AlmondFX -Overview of Minimum Deposit, Leverage, Spreads

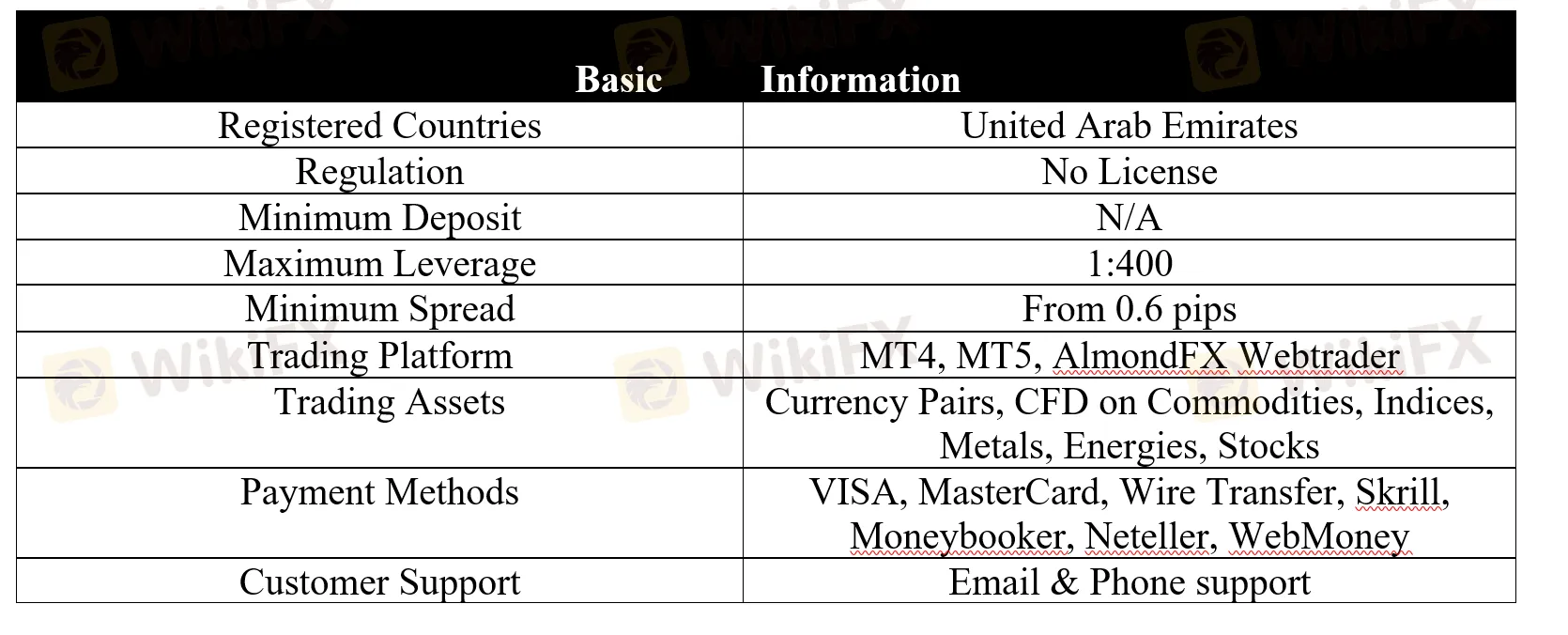

Abstract:Registered in the United Arab Emirates, AlmondFX is online forex broker providing easy access to various trading instruments, including Forex, Indices, Commodities, Stocks, Metals, and more. With the AlmondFX platform, traders can enjoy low spreads from 0.6 pips, and leverage up to 1:400. AlmondFX does not hold any regulatory license to show it operates legally. Please be aware of the risk involved.

General Information

Registered in the United Arab Emirates, AlmondFX is online forex broker providing easy access to various trading instruments, including Forex, Indices, Commodities, Stocks, Metals, and more.

With the AlmondFX platform, traders can enjoy low spreads from 0.6 pips, and leverage up to 1:400.

AlmondFX does not hold any regulatory license to show it operates legally. Please be aware of the risk involved.

Market Instruments

With the AlmondFX platform, investors can get access to multiple range of trading instruments, including currency pairs, CFD on commodities, indices, metals, energies, stocks, and more.

Account Types

Two types of trading accounts can be opened with the AlmondFX platform: Individual Account and the Corporate Account, with the minimum deposit not disclosed.

Traders can also use a demo account to gain a feel for the platform and practice their trading skills without risking any real money.

How to open an account with AlmondFX?

