WIKIFX REPORT: Forex Technical Analysis & Forecast 07.06.2022

Abstract:This is based on identifying supply and demand levels on price charts by observing various patterns and indicators.

This is based on identifying supply and demand levels on price charts by observing various patterns and indicators.

EURUSD, “Euro vs US Dollar”

EURUSD has completed the descending wave at 1.0675 and may later correct up to 1.0710. After that, the instrument may resume falling to break 1.0640 and then continue moving within the downtrend with the target at 1.0585.

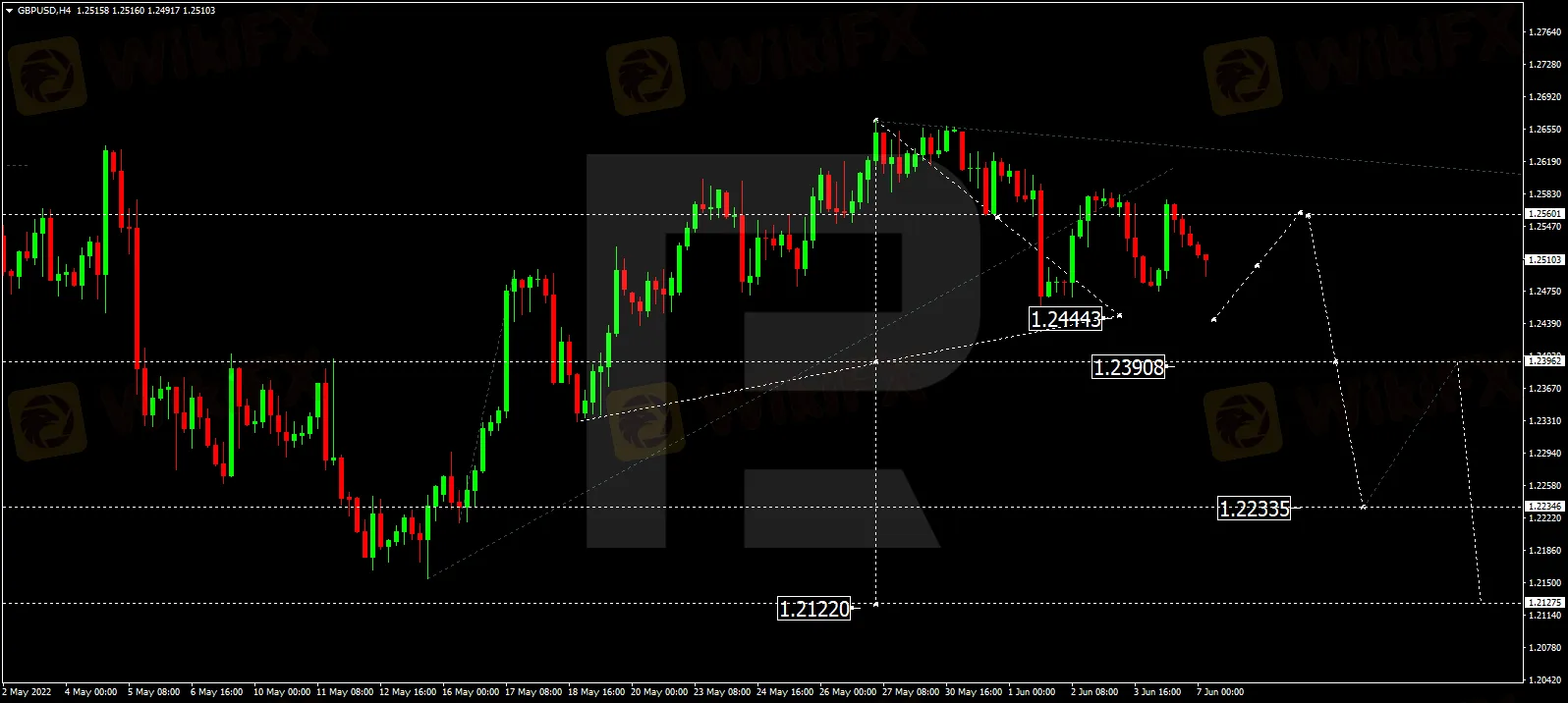

GBPUSD, “Great Britain Pound vs US Dollar”

Having rebounded from 1.2560, GBPUSD is forming a new descending structure towards 1.2390 and may later break this level. After that, the instrument may continue trading downwards with the short-term target at 1.2233.

