SpotX Markets

Abstract:SpotX Markets is an unregulated brokerage firm headquartered in Saint Vincent and the Grenadines. They offer a range of trading instruments across Forex, CFDs, and Precious Metals, catering to traders with various account types and trading preferences. The company provides trading tools, accepts deposits and withdrawals through multiple methods, and offers customer service through various channels.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| SpotX Markets Review Summary | |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, CFDs, Precious Metals |

| Leverage | 1:400 |

| EUR/USD Spread | 0.2 pips (Pro) |

| Trading Platforms | N/A |

| Minimum Deposit | $100 |

| Customer Support | online messaging, email, social media |

What is SpotX Markets?

SpotX Markets is an unregulated brokerage firm headquartered in Saint Vincent and the Grenadines. They offer a range of trading instruments across Forex, CFDs, and Precious Metals, catering to traders with various account types and trading preferences. The company provides trading tools, accepts deposits and withdrawals through multiple methods, and offers customer service through various channels.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

Pros & Cons

| Pros | Cons |

| • Different account types to cater to varying needs | • Lack of regulation |

| • 24/7 customer service availability | • Higher minimum deposit requirements for VIP account |

| • No fees for deposit and withdrawal | • Spread and commission fees for certain account types |

SpotX Markets Alternative Brokers

There are many alternative brokers to xxx depending on the specific needs and preferences of the trader. Some popular options include:

Ally Invest - A reputable broker providing competitive pricing, a robust trading platform, and valuable educational resources, making it a strong choice for self-directed investors.

Merrill Edge - A trusted broker backed by Bank of America, offering a seamless integration with banking services, making it convenient for clients looking for a combined investment and banking experience.

TradeStation - A feature-rich broker with advanced charting tools, algorithmic trading capabilities, and a wide range of tradable instruments, ideal for experienced traders and those seeking sophisticated trading technology.

Is SpotX Markets Safe or Scam?

SpotX Markets is an unregulated brokerage firm. Lack of regulation raises concerns about the level of investor protection and oversight. Traders should exercise caution when dealing with unregulated entities, as there is no regulatory authority overseeing their operations or ensuring compliance with industry standards.

Market Instruments

SpotX Markets provides traders with a diverse range of trading instruments that span across different asset classes, enabling them to access multiple markets and enhance portfolio diversification. With their offerings in Forex, traders can participate in the largest and most liquid financial market in the world, trading currency pairs and taking advantage of fluctuations in exchange rates.

In addition to Forex, SpotX Markets offers Contracts for Difference (CFDs), which provide traders with the opportunity to speculate on the price movements of various financial instruments without actually owning the underlying asset.

Furthermore, SpotX Markets provides access to Precious Metals, such as gold, silver, platinum, and palladium. Precious metals have long been considered a safe haven investment and a store of value during times of economic uncertainty.

Accounts

| Account Type | Minimum Deposit |

| Pro | $1,000 |

| ECN Pro | $1,000 |

| Platinum VIP | $50,000 |

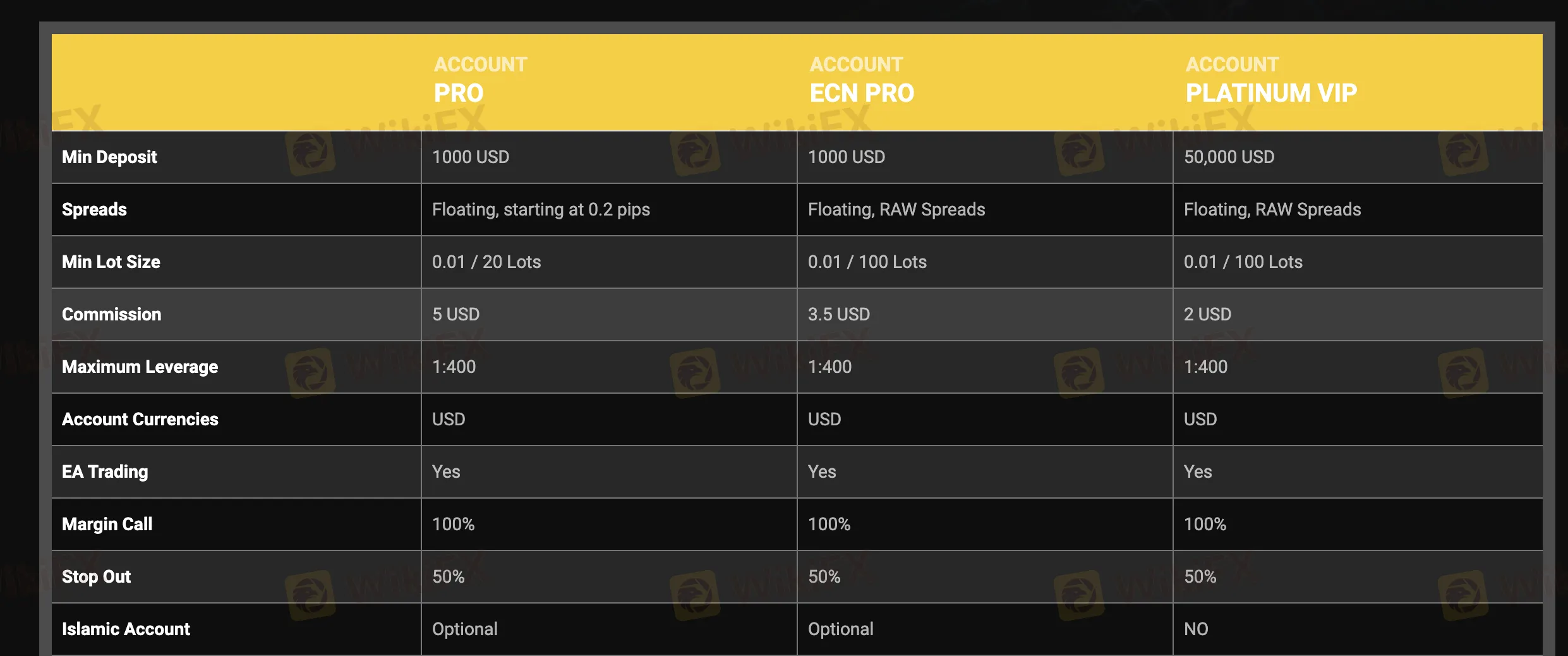

SpotX Markets caters to the diverse needs of traders by offering different types of trading accounts, each designed to accommodate varying levels of experience and trading capital. The Pro account is the entry-level option, requiring a minimum deposit of $1000. This account is suitable for traders who are starting their journey in the financial markets and wish to explore the available trading instruments with a moderate initial investment.

For more experienced traders seeking enhanced trading conditions, SpotX Markets offers the ECN Pro account. Similar to the Pro account, it also requires a minimum deposit of $1000. However, the ECN Pro account provides access to raw spreads, which can be favorable for traders looking for tighter pricing and faster execution.

SpotX Markets also caters to high-net-worth individuals and professional traders with the Platinum VIP account. This exclusive account requires a significantly higher minimum deposit of $50000, indicating its tailored services and advanced features.

Leverage

SpotX Markets offers a maximum leverage of 1:400 for all types of accounts. Leverage allows traders to amplify their trading positions and potentially increase their profits. However, it's important to note that higher leverage also entails higher risk.

Spreads & Commissions

For the Pro account, SpotX Markets offers a spread of 0.2 pips and a commission of $5. The ECN Pro account and Platinum VIP account have raw spreads, with commissions of $3.5 and $2, respectively. These costs and fees are important considerations for traders when evaluating their potential trading expenses.

When considering trading costs and fees, it is essential for traders to assess their trading strategy, volume, and frequency of trades, as well as their anticipated profit margins. By factoring in the spreads and commissions charged by SpotX Markets, traders can make informed decisions about their trading expenses and ensure that they align with their overall trading goals and profitability targets.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| SpotX Markets | 0.2 pips | $5 |

| Ally Invest | 1.2 pips | $0 |

| Merrill Edge | 1.6 pips | $0 |

| TradeStation | 0.2 pips | $0.0035 per share |

Trading Tools

SpotX Markets offers three trading tools for clients to make informed trading decisions and effectively manage their positions.

One of the key tools offered by SpotX Markets is the Economic Calendar. This calendar provides traders with a comprehensive overview of upcoming economic events, such as central bank announcements, economic indicators, and geopolitical developments.

Another useful tool provided by SpotX Markets is the Position Size Calculator. This calculator assists traders in determining the appropriate position size for their trades based on their desired risk level, account balance, and the specific market conditions.

Additionally, SpotX Markets offers a Margin Calculator, which enables traders to calculate and monitor their margin requirements. Margin trading allows traders to control larger positions with a smaller amount of capital. However, it is crucial to have a clear understanding of the margin requirements to avoid potential margin calls and account liquidation.

Deposit & Withdrawal

SpotX Markets accepts deposits and withdrawals via VISA, Bank Transfer, and Webmoney. The minimum deposit and withdrawal amount is $100, and there are no associated fees for these transactions. Withdrawals are processed within a maximum of 1 business day, providing relatively quick access to funds.

| SpotX Markets | Most other | |

| Minimum Deposit | $100 | $100 |

Customer Service

SpotX Markets offers customer service through 24/7 online messaging, email (support@spotxmarkets.com), and social media platforms such as Facebook and Instagram. Traders can reach out for assistance, inquiries, or support regarding their trading activities.

The company's physical address is Suite 305, Griffith Corporate Centre, Beachmont, Kingstown PO Box 1510, St. Vincent and the Grenadines.

| Pros | Cons |

| • 24/7 customer service | • Lack of telephone service |

| • Multiple contact channels | • Lack of live chat service |

| • Address provided |

Conclusion

SpotX Markets is an unregulated brokerage firm based in Saint Vincent and the Grenadines, offering a variety of trading instruments across different asset classes. While they provide trading opportunities, it's important to note that the company operates without regulatory oversight. Traders should carefully consider the risks associated with dealing with an unregulated entity and conduct thorough due diligence before engaging in any financial activities.

Frequently Asked Questions (FAQs)

Q1: What are the minimum deposit requirements for SpotX Markets?A1: The minimum deposit requirements for SpotX Markets are $1000 for the Pro account, $1000 for the ECN Pro account, and $50000 for the Platinum VIP account.

Q2: Is SpotX Markets regulated?A2: No, SpotX Markets is an unregulated brokerage firm.

Q3: What trading instruments are available on SpotX Markets?A3: SpotX Markets offers a variety of trading instruments, including Forex, CFDs, and Precious Metals.

Q4: Which payment methods are accepted for deposits and withdrawals on SpotX Markets?A4: SpotX Markets accepts deposits and withdrawals via VISA, Bank Transfer, and Webmoney.

Q5: Does SpotX Markets has any regional restrictions?

A5: Yes. SpotX Markets Ltd does not provide services to residents of the USA, Canada, Sudan, Syria, North Korea.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

Kraken Secures MiFID License to Boost EU Crypto Derivatives Trading

Rate Calc