Everest FX

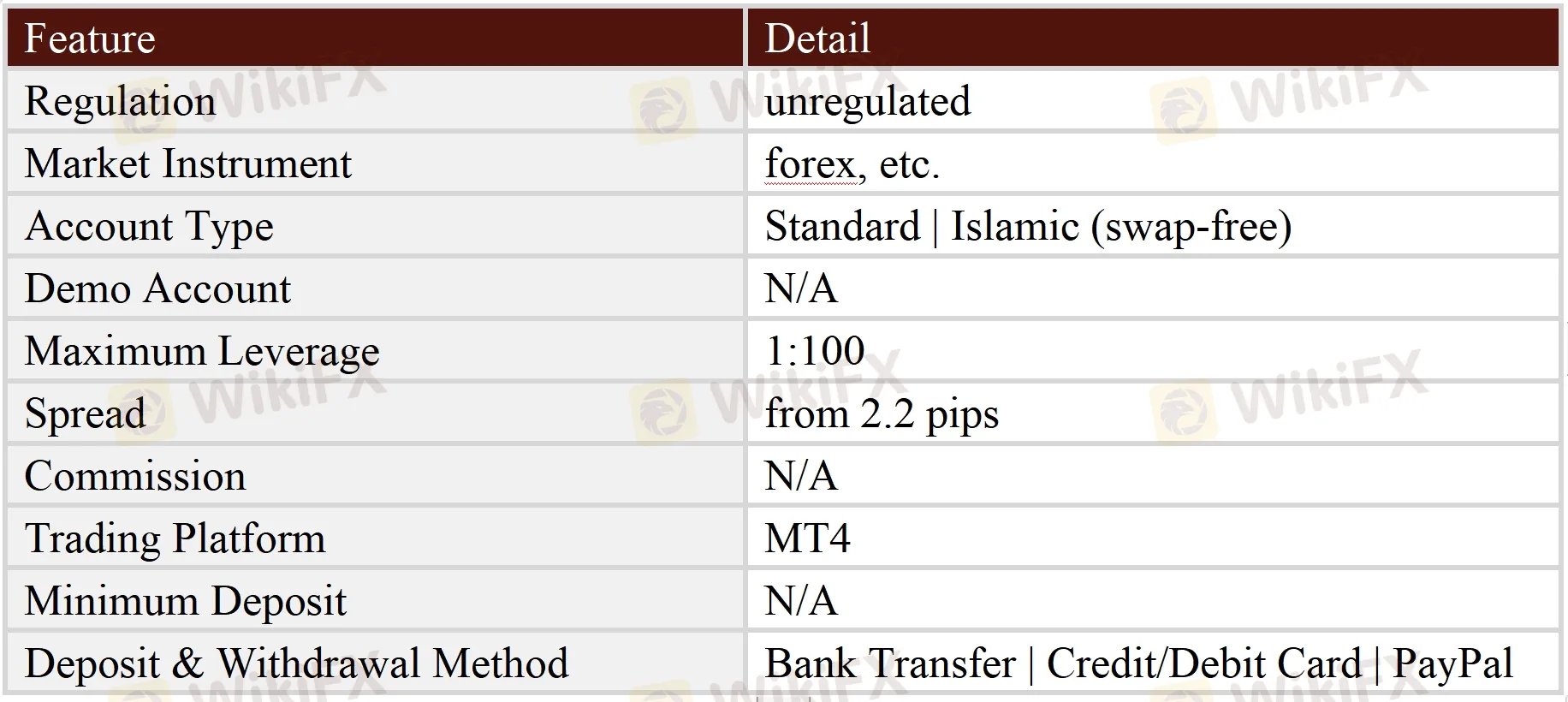

Abstract:Everest FX presents itself as a forex broker registered in Saint Vincent and the Grenadines and focused on the Arabian market. The broker claims to provide its clients with leverage up to 1:100 and floating spreads from 2.2 pips on the state-of-the-art MT4 trading platform.

Note: For some unknown reason, we cannot open Everest FXs official sites (https://everestfx.info/Default.aspx, https://everestfx.com/Default.aspx) while writing this introduction, therefore, we could only gather relevant information from the Internet to present a rough picture of this broker. Traders should be careful about this issue.

General Information & Regulation

Everest FX presents itself as a forex broker registered in Saint Vincent and the Grenadines and focused on the Arabian market. The broker claims to provide its clients with leverage up to 1:100 and floating spreads from 2.2 pips on the state-of-the-art MT4 trading platform.

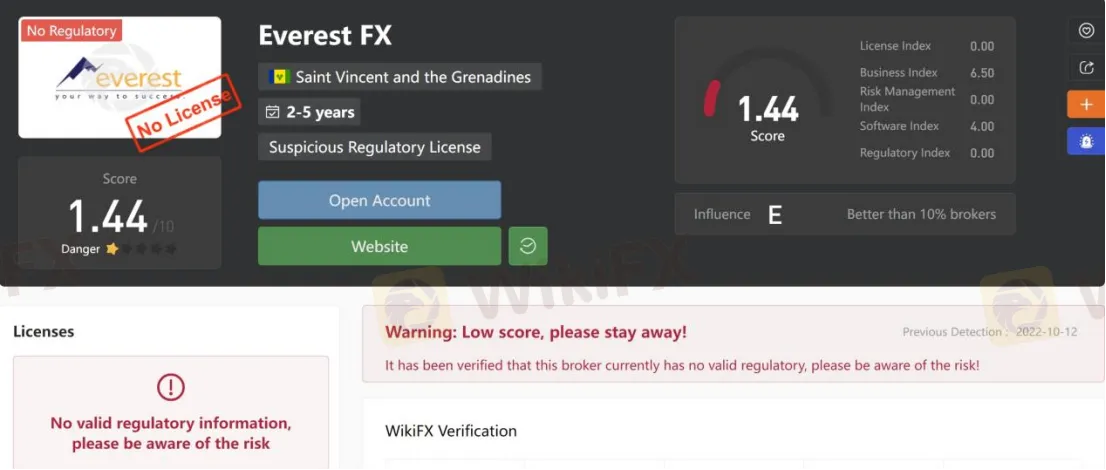

As for regulation, it has been verified that Everest FX does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.44/10. Please be aware of the risk.