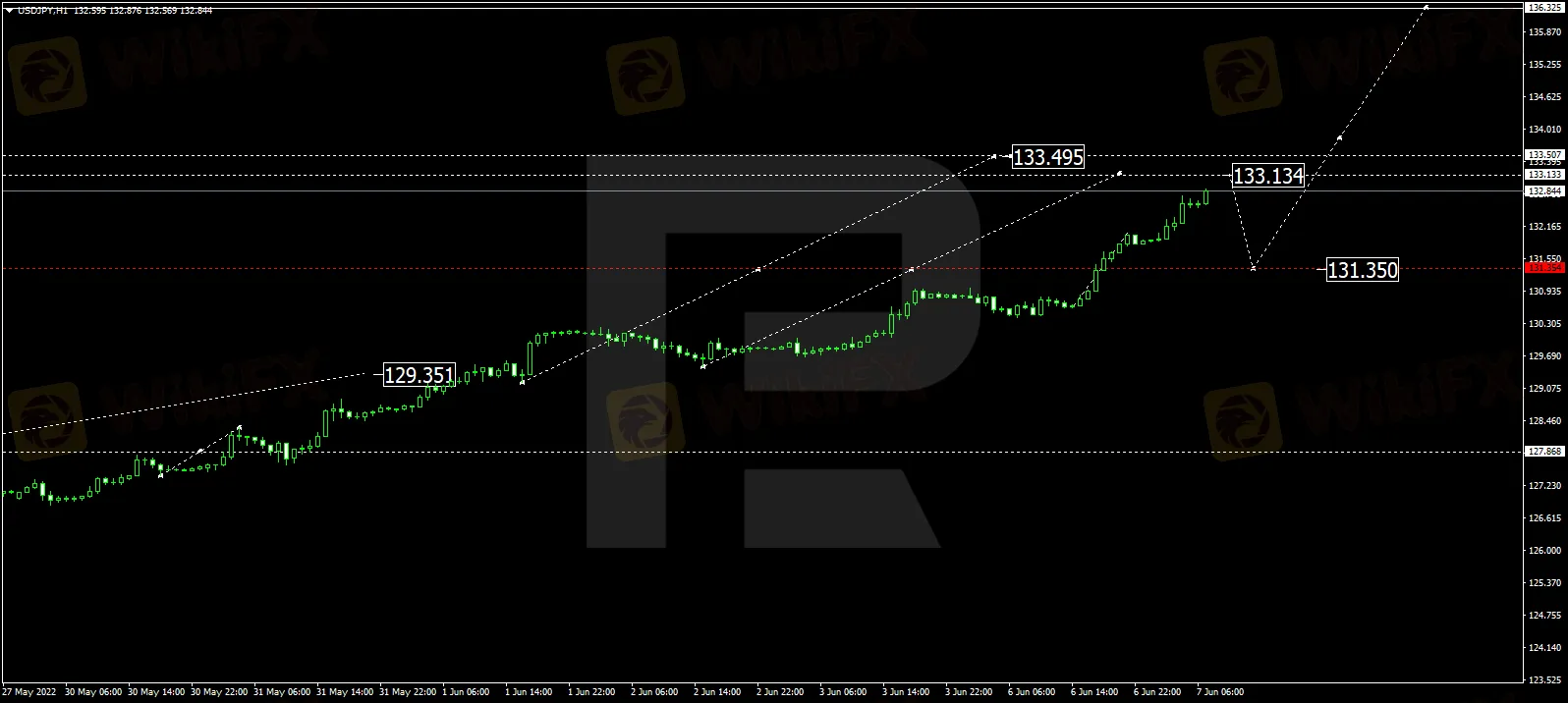

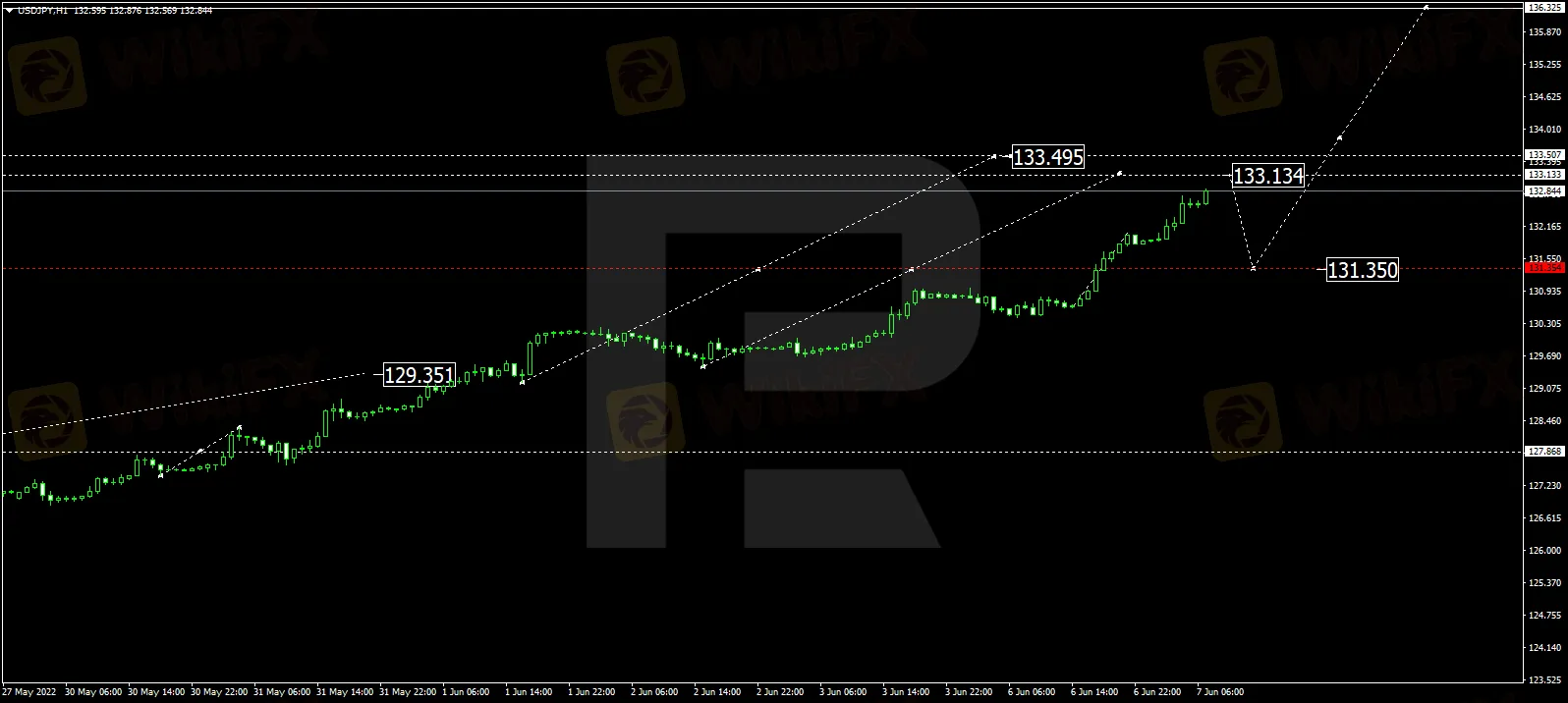

USDJPY, “US Dollar vs Japanese Yen”

After breaking the consolidation range to the upside at 131.50, USDJPY is expected to continue moving within the uptrend with the target at 136.33. Possibly, today the pair may grow towards 133.13 and then fall to return to 131.50. Later, the market may resume trading upwards to reach 133.50.

