VitalMarkets-Overview of Minimum Deposit, Spreads & Leverage

Abstract:Vital Markets is a forex and CFD broker that provides access to various financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies, through the MetaTrader 4 and MetaTrader 5 trading platforms. The broker offers different account types with varying spreads, commissions, and leverage options, and supports crypto deposits. However, it is not regulated by any major financial authority, which may pose a risk to traders.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Vital Markets Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | China |

| Regulation | No license |

| Market Instruments | forex, energies, metals, indices, shares, cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | TradeLocker, MT4, MT5 |

| Minimum deposit | $10 |

| Customer Support | 24/7 live chat, request a callback |

What is Vital Markets?

Vital Markets is a forex and CFD broker that provides access to various financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies, through the MetaTrader 4 and MetaTrader 5 trading platforms. The broker offers different account types with varying spreads, commissions, and leverage options, and supports crypto deposits. However, it is not regulated by any major financial authority, which may pose a risk to traders.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Vital Markets offers a variety of trading instruments and platforms, including the popular MetaTrader 4 and 5. However, the lack of regulation is a significant red flag, as it means there is no protection for clients' funds. Additionally, the limited deposit options and fees for withdrawals using anything other than Bitcoin may be a disadvantage for some traders. Overall, traders should exercise caution when considering trading with Vital Markets due to the lack of regulation.

| Pros | Cons |

| • Access to multiple financial markets | • Not regulated by a financial authority |

| • Variety of account types | • US clients are not accepted |

| • Demo account available | • No guaranteed funds or segregated accounts |

| • Competitive spreads | • Limited payment options (only cryptos) |

| • User-friendly MT4 & MT5 trading platforms | • Limited trading tools and educational resources |

| • Low minimum deposit requirement |

Vital Markets Alternative Brokers

Vantage FX - offers a user-friendly trading platform, competitive spreads, and low fees, making it a good option for traders of all experience levels.

Windsor Brokers - provides a range of trading tools and platforms, but its limited asset selection and lack of regulation in some countries may not make it the best choice for all traders.

Forex Club - ffers a simple and easy-to-use trading platform, as well as educational resources and market analysis, but its high minimum deposit and lack of diversity in trading instruments may not suit all traders.

There are many alternative brokers to Vital Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Vital Markets Safe or Scam?

After taking a look at their website, it shows that Vital Markets does not fall under any regulating agency. That is a MAJOR RED FLAG!! No guaranteed funds. No segregated accounts. These should be enough for you NOT to invest with them. So Vital Markets is just another unregulated forex broker, which means the customers are not protected, and there is highly likely they will get away with your hard earned money and there will be no regulating agency to hold them responsible.

Market Instruments

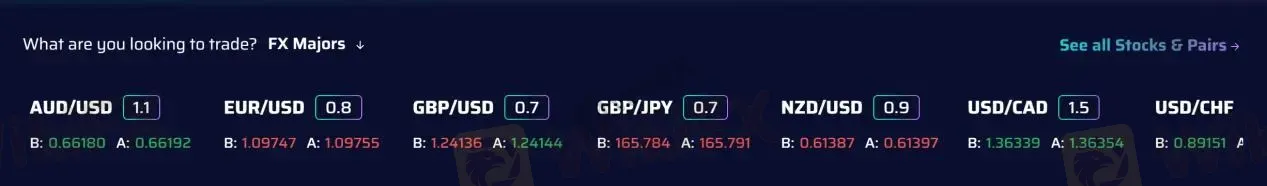

Vital Markets offers investors a range of financial instruments including Forex, Cryptocurrencies, Stocks, Indices, and Commodities. The Forex market offers a variety of currency pairs, including majors, minors, and exotics, allowing traders to participate in the most liquid market in the world. The Cryptocurrency market includes popular digital currencies such as Bitcoin, Ethereum, and Litecoin. The Stocks market features a wide range of equities from popular companies across the globe, and the Indices market covers popular indices such as S&P500, NASDAQ, and Dow Jones. Additionally, the Commodity market offers a range of commodities such as Gold, Silver, Oil, and more.

