Fake FXCM-Some Important Details about This Broker

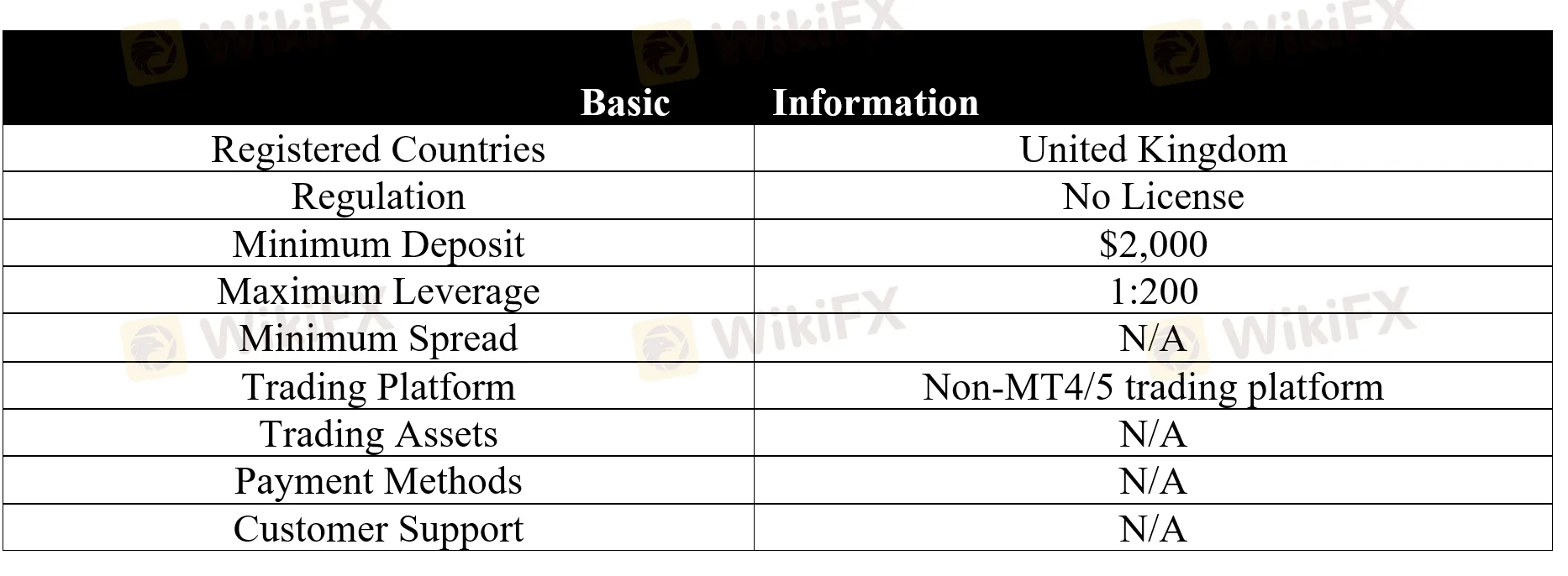

Abstract:This Fake FXCM was registered in the United Kingdome, and it was not established long, with an operating time of 2-5 years. This fake FXCM boasts that it provides four trading accounts to choose, its minimum deposit requirement, however, is as high as $2,000. Please note this fake FXCM is posing as a legit one try to defraud investors. It has been verified that this broker currently has no valid regulation. please be aware of the risk.

Risk Warning: This Fake FXCM is posing as a legit one by using the name of legit FXCM. It has been verified that this broker currently has no valid regulatory. Please be aware of the risk.

General Information

This Fake FXCM was registered in the United Kingdome, and it was not established long, with an operating time of 2-5 years. This fake FXCM boasts that it provides four trading accounts to choose, its minimum deposit requirement, however, is as high as $2,000.

Please note this fake FXCM is posing as a legit one try to defraud investors. It has been verified that this broker currently has no valid regulation. please be aware of the risk.

Account Types

This Fake FXCM provides four trading accounts, namely Standard, Plus, Pro and ECN accounts. The minimum deposit for each account is quite high, with the Standard account from $2,000, the Plus account from $5,000, the Pro account from $30,000, the ECN account from $100,000.

Obviously, as un illegal forex broker, what Fake FXCM wants to do is extracting all available money from investors pockets.

Leverage

Fake FXCM allows its clients to use leverage of up to 1:1000, higher than the levels regarded appropriate by many regulators. This is a typical tactic employed by scammers trying to attract more investors.

Leverage can magnify gains, it can also cause serious fund losses, especially to inexperienced traders. Therefore, it is wise for beginners to choose the smaller size no more than 1:10 until they gain more trading experience.

Trading Platform

What this fake FXCM provides is not the industry-leading MT4 or MT5 trading platform.

Customer Support

Fake FXCM offers extremely poor customer support, as there is no contact information left for clients with trading-related problems to get in touch with them.

Negative Reviews

The number of the complaints received by WikiFX have reached 15 for this broker in the past 3 months. Please be aware of the risk and the potential scam.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Read more

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

Win $100,000 in XM Competitions: Trade for Cash Prizes!

Join XM Competitions from 20-27 Feb for a chance to win $100,000! Compete by skill or luck. No entry fees. Trade on a secure, award-winning platform.

Why Do Malaysians Keep Falling for Money Games?

Malaysia has seen a persistent rise in money game schemes, luring thousands of unsuspecting investors with promises of high returns and minimal risk. These schemes operate under various disguises, from investment clubs to digital asset platforms, yet they all follow the same fundamental principle—new investors fund the profits of earlier participants. Once the cycle collapses, the majority are left with devastating losses. Despite repeated warnings and high-profile cases, many Malaysians continue to fall victim. What drives this phenomenon?

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Rate Calc