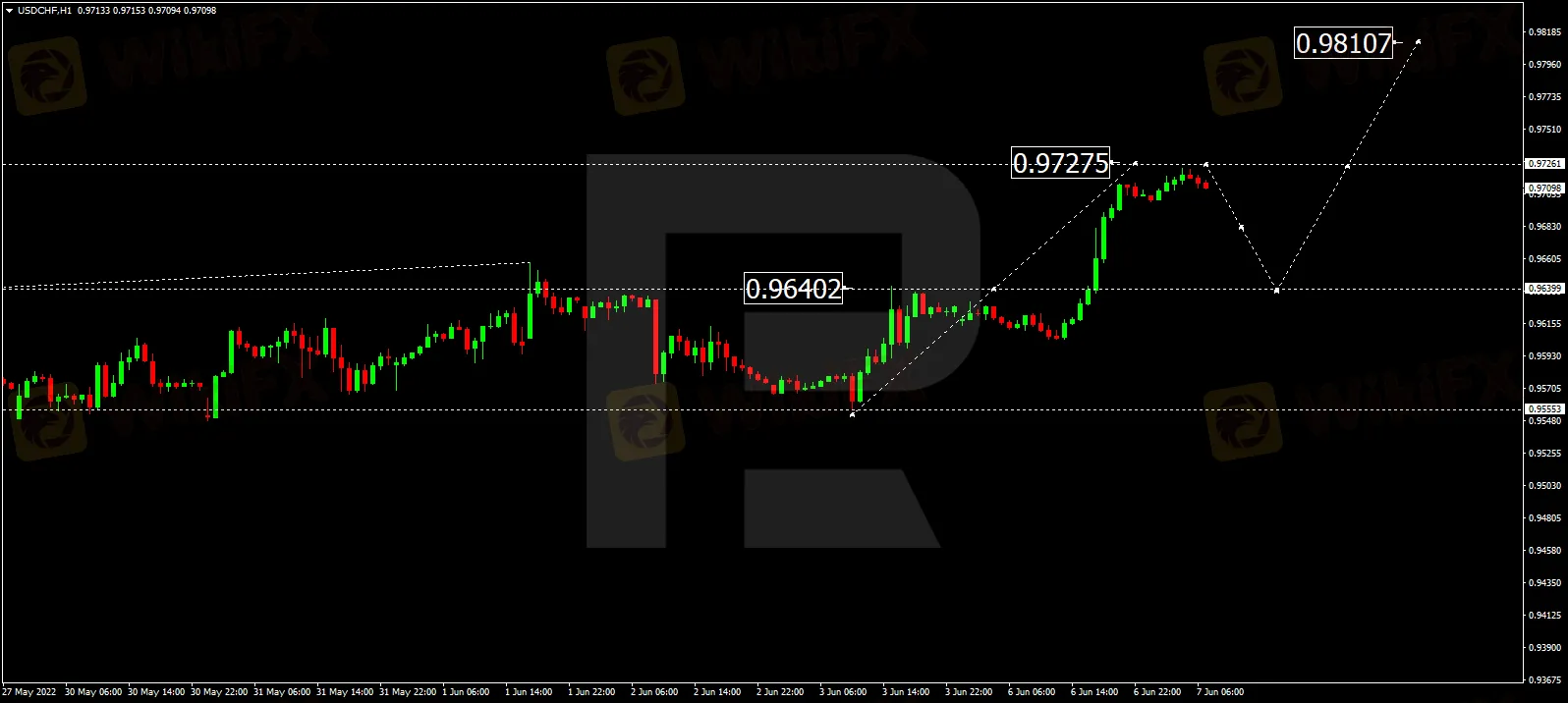

USDCHF, “US Dollar vs Swiss Franc”

Having broken 0.9640, USDCHF continues trading towards 0.9727. After that, the instrument may correct to return to 0.9640 and then resume growing with the target at 0.9810.

