09/09 Market report

Abstract:【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

【Dow Jones】

Powell said on the 8th that the Federal Reserve is firmly committed to reducing inflation and will continue to make efforts until the task is completed. The external estimate of the possibility of the Federal Reserve raising interest rates by 75 basis points this month also increased, with the assessment rising to 87%. In addition, U.S. economic data showed that the number of jobless claims fell to a three-month low last week, showing that the labor market remained strong even though the Federal Reserve would raise interest rates.

In the daily technical indicators of the Dow Jones industrial average, although Alligator showed a dead cross, indicating that the long-term Dow Jones industrial average was slightly empty, and the short-term KD index showed a gold cross, plus two consecutive days of gains indicating that the short-term bottom was formed, but the breakthrough in the most recent pressure point was the moment when the bulls launched an attack.

USA30-D1:Downtrend

Price point: 32058

Current transactions:Hold empty orders with targets at 31500 and 31200

Alternatives:Set 32200 and 32500 after the price hit 32058

Comments:The RSI value of 39.94% was off the mark.

【Euro】

In an effort to contain soaring inflation, the European Central Bank (ECB) announced on the 8th an unprecedented 3-yard hike in interest rates, raising the benchmark deposit rate from 0 to 0.75% and the refinancing rate to 1.25%, the highest level since 2011. This shows the ECB's determination to contain inflation even at the expense of economic growth.

The ECB is widely expected to raise interest rates at this meeting, with the difference being only 2 or 3 yards. The ECB's July meeting raised interest rates by 2 yards, but inflation pressure did not ease.

In the technical line of the euro zone's Japan line, the long-term Alligator forms a dead cross, indicating that the euro has fallen in the long run, and the short-term KD presents a high-end passivation, indicating that the euro has buying support in the short run, and observing whether the upward pressure breaks through in the short run. if so, it indicates that investors will start to return funds to the euro in the short run because of the interest rate hike.

EURUSD-D1:Downtrend

Price point:1.00916

Current transactions:Hold empty orders with targets at 1.00200 and 1.00000

Alternatives:Set 1.01000 and 1.01200 after the price hit 1.00916

Comments:The RSI value of 51.35% was too high.

【Gold】

The current price of the FEL futures is 85% likely that the Fed will raise interest rates by 75 basis points at its policy meeting on September 20-21.

The World Gold Association reported on September 7 that in August 2022, the global gold ETF (exchange traded fund) position decreased by 50.8 metric tons, the fourth consecutive month of decrease. The cumulative gold ETF position in January-August this year still increased by 102 metric tons or 3.6%.

In the technical line of the Japanese gold line, the long-term Alligator shows a dead cross, indicating that the long-term gold line is bearish, while the short-term KD index forms a gold cross, indicating that the short-term gold has a buying trend with conflicting lengths, indicating that the key supporting price below gold has a certain buying trend.

XAUUSD-D1:Downtrend

Price point:1726

Current transactions:Hold empty orders with targets at 1712.2 and 1710.8

Alternatives:Set 1728.2 and 1730.5 after the price hit 1726

Comments:The RSI value of 41.87% was wide.

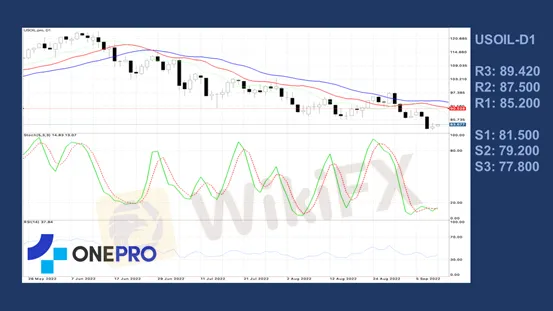

【Crude Oil】

WTI andBrent crude oil

In the technical line of the Japanese crude oil, the long-term Alligator shows a dead cross, indicating that the trend of the long-term crude oil is relatively empty, and the short-term KD index goes into low-grade passivation, indicating that the crude oil has dropped below the recent wave band low point, indicating that the bulls have lost and the subsequent bears have grasped the trend again.

USOIL-D1:Downtrend

Price point:90.52

Current transactions:Hold empty orders with targets at 82.50 and 81.80

Alternatives:Set 92.5 and 93.8 after the price hit 90.52

Comments:The RSI value of 37.77% was wide.

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

This is a personal opinion and does not represent anyopinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

Read more

3/19 Market report

【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

3/18 Market report

【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

3/15 Market report

【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

3/13 Market report

【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

WikiFX Broker

Latest News

When was Forex created?

Market Structure Forex: Key Trading Components & Phases Every Trader Should Know

How Much Is a Pip per Lot? 0.01, 0.1, 1.0 Examples

FCA Issues Fresh Scam Alert: Brokers to Stay Away From in 2025

Santander Exposed: Withdrawal Denials & Poor Customer Support Service Trap Traders

SCAM ALERT! Swiss Watchdog FINMA Issues Fresh Warning on Suspicious Brokers

Is A Second Wave Of Inflation Coming?

Deepfake Scams Target Kiwi Investors on Facebook, WhatsApp

SEC Sues Carole Liston, Stock Purse Trading for $5.7M Fraud

The ‘Godfather of Japanese Stocks’ Scam Exposed Within Japan’s Chinese Community

Rate Calc