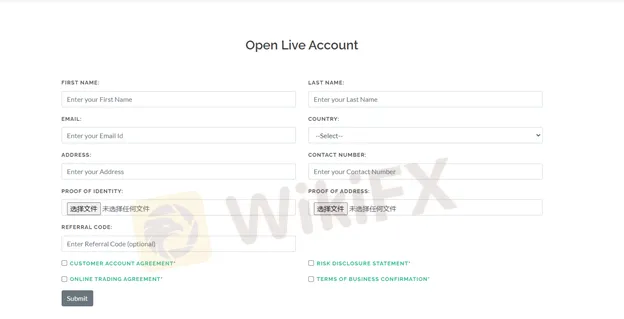

Opening an account with VRN Capitals is an easy and simple process:

1. Click the CREATE ACCOUNT link, and fill up some required details on the popping-up page.

2. Upload your personal data for this company to verify your details.

3. Fund your account and start to trade with this forex broker.

Leverage

In terms of trading leverage, AlmondFX permits traders to use leverage of up to 1:400, insanely higher than the levels regarded appropriate by many regulators, with the maximum leverage for major forex up to 1:30 in Europe and Australia, and 1:50 in Canada and U.S.

Since leverage can magnify gains as well as losses, it is wise for beginners to choose a smaller size until they gain more trading experience.

Spreads & Commissions

AlmondFX hypes that it offers extremely competitive spreads, with the spread on the EUR/USD pair starting at 0.6 pips.

Trading Platform

AlmondFX claims that it gives multiple trading platform options, which include MT4, MT5, AlmondFX Webtrader. MT4 and MT5 are among the most popular trading platforms around the world, featuring the robust charting package, the ability to use automated trading bots (Expert Advisors), and the flexibility of the interface.

Payment Methods

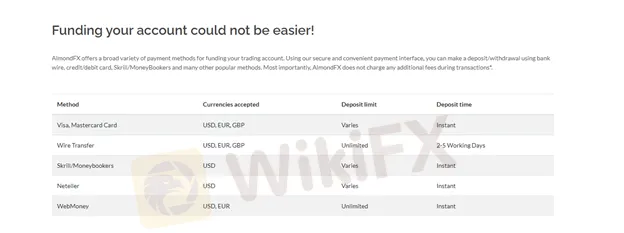

The minimum deposit to invest with AlmondFX is not mentioned. And this brokerage house allows its clients to make a deposit and withdrawal through multiple payment methods, which include VISA, MasterCard, Wire Transfer, Skrill, Moneybooker, Neteller, WebMoney.

AlmondFX promises that it does not charge any additional fees during transactions.

Customer Support

AlmondFX offers the poor customer support, with online communication, phone support unavailable. Clients who need staff service to solve their trading service can only reach out to this brokerage house through an email: tech@almond-fx.com.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

bitcastleFX Labelled as ‘SCAMMER’ by Traders: Here’s Why

Does bitcastleFX prevent you from withdrawing funds despite repeated requests? Do you face account bans after depositing into your bitcastleFX trading account? Facing high withdrawal fees? You are with a forex broker, which is called a ‘SCAMMER’ by many traders on several broker review platforms. In this article, we have shared multiple negative reviews about this broker.

User Reports Issues with TMI Markets! Be Worried About Your Investment

When it comes to investing your hard-earned money, choosing a reliable and trustworthy broker is crucial. Many new brokers enter the market each year, offering attractive deals to grab your attention. However, not all of them are safe. One such broker that has recently raised several concerns is TMI Markets. In this article, we’ll walk you through five major red flags you need to know.

TeleTrade Exposed: Withdrawal Denials, Deposit Rejections & Trader Losses

Facing withdrawal issues at TeleTrade and finding them not ending anytime soon? Depositing through a valid mode yet getting a rejection from the broker? Constantly facing losses at TeleTrade? These are nothing but an indicator of the investment scam you may witness later. Many traders have expressed concerns over their bad experience at the broker. In this article, we will share their comments. So, keep reading!

Planning to Trade with Zentrader? Know These 5 Risks to Stay Safe!

Do not invest with any broker just because of their fancy offers and polished website. Scam brokers have a dark side too, which they hide from you. Zentrader is no different from such brokers. Read this article and know the five risks associated with the broker.

WikiFX Broker

Latest News

What Is an IB in Forex? A Total Trader’s Guidebook

What is a Forex CRM System? The Complete Guide for Brokers

US Factory Orders Dropped Again In July As Tariff Front-Running Hangover Lingers

Wrong Advice & Trade Manipulation Tarnish CapPlace’s Reputation Among Traders

UBS Advisor Suen Kin-wing Banned for Life by SFC

BingX Exposed: 5 Risky Downsides You must Know!

UBS Becomes First Foreign Islamic Broker on Bursa Malaysia

Veteran trader sees key economic signal in surging gold prices

DON'T TRANSFER: Requests to Transfer Funds to Other Accounts Could be a Scam!

Jane Street Appeals SEBI Ban Over Index Allegations

Rate Calc