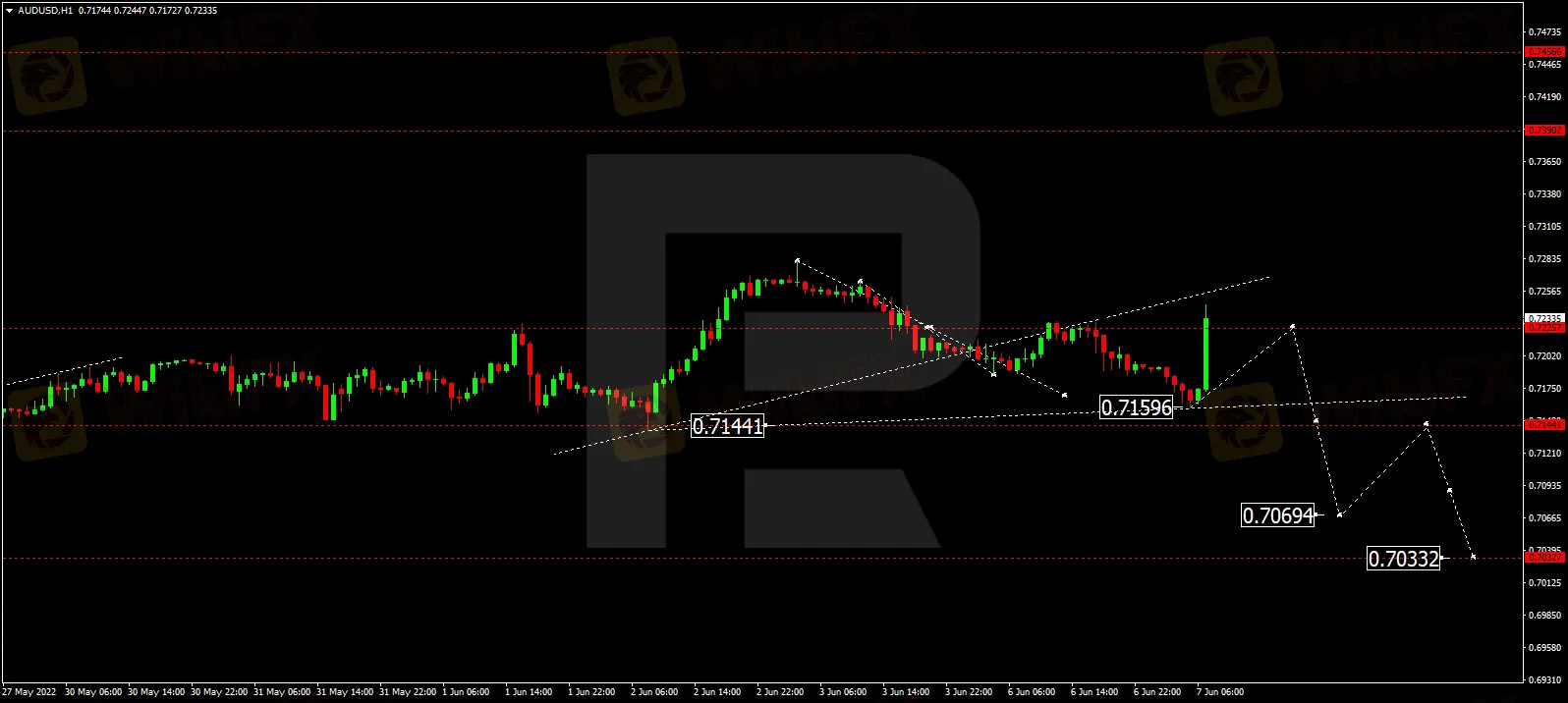

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed the descending wave at 0.7160 along with the correction up to 0.7222. Today, the pair may form a new descending structure to break 0.714 and then continue falling with the target at 0.7070.