Accounts

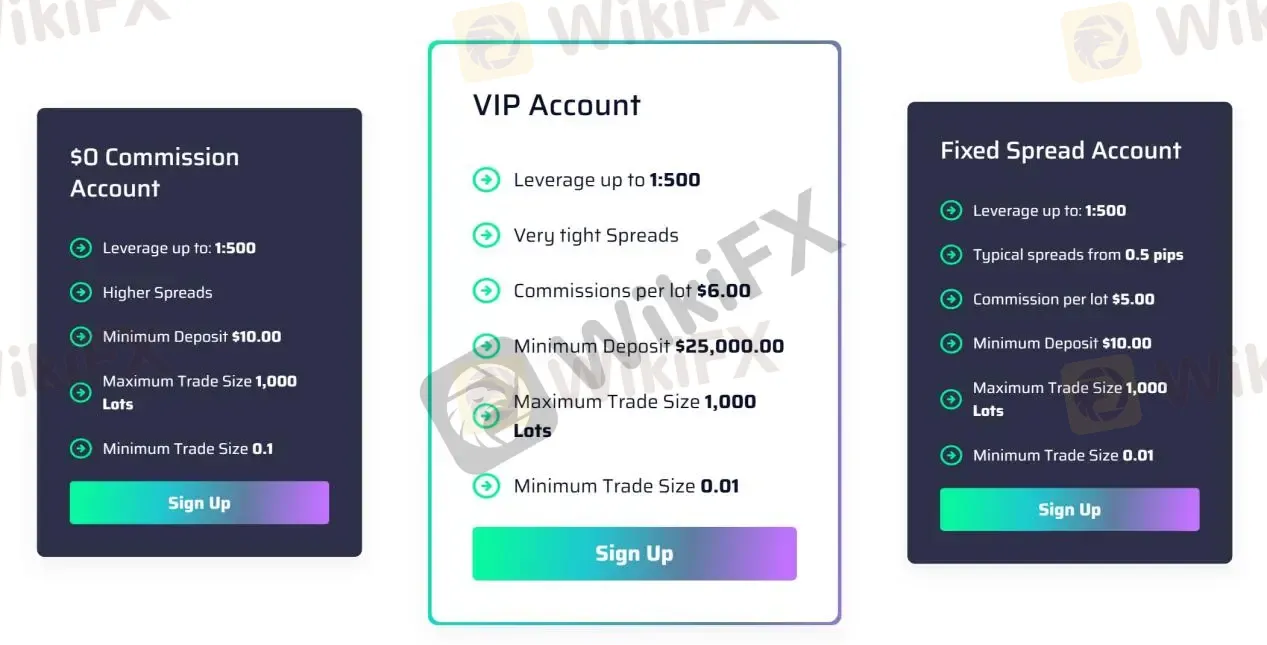

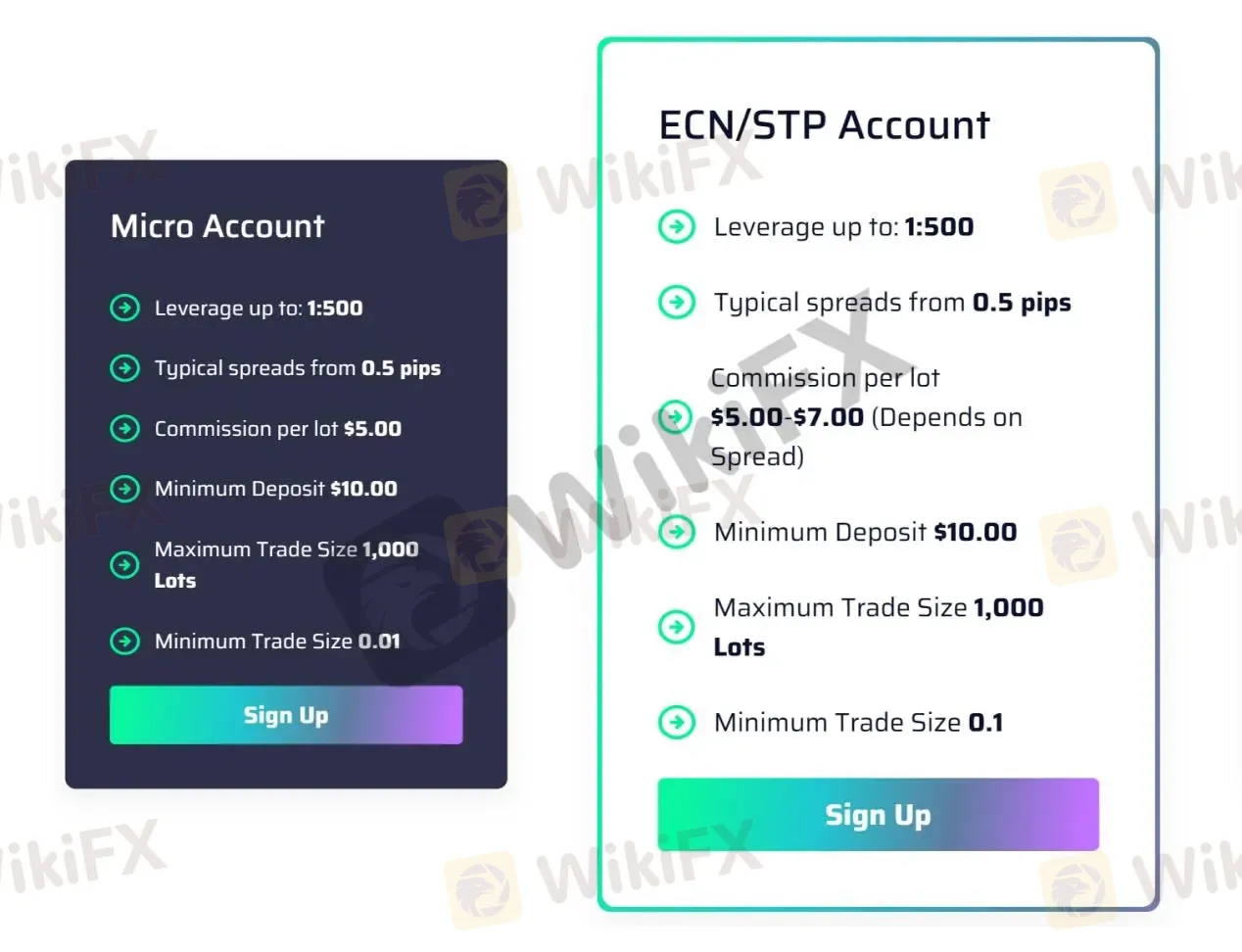

There are 5 kinds of account types for investors to choose from at Vital Markets, namely $0 Commission Account, VIP Account, Fixed Spread Account, Micro Account, and ECN/STP Account. The minimum deposit is $25,000 for VIP and $10 for the other four account types. You can also open a demo account with virtual capital of $100-$1,000,000.

Leverage

The maximum leverage offered by the broker is up to 1:500 for all account types, which is considered to be relatively high compared to some other brokers. Additionally, demo accounts can choose leverage ranging from 1:50 to 1:500, which is beneficial for traders who want to test their strategies and get familiar with trading with lower leverage before moving on to higher leverage. However, it's important to note that trading with high leverage can significantly increase the risk of losing funds, so it's crucial to use leverage wisely and with caution.

Spreads & Commissions

The broker offers different types of accounts, each with its own set of spreads and commissions. The $0 Commission Account has higher spreads but no commission, the VIP Account has very tight spreads but comes with a commission of $6 per lot, while the Fixed Spread Account, Micro Account, and ECN/STP Account have typical spreads starting from 0.5 pips and a commission ranging from $5-7 per lot depending on the account type.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Vital Markets | From 0.5 pips | $5-$7 (ECN/STP) |

| Vantage FX | From 0.0 pips | $3.00 (Standard) |

| Windsor Brokers | From 0.2 pips | $4.00 (Standard) |

| Forex Club | From 0.6 pips | $0-$20 (depends on account type) |

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

Vital Markets offers its clients access to the global financial markets via a range of trading platforms. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are both available for Windows, Web Trader, Android, and iOS devices. In addition, the broker provides TradeLocker, which is an advanced platform that allows users to analyze their trading history, develop trading strategies, and create custom indicators. These platforms offer clients the ability to execute trades, manage their accounts, view real-time quotes, and access a variety of charting and analysis tools.

