Mai hui MHmarkets: June 26, 2023-MHM European Perspective

Abstract:On Monday (June 26), spot gold shocked slightly up during the Asian session, and is currently trading near $1926.68 per ounce. On the one hand, the U.S. June PMI data underperformed last Friday, the market on the year and then 2 interest rate hikes are expected to cool

Market Overview

On Monday (June 26), spot gold shocked slightly up during the Asian session, and is currently trading near $1926.68 per ounce. On the one hand, the U.S. June PMI data underperformed last Friday, the market on the year and then 2 interest rate hikes are expected to cool, the dollar and U.S. bond yields fell slightly, to provide support for gold prices; on the other hand, the poor economic data in Europe and the United States, so that the market on the recession fears rise, and Russia last weekend “mutiny”. Pushed up the gold safe-haven buying. In the short term, gold prices held the 1910 mark last Friday, there are some rebound opportunities.

U.S. crude oil traded near $69.73 per barrel; oil prices fell weekly last week as traders worried that interest rate hikes could weaken demand, despite signs such as falling U.S. crude inventories