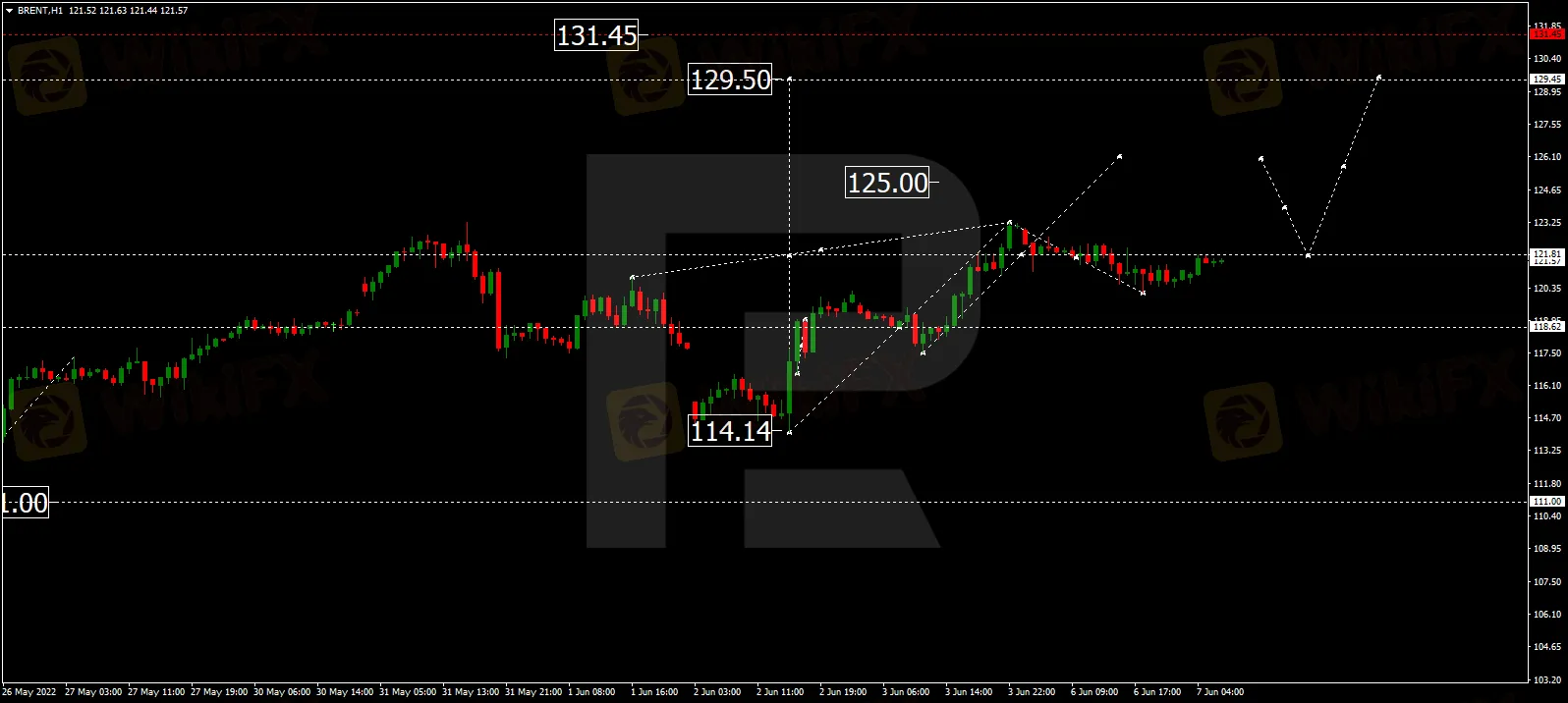

BRENT

Brent has finished the correction at 120.20. Possibly, today the asset may resume growing to break 123.23 and then continue trading upwards with the target at 126.00, or even extend this structure up to 129.45.