Overall, Vital Markets' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Vital Markets | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradeLocker |

| Vantage FX | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader |

| Windsor Brokers | MetaTrader 4 (MT4), Windsor MT4 Desktop, WebTrader |

| Forex Club | StartFX, Rumus, MT4, MT5, Libertex |

Trading Tools

Vital Markets provides various trading tools to assist traders in their trading activities. One of these tools is a trading calculator which allows traders to calculate the potential profits or losses of their trades. To use the trading calculator, traders only need to fill in their starting balance, the percentage of profit they expect to earn per month, and the number of months they intend to hold their trades. This can help traders make informed decisions about their trading strategies and manage their risks effectively.

Deposits & Withdrawals

Vital Markets only accepts crypto deposits and supports a variety of cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Dogecoin (DOGE), and Tether (USDT). BTC deposits are free of charge, while other cryptocurrencies have a 2.5% deposit fee. It's important to note that traditional fiat currencies are not accepted for deposits.

Vital Markets minimum deposit vs other brokers

| Vital Markets | Most other | |

| Minimum Deposit | $10 | $100 |

Vital Markets Money Deposit

To deposit funds into your Vital Markets account, you need to follow these steps:

Step 1: Create your Vital Markets Account and log in to access your secure wallet.

Step 2: Navigate to the 'Funding' tab. Select 'Add Funds' and fill in the relevant details. Once done, click on 'Deposit'.

Step 3: Follow the on-screen instructions to complete the transaction. Once your funds are in your wallet you are ready to go!