Negative Reviews

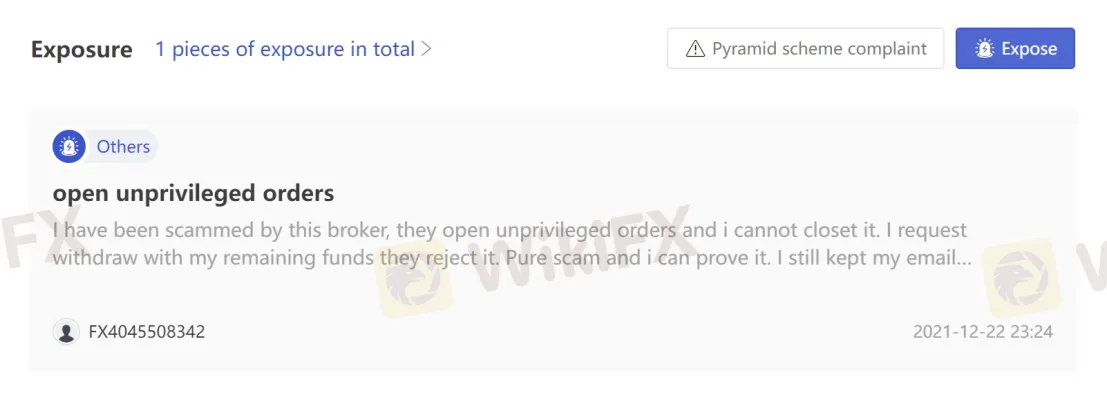

A trader shared his terrible trading experience on the Everest FX platform at WikiFX. He said he has been scammed by this broker and was unable to withdraw. It is necessary for traders to read reviews left by some users before choosing forex brokers, in case they are defrauded by scams.

Market Instruments

Everest FX advertises that it is a forex broker that mainly offers forex trading. However, more specific information about tradable assets cannot be found on the Internet.

Account Types

There is a Standard account with no minimum initial deposit requirement revealed. Everest FX also supposedly offers multiple Islamic (swap-free) account types.

Leverage

The leverage provided by Everest FX is capped at 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Everest FX claims that the spread on the Standard account starts from 2.2 pips. However, as tested with the platform, the EUR/USD spread was floating around 2.4-2.6 pips.

Trading Platform Available

The platform available for trading at Everest FX is the worlds leading MetaTrader4. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

Everest FX provides only a few payment options which include Bank Transfer, Credit/Debit Card and PayPal. Note that bank transfers (especially international ones) may take several business days and include significant fees (depending on the banks involved). However, there is no mention of the minimum deposit and withdrawal amount.

Customer Support

Everest FX‘s customer support can be reached by telephone: 0041225187116, email: info@everestfx.com. You can also follow this broker on social networks such as Twitter and Facebook. However, this broker doesn’t disclose other more direct contact information like the company address that most brokers offer.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

Scam Exposed: GlobTFX Deceives Another Investor

This article will focus on sharing the testimonies of victims deceived by GlobTFX's false profit claims, revealing how the platform responds to user complaints and demands for compensation with fraudulent tactics.

WikiFX Review: Can you give credit to a broker named HERO?

In today’s article, WikiFX made a comprehension review about HERO to help you better understand this broker. We will analyze the reliability of this broker from specific information, regulation, exposure, etc. Let’s get into it.

Key Risks and Downsides of Forex Trading Explained

Discover the key risks and downsides of forex trading, including market volatility, leverage dangers, and emotional challenges. Learn how to trade wisely.

eToro Review 2025: Trading Accounts & Withdrawals to Explore

eToro is an intuitive online trading platfrom that features social trading solutions, a unique being in the industry, with great popularity among both novices and seasoned traders. On the eToro platform, traders can trader over greater amount of stocks and ETFs with zero commission charged,anencouraging feature was later adopted by many of its competitors. 55 currencies can be traded, with spreads starting at 1 pip (typically on the euro/usd pair), not that competitive, and a trading fee of 1% trading fee of 1% applies to crypto trading. Opening a trading account is quite easy for investors, and demo accounts (funded with $100,000 virtual money) are also provided to enhance beginners' trading courage. However, a major disencouraging point is that this broker has a more limited platform options, only eToro proprietary trading platform and MetaTrader (MT4) supported.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

Scam Exposed: GlobTFX Deceives Another Investor

The Top 5 Trading Strategies You Can't Miss

Crypto Market Flooded with 11 Million Tokens

Alert! Rising X Account Thefts as Hackers Flood the Market with Scam Meme Coins

Sweden’s Fintech Giant Klarna Ventures into Crypto Before US IPO

Japan Pressures Apple and Google to Block Unregistered Crypto Exchanges

WikiEXPO Becomes Partner of the Liberland Government, Promoting Innovation and Healthy Development

Rate Calc