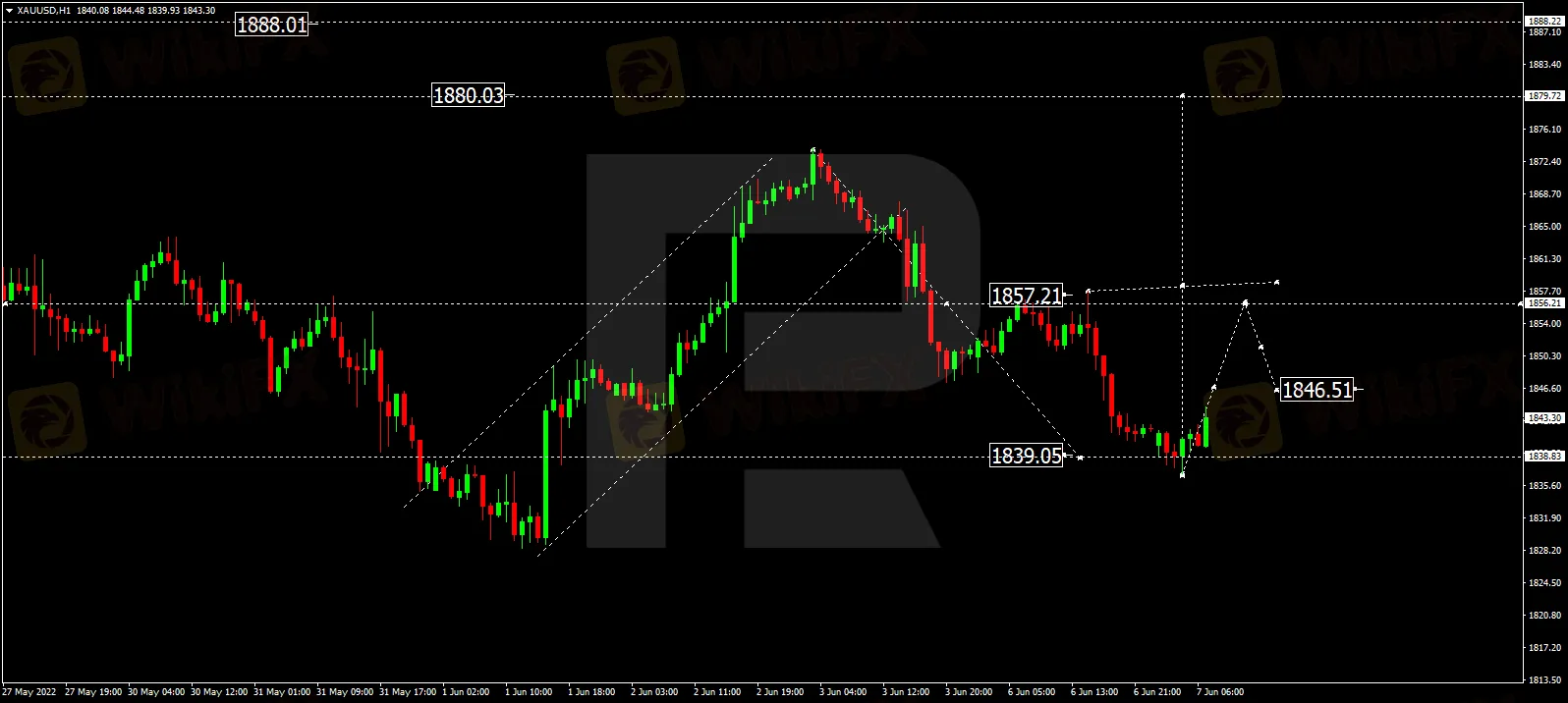

XAUUSD, “Gold vs US Dollar”

Having completed the correction at 1839.00, Gold is forming one more ascending structure towards 1857.20. Later, the market may break the latter level and continue trading upwards with the target at 1879.70.