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| Vital Markets | Free for BTC, 2.5% for other cryptos | N/A |

| Vantage FX | Free | Free |

| Windsor Brokers | Free | Free |

| Forex Club | Free | Free for bank transfer, fees for other methods vary |

Customer Service

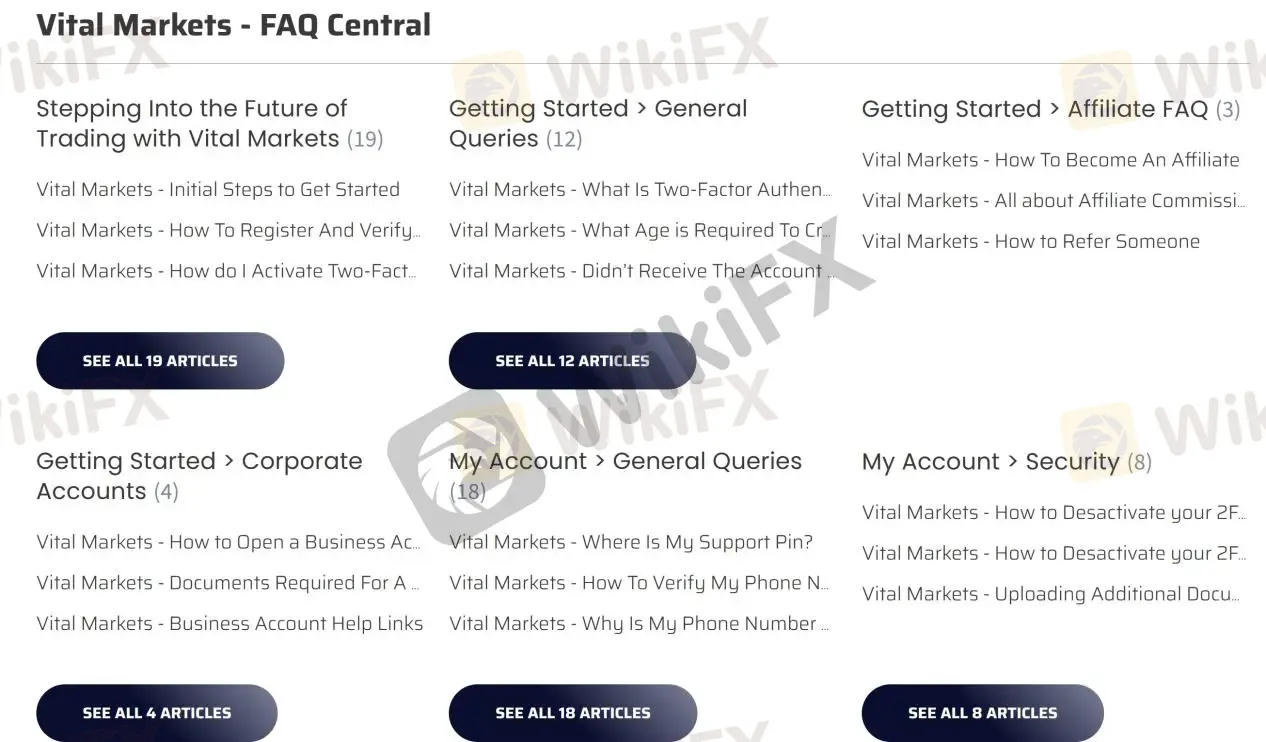

Vital Markets offers several options for customer support, including live chat, online messaging to request a callback, and an FAQ section. The live chat feature is available 24/7 and can be accessed directly from the website. The online messaging system allows clients to request a callback from the customer support team. Additionally, the FAQ section is a useful resource for clients who prefer self-help options.

| Pros | Cons |

| • 24/7 Live chat support | • No phone or email support |

| • FAQ section available | • Limited language options |

| • No social media support |

Note: The pros and cons of customer service may vary depending on individual experiences.

Conclusion

In conclusion, Vital Markets is a relatively new online broker that offers access to various financial markets with competitive spreads, leverage up to 1:500, and a choice of different account types. However, Vital Markets is not regulated by any well-known regulatory authority, which is a significant red flag. Additionally, the broker has limited payment options, no guaranteed funds or segregated accounts, and its customer support can be slow to respond. Therefore, traders should proceed with caution when considering Vital Markets as their online broker.

Frequently Asked Questions (FAQs)

| Q 1: | Is Vital Markets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At Vital Markets, are there any regional restrictions for traders? |

| A 2: | Yes. Vital Markets provides services and information on this site that are not aimed at or intended for citizens and/or residents of the USA. |

| Q 3: | Does Vital Markets offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Vital Markets offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports TradeLocker, MT4 and MT5. |

| Q 5: | What is the minimum deposit for Vital Markets? |

| A 5: | The minimum initial deposit to open an account is $10. |

| Q 6: | Is Vital Markets a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it advertises well, dont forget the fact that it is an unregulated broker. |

Read more

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

Is Tiger Brokers Regulated? Investor Protection Guide

Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Rate Calc