Citadel Securities

Abstract:Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

| Citadel Securities Review Summary | |

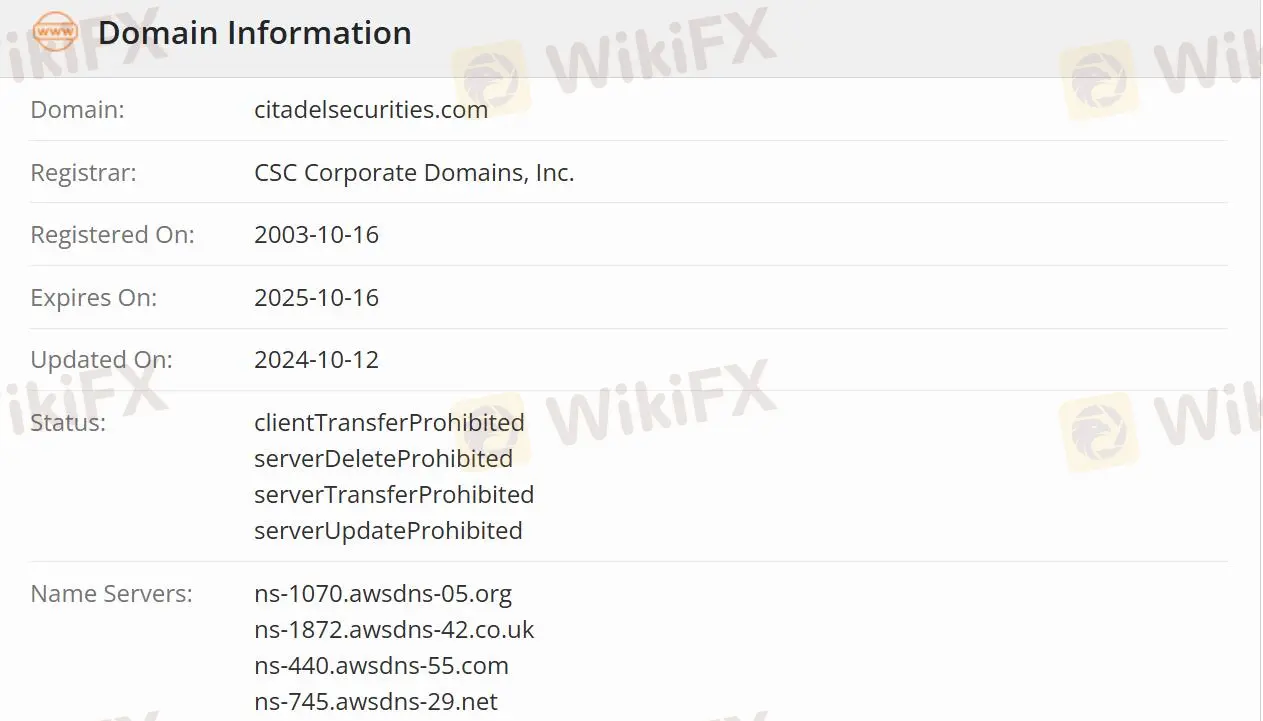

| Founded | 2003-10-16 |

| Registered Country/Region | United States |

| Regulation | Regulated |

| Services | Equities/Options/Fixed Income & FX/Corporate Solutions |

| Customer Support | LinkedIn/Facebook/Instagram/YouTube |

Citadel Securities Information

Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

Is Citadel Securities Legit?

Citadel Securities is authorized and regulated by the Securities and Futures Commission of Hong Kong(SFC), making it safer than an unregulated company.

What services does Citadel Securities provide?

One of Citadel Securities' functions is market making, which provides liquidity to investors by purchasing securities from sellers and selling them to buyers. Citadel Securities Enterprise Solutions also helps investors make decisions.

Bringing together financial services firms, including major banks, brokers, and even other market makers, to lead the creation of an exchange founded and operated by its members to launch the MEMX fully electronic stock exchange.

Asset-related businesses include equities, options, and fixed income & FX.

Read more

Trade245 Review 2025: Live & Demo Accounts, Withdrawals to Explore

Trade345, a young South African broker, has gained some regional popularity, but lacks an established reputation. Trade245 offers access to FX pairs, indices, stocks and commodities CFDs with operation on both MetaTrader 4 and MetaTrader 5. Although this broker only asks for a modest minimum deposit, it does not shine on trading costs. Besides, this broker heavily relies on bonuses to attract new investors and it does not provide trading signals.

How to Withdraw Funds from Pocket Option?

Pocket Option is considered a beginner-friendly trading platform, providing access to over 100 CFD instruments. Though not in an extensive range, 12 currency pairs, 10 cryptocurrencies, and stock indices are enough for focused and efficient trading. Particularly, forex trading starts at $10, perfectly fit for beginners' trading styles. Besides, Pocket Option provides a free demo account with virtual funds of $50,000 to give users risk-free practice. Though Pocket Option introduces commission-free option trading, they are less competitive in trading costs for other instruments.

OlympTrade Review 2025: Trading Accounts, Demo Account, and Withdrawal to Explore

OlympTrade is a relatively young online broker registered in Saint Vincent and the Grenadines, a shady spot with a booming of unlicensed entities. Tradable assets on the OlymTrade are not extensive, and this broker does not tell many essential trading conditions. As for trading platforms, I found trades can only operated on a simple web-based trading platform, no Metatrader platform at all.

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc