Wonderinterest

Abstract:Wonderinterest, a trading name of Wonderinterest Trading Ltd, is allegedly a forex and CFD broker registered in Cyprus that claims to provide its clients with various tradable financial instruments with leverage up to 1:30 and floating spreads on the MT5 and Mobile App trading platform via five different live account types, as well as 24/5 customer support service.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | Regulated |

| Market Instrument | CFDs on shares, indices, commodities, forex and physical shares |

| Account Type | Coal, Water, Solar, Nuclear and Fusion |

| Demo Account | yes |

| Maximum Leverage | 1:30 |

| Spread (EUR/USD) | 3.3 pips on Coal account |

| Commission | Vary on the asset type |

| Trading Platform | MT5 & Mobile App |

| Minimum Deposit | $20,000 |

| Deposit & Withdrawal Method | credit/debit cards and wire transfers |

Wonderinterest, a trading name of Wonderinterest Trading Ltd, is allegedly a forex and CFD broker registered in Cyprus that claims to provide its clients with various tradable financial instruments with leverage up to 1:30 and floating spreads on the MT5 and Mobile App trading platform via five different live account types, as well as 24/5 customer support service. Here is the home page of this brokers official site:

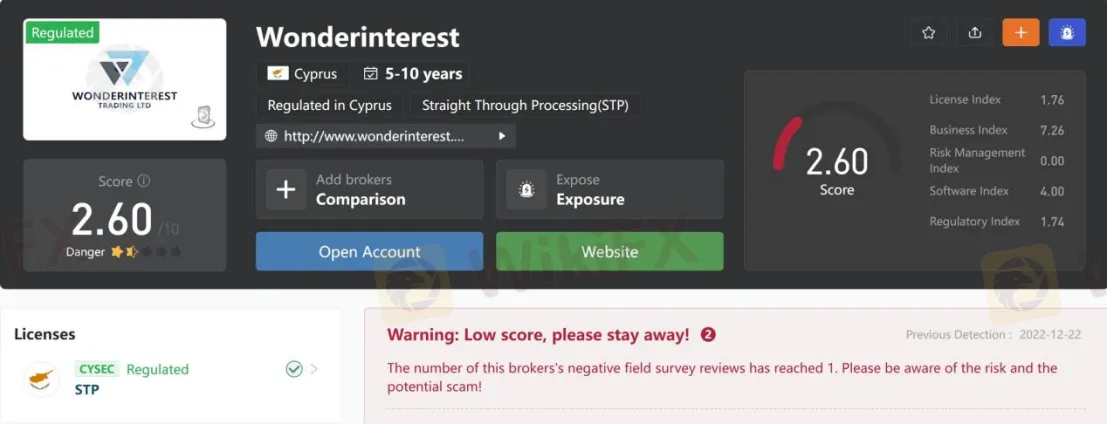

As for regulation, it has been verified that Wonderinterest is currently regulated by Cyprus Securities and Exchange Commission (CYSEC). That is why its regulatory status on WikiFX is listed as “Regulated” and receives a relatively low score of 2.60/10. Please be aware of the risk.

Market Instruments

Wonderinterest advertises that it offers access to 1,000+ trading instruments in financial markets, including CFDs on shares, indices, commodities, forex and physical shares.

Account Types

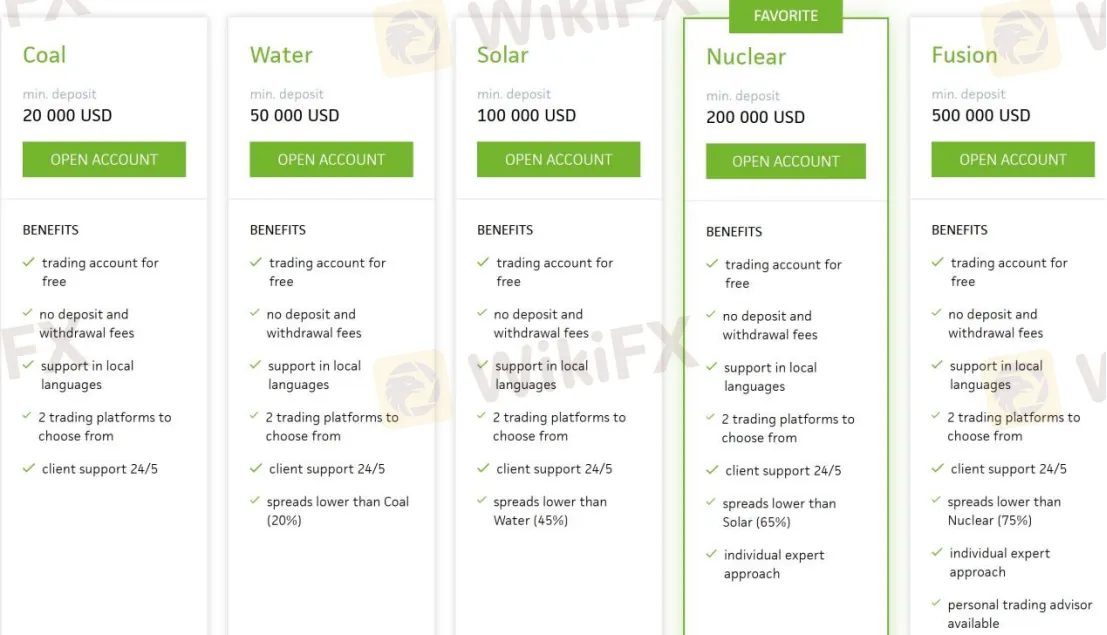

Apart from demo accounts, Wonderinterest claims to offer five types of trading accounts, namely Coal, Water, Solar, Nuclear and Fusion, with minimum initial deposit requirements of $20,000, $50,000, $100,000, $200,000 and $500,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The maximum leverage at Wonderinterest is 1:30 for retail traders. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

As tested on the Coal account, spreads on the EURUSD pair are 3.3 pips. You should know that the industry average is only 1.5 pips. The commission for trading physical shares is 0.75% with a minimum of $20, and the one for trading CFDs on shares is 0.25% with a minimum of $25.

Trading Platform Available

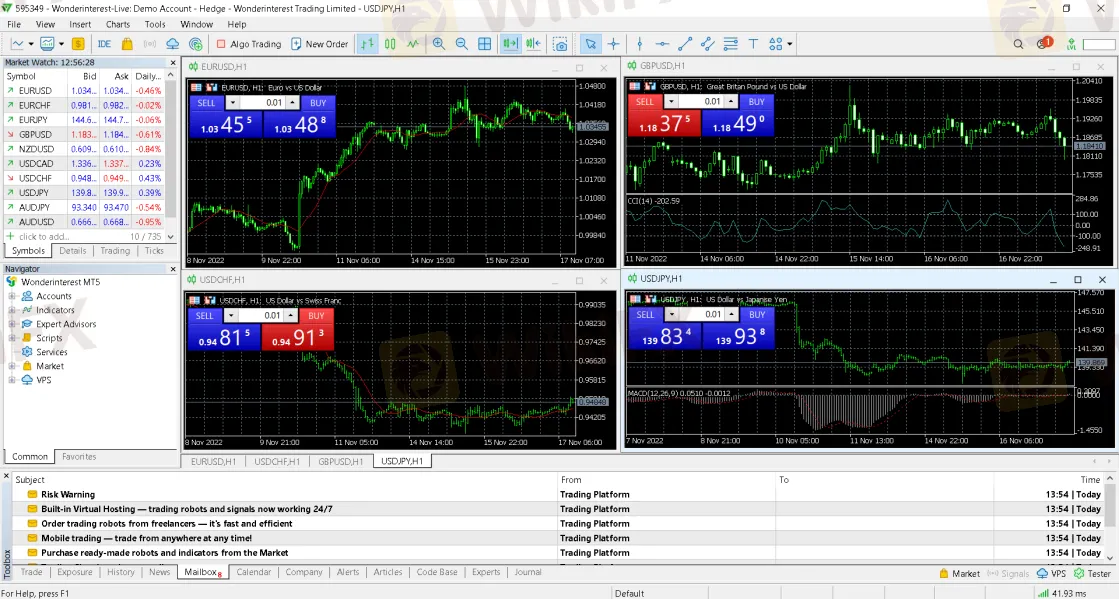

The platform available for trading at Wonderinterest is one of the most notable and preferred trading platforms the market offers - MetaTrader5 and its own-designed Mobile App. The MT5 is highly praised by traders and brokers alike due to its ease of use and great functionality, offering top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

Like most brokers, Wonderinterest also accepts deposits and withdrawals via credit/debit cards and bank transfers. The minimum initial deposit requirement is extremely high - $20,000. The broker itself does not charge any deposit or withdrawal fees – but keep in mind that your payment method provider might.

Fees

Another thing that is worth taking into consideration is that Wonderinterest charges inactivity fees, maintenance fees, and special service fees, but they did not specify the size of those.

Customer Support

Wonderinterests customer support can be reached by telephone: +357 25 056 419, email: support@wonderinterest.com or send messages online to get in touch. You can also follow this broker on social networks such as Facebook, Instagram and LinkedIn. Company address: 176, Makariou III Avenue, Paschalis Avenue House, Agia Zoni, Limassol, Cyprus.

Pros & Cons

| Pros | Cons |

| • Regulated | • Wide spreads and high commission fee |

| • Multiple trading instruments and account types offered | • Extremely high minimum deposit ($20,000) |

| • Demo accounts available | |

| • MT5 supported |

Frequently Asked Questions (FAQs)

| Q 1: | Is Wonderinterest regulated? |

| A 1: | Yes. Wonderinterest is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | Does Wonderinterest offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Wonderinterest offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Wonderinterest offers the MT5 and Mobile App. |

| Q 4: | What is the minimum deposit for Wonderinterest? |

| A 4: | The minimum initial deposit at Wonderinterest to open the most basic account is $20,000. |

| Q 5: | Is Wonderinterest a good broker for beginners? |

| A 5: | No. Wonderinterest is not a good choice for beginners. Although it is regulated, and also, it offers demo accounts on the MT5 platform, the trading condition is uncompetitive and the initial capital is too high for beginners. |

Read more

Why Do Malaysians Keep Falling for Money Games?

Malaysia has seen a persistent rise in money game schemes, luring thousands of unsuspecting investors with promises of high returns and minimal risk. These schemes operate under various disguises, from investment clubs to digital asset platforms, yet they all follow the same fundamental principle—new investors fund the profits of earlier participants. Once the cycle collapses, the majority are left with devastating losses. Despite repeated warnings and high-profile cases, many Malaysians continue to fall victim. What drives this phenomenon?

Axi Review 2025: How to Open An Account & Withdraw Money ?

Launched in 2008, Axi (formerly Axitrader), is an Australia-registered online forex broker that has gained solid development these years. Globally and heavily regulated, the Axi brand has several entities operating under different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Cyprus, FMA in New Zealand, and DFSA in the United Arab Emirates. Axi gives investors the opportunity to enter some popular markets with small budgets, including Forex, Metals, Indices, Commodities, Cryptocurrency, particularly IPOs, using its advanced software—the Axi Trading platform (newly launched), Copy Trading App, MT4, MT4 Webtrader . With no cost during account setup, traders can choose from 3 tailored live accounts in addition to a demo account. Among many forex brokers, Axi stands out due to its user-friendly interface, which allows for quick and simple account opening and withdrawals.

How to Start 2025 Strong in Forex: February Market Insights

As we step into February 2025, the global Forex market is already showing signs of movement that traders can harness for profitable opportunities. With the start of a new year, it's the perfect time for both new and experienced traders to set clear goals, refine strategies, and position themselves for success. In this article, we’ll explore the key market trends, economic events, and actionable strategies that can help you start 2025 strong in Forex.

The Best Forex Pairs to Trade in February 2025

As we enter February 2025, Forex traders are looking ahead at the key currency pairs that will offer the most potential for profit, based on economic events, market sentiment, and geopolitical factors. In this article, we’ll explore the best Forex pairs to focus on this month, considering expected volatility, upcoming events, and fundamental market shifts.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

India engaging US to ensure deportees not mistreated, foreign minister says

Carmaker Kia becomes latest global firm to face tax trouble in India

Judge halts Trump\s government worker buyout plan: US media

Rate Calc