains that all trading and settlement activities were channelled through pinnaclepips.com, which the victim now describes as a fraudulent exchange that traps deposits.

Instead of processing the payout, Pinnacle Pips allegedly cited unspecified reasons to refuse the withdrawal request, a classic pattern in many forex scams. The case is linked to South Korea under code 2‑14‑1016, and the report emphasizes that more victims are still coming forward, suggesting this is not an isolated incident but an ongoing exposure to a forex trading scam.

How the WikiFX App Flags Pinnacle Pips

The WikiFX page for Pinnacle Pips includes a broker score indicating serious risk, along with a prominent notice about the missing forex license and related exposure records from users. This type of data in the WikiFX App helps traders quickly see whether a broker is legitimate or associated with forex scams before they hand over their money.

By aggregating user complaints, regulatory checks, and background details such as corporate addresses and key personnel, the WikiFX App builds a more complete picture than a brokers marketing website alone. In the case of Pinnacle Pips, the combination of an unregulated label, user exposure from South Korea, and a low overall score paints a clear picture of a potential forex scam.

Key Red Flags Traders Should Notice

The first red flag is the absence of any valid forex trading license for Pinnacle Pips, which removes standard investor protections and dispute mechanisms. The second red flag is user exposure: a supposedly successful trading account with a 20,000 USD profit suddenly became inaccessible for withdrawals, with the broker giving vague reasons.

A third red flag is the reliance on external transactional channels like pinnaclepips.com, which the exposure labels as a fraudulent exchange where all deposits and trades occur. Taken together, these elements strongly resemble known patterns in forex investment scams: fake profits, blocked withdrawals, and a lack of regulatory oversight.

Why Unregulated Brokers Are Dangerous

Unregulated brokers like Pinnacle Pips are not subject to strict capital requirements, regular audits, or conduct rules that protect investor funds. If such a broker decides to cancel profits or refuse withdrawals, clients usually have no recourse other than public exposure and private legal action, which can be expensive and uncertain.

These entities may also change leverage rules, fees, or bonus conditions at any time to fabricate “violations” that justify seizing balances. For many victims, the first clear sign of trouble is when they try to withdraw profits and are met with stalling tactics, extra deposits demanded, or outright silence—warning signs that the operation is closer to a forex trading scam than a true broker.

How the WikiFX App Helps You Avoid Similar Forex Scams

Checking any broker in the WikiFX App before opening an account gives traders immediate visibility into its regulatory status and user feedback. For Pinnacle Pips, this quick check would have shown the lack of a forex license, the low score, and the South Korean exposure related to the blocked 20,000 USD withdrawal.

By relying on a specialized regulatory inquiry tool, users can differentiate between licensed institutions and high‑risk platforms marketed through flashy websites. This extra step is particularly important for avoiding offshore entities that offer high leverage and big bonuses but operate as forex scams targeting inexperienced traders.

Practical Tips to Protect Yourself From Pinnacle Pips‑Style Scams

Always verify a brokers regulatory status through independent resources like the WikiFX website or the WikiFX App before depositing money. Make sure the license actually belongs to the same legal entity and that the regulator is recognized in your jurisdiction.Be suspicious of brokers that block withdrawals, insist on extra deposits before releasing funds, or move all activity to little‑known domains like pinnaclepips.com. When you see multiple user complaints matching these patterns, treat the broker as a likely forex scam and stop sending any additional funds immediately.

Final Warning on Pinnacle Pips

Given its unregulated status, the refusal of the 20,000 USD withdrawal, and its exposure linked to South Korea, Pinnacle Pips presents multiple characteristics of a high‑risk forex trading scam. Traders using this platform face a significant risk of losing both their initial capital and any apparent profits in their trading account.

Anyone considering opening an account with Pinnacle Pips should reconsider and instead choose a properly regulated broker with a transparent track record. Before investing in any forex platform, take a moment to check its profile on the WikiFX website or inside the WikiFX App so you can avoid becoming the next victim of a forex investment scam.

Read more

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

ZarVista Regulatory Status: A Complete Guide to Its Licenses and Company Information

When choosing a trading broker, every trader asks the same important question: "Will my capital be safe?" To answer this question about ZarVista, we need to look at the facts carefully. While the broker does have licenses, our first look shows that all of its regulation comes from offshore locations. This fact alone creates serious concerns about how well traders are protected. When we look deeper into ZarVista regulation and license details, we find a complicated situation with many warning signs. Read on for more updates.

PFD Broker Review: Reliable Forex Broker or Risk?

PFD is a regulated forex broker based in New Zealand, operating under the name Pacific Financial Derivatives Limited. This PFD review examines its regulation, trading conditions, and potential risks so you can decide whether this broker fits your Forex trading needs.

WikiFX Broker

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc