FXMTB-Overview of Minimum Deposit, Leverage, Spreads

Abstract:FXMTB is allegedly an unregulated STP broker registered in Denmark that claims to provide its clients with over 250 tradable financial instruments with leverage up to 1:200 and floating spreads from 0.2 pips on the industry-standard MetaTrader4 and MetaTrader5 trading platforms, as well as a choice of three different live account types and 24/5 customer support service.

General Information & Regulation

FXMTB is allegedly an unregulated STP broker registered in Denmark that claims to provide its clients with over 250 tradable financial instruments with leverage up to 1:200 and floating spreads from 0.2 pips on the industry-standard MetaTrader4 and MetaTrader5 trading platforms, as well as a choice of three different live account types and 24/5 customer support service.

Market Instruments

FXMTB advertises that it offers more than 250 trading instruments across 8 asset classes, including forex, stocks, indices, ETFs, soft commodities, energies, metals and cryptocurrencies.

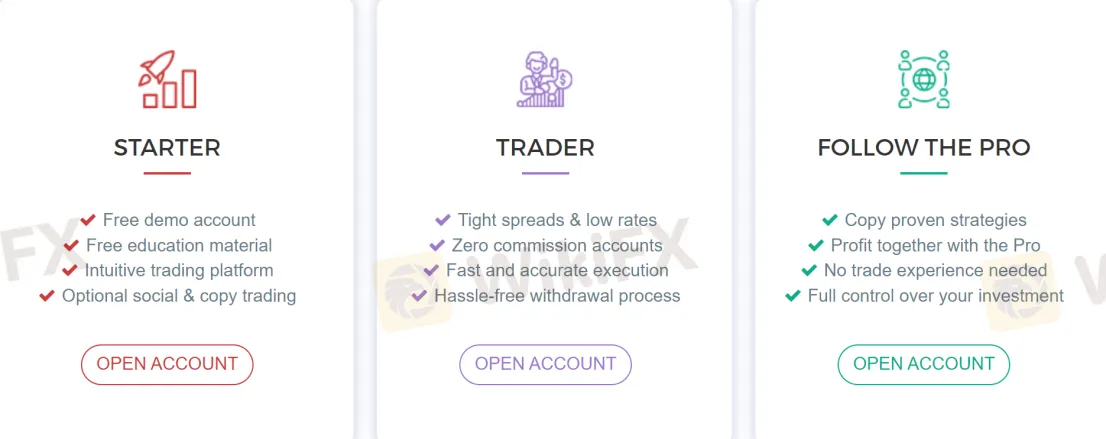

Account Types

Apart from free demo accounts, there are three live trading accounts offered by FXMTB, namely Starter, Trader and Follow the Pro accounts.

Leverage

Traders holding different asset classes can enjoy different maximum leverage ratios. For example, the leverage is 1:200 for forex trading, 1:20 for stocks, ETFs and soft commodities, 1:100 for indices and energies, 1:1000 for metals and 1:50 for cryptocurrencies. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

Spreads & Commissions

FXMTB claims that the spread on the benchmark EUR/USD is 0.2 pips and all charging no commissions.

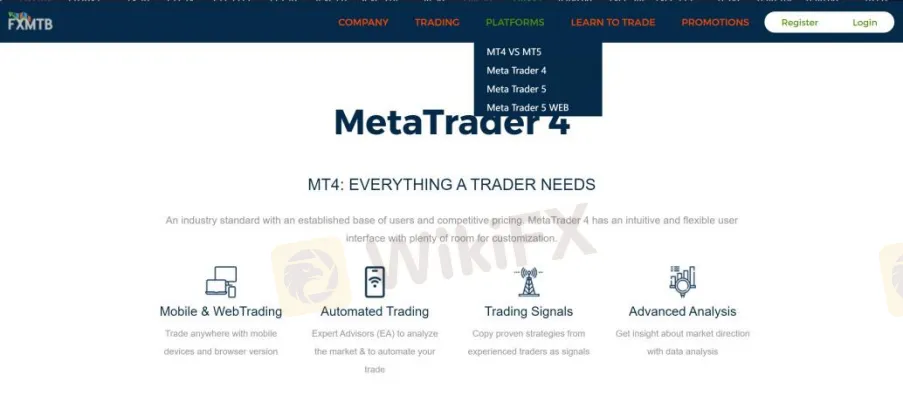

Trading Platform Available

Platforms available for trading at FXMTB are the worlds most trusted and popular MetaTrader4 and MetaTrader5 trading platforms. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

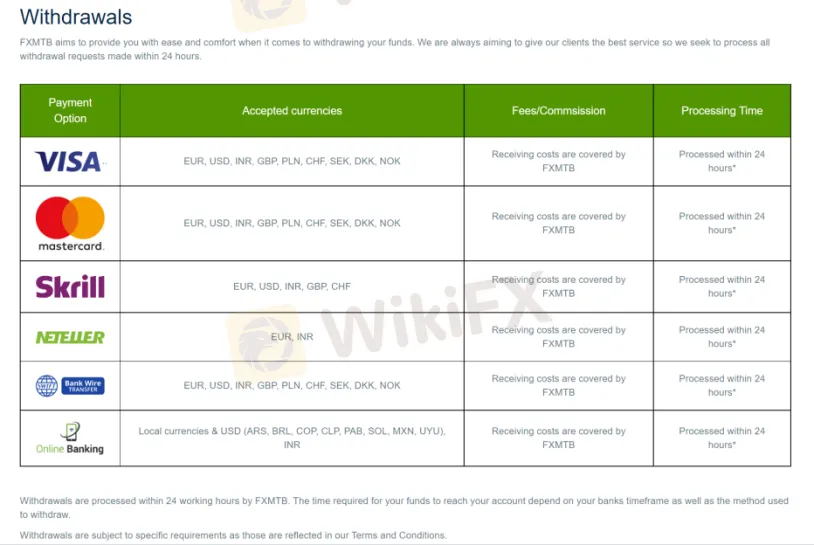

Deposit & Withdrawal

FXMTB says to accept deposits via Visa, MasterCard, Maestro, Skrill, Neteller, Bank Wire Transfer and online banking, while withdrawal methods with the exception of Maestro. The minimum initial deposit requirement is said to be $200. Bank wire deposits may take 1-4 working days while withdrawals are said to be processed within 24 working hours.

Bonuses

FXMTB claims to offer a 150% bonus on the first deposit, yet we cannot be sure if the bonus can be withdrawn without any condition.

Customer Support

FXMTBs customer support can be reached by telephone: 4578746260, email: support@fxmtb.com. Company address: Copenhagen Towers, Ørestads Blvd. 114 - 118, 2300 København, Denmark.

Read more

Become a Broker Reviewer: Your Experience is Worth Its Weight in Gold

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

Fed Minutes in Focus as USD Stabilizes, Gold Slips from Record Highs

Markets turn cautious as investors await the Fed’s December meeting minutes. The US Dollar stabilizes near 98.10, gold drops sharply from record highs, while GBP/USD, EUR/USD, and USD/JPY react to central bank signals.

Star-Studded Jury Panel Unveiled as WikiFX Golden Insight Award’s Expert Judging Commences

Following the successful conclusion of the global public voting phase, the WikiFX Golden Insight Award has now officially entered its final evaluation stage—the expert judging. This marks a critical juncture in the 2025 Golden Insight Award selection process, ushering in the most authoritative and rigorous phase of professional assessment and industry consensus-building.

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

WikiFX Broker

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

What Is a Liquid Broker and How Does It Work?

Rate Calc