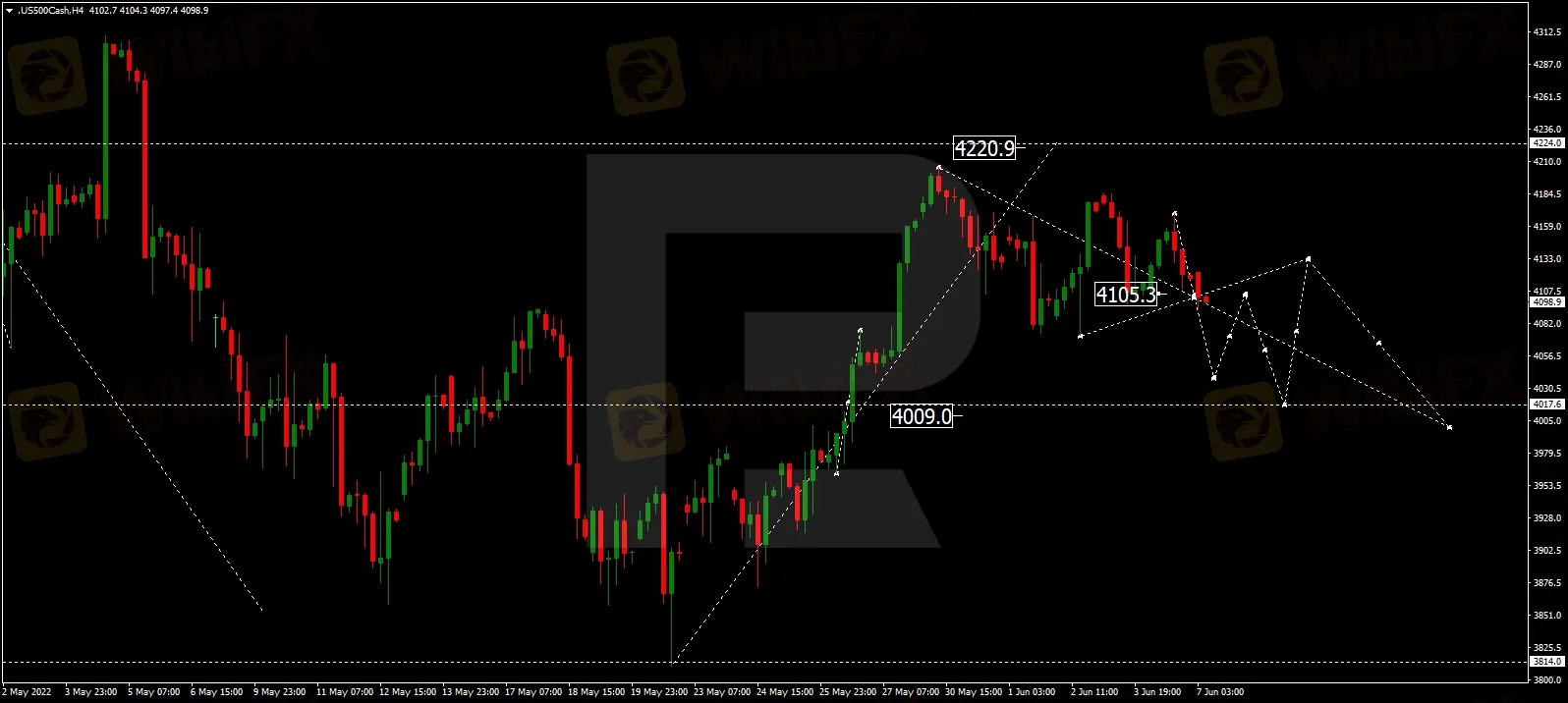

S&P 500

The S&P index is still consolidating around 4105.3. If later the price breaks this range to the upside, the market may form one more ascending structure towards 4220.0 and the start a new decline with the target at 4000.0; if to the downside – resume falling to reach the above-mentioned target, or even extend this descending structure down to 3814.0.

Read more

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

Admirals Resumes EU Client Onboarding After Pause in 2024

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

How to Withdraw Funds from Pocket Option?

Pocket Option is considered a beginner-friendly trading platform, providing access to over 100 CFD instruments. Though not in an extensive range, 12 currency pairs, 10 cryptocurrencies, and stock indices are enough for focused and efficient trading. Particularly, forex trading starts at $10, perfectly fit for beginners' trading styles. Besides, Pocket Option provides a free demo account with virtual funds of $50,000 to give users risk-free practice. Though Pocket Option introduces commission-free option trading, they are less competitive in trading costs for other instruments.

Crypto vs Forex: Which is Better? Which Should You Choose?

The global financial landscape has been reshaped by two dominant trading markets: cryptocurrency and foreign exchange (forex). Each offers unique opportunities, risks, and rewards, leaving traders and investors divided on which market holds the upper hand. But when it comes to choosing between them, is there a definitive answer, or does it all boil down to personal preference and risk appetite?

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

Rate Calc