Reports From Interactive Brokers DARTs Increased By 8% Year On Year In August

Abstract:Interactive Brokers (Nasdaq: IBKR), a well-known American electronic trading platform with a worldwide reach, has released its August performance data. The Daily Average Revenue Trades (DARTs) totaled 1.968 million, up 8% from the previous month but down 9% from the previous year.

It had 1.99 million customer accounts at the end of the month.

It cleared 222 yearly DARTs per customer on average.

Interactive Brokers (Nasdaq: IBKR), a well-known American electronic trading platform with a worldwide reach, has released its August performance data. The Daily Average Revenue Trades (DARTs) totaled 1.968 million, up 8% from the previous month but down 9% from the previous year.

The broker ended the month with $310.1 billion in client equity, a 1% decrease from the previous month but a 15% decrease from the previous year. The customer margin loan amount increased by 2% monthly to $43.1 billion, a 13 percent decrease.

At the end of August, the client's credit amount was $95.9 billion, 2% more than in July and 13% higher than in August 2021. $2.1 billion in insured bank deposit sweeps are included in the total.

Furthermore, the broker's platform saw solid growth in customers. It completed the month with 1.99 million customer accounts, a 2% monthly increase, and a 33% increase over the same month last year.

It cleared 222 yearly DARTs per customer on average. The broker paid an average commission of $2.87 per cleared commissionable order, including exchange, clearing, and regulatory fees.

2022 Performance Interactive Brokers' revenue fell in both the first and second quarters of 2022. It generated $645 million in net revenue between January and March and $656 million in the following three months. The declines in the first and second quarters were 28% and 13%, respectively.

The broker's pre-tax income was $394 million in the first quarter and $392 million in the second quarter. When compared to the same quarter the previous year, both numbers fell.

About Interactive Brokers

The most comprehensive investment platforms are led by Interactive Brokers (IBKR). From a single integrated account, clients can trade stocks, options, futures, forex, cryptocurrencies, bonds, and funds in 135 markets. The Impact Dashboard and app, which let you analyze assets via a socially responsible investing (SRI) perspective, will please sustainable investors. The downloadable Trader Workstation (TWS) software caters to professional traders and skilled, active investors looking for complicated technical and fundamental trading tools as well as in-depth research.

In terms of assets, research reports, global market access, tools, calculators, and educational materials, Interactive Brokers is unrivaled. This variety of goods and services is both a boon and a burden. The sheer volume of information available on IBKR might be overwhelming at times. However, the free paper trading and three-month trial period allow consumers to test out this complete investing broker.

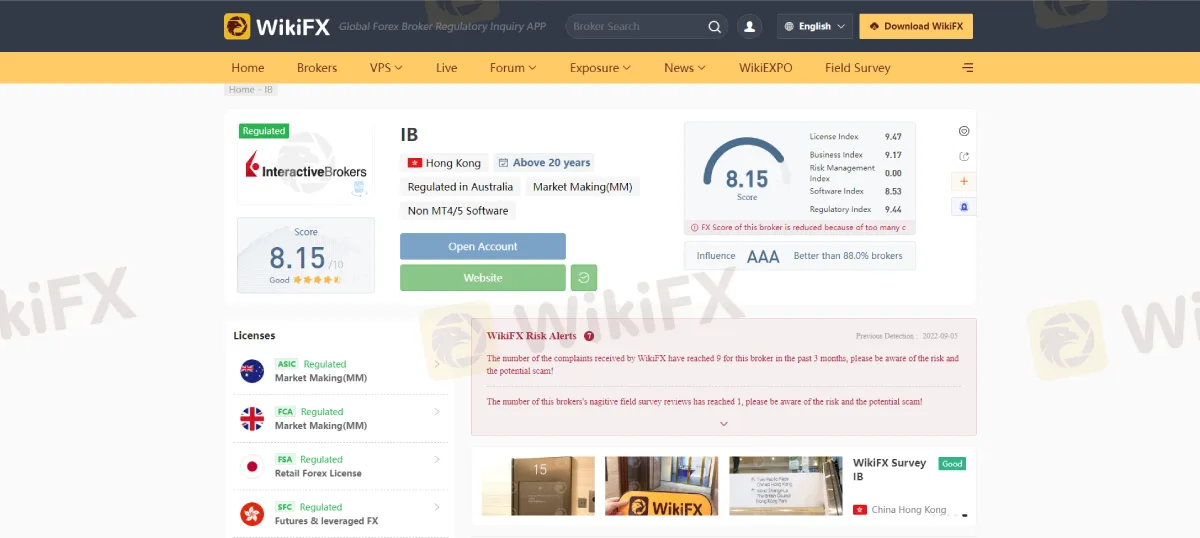

About WikiFX

Wikifx is a platform for searching worldwide company financial information. Its primary duty is to provide the included foreign exchange trading organizations with basic information searching, regulatory license seeking, credit assessment, platform identification, and other services.

WikiFX's database is sourced from official regulatory bodies such as the FCA, ASIC, and others. The published information is also fair, objective, and factual. WikiFX does not charge public relations fees, advertising costs, ranking fees, data cleaning fees, or any other unreasonable expenses. WikiFX will do everything possible to keep the database consistent and synchronized with authoritative data sources such as regulatory bodies, but cannot promise that the data will always be up-to-date.

Stay tuned for more broker's news.

Download the WikiFX App from the App Store or on Google Play Store.

Read more

Aximtrade Exposure: Growing Allegations of Withdrawal Denials by Traders

Is your Aximtrade withdrawal application pending for months despite everything right from your end? Even after months, do you still see the withdrawal application under review while logging in to the trading platform? Or does the broker official tell you that the withdrawal is approved, but give you the excuse of the payment provider’s unavailability? These issues have allegedly become the norm at Aximtrade, a Saint Vincent and the Grenadines-based forex broker. In this Aximtrade review article, we have highlighted numerous complaints that need your attention.

Big Boss Review: Examining Withdrawal Denials & Profitable Record Deletion Claims

Did you fail to receive profits from Big Boss, a Comoros-based forex broker? Did the broker delete your profitable forex transactions so that you cannot withdraw your gains? Did you face an account freeze after making profits on the trading platform? These are some allegations we found while investigating the broker. In this Big Boss review article, we have shared some complaints traders have made against the company. Take a look!

ICM Broker Review: Scams & Alerts Exposed

Uncover ICM Broker scams and alerts: deposit delays, withdrawal blocks, and trader complaints despite regulation. WikiFX App reveals risks to help you trade more safely.

Markets.com Review: Withdrawal Risks Exposed

Markets.com withdrawal issues: Ukraine, 10+ day delays on 3 tries, repeated bank statements. India's unresolved payout. CySEC-regulated but complaints grow—read now!

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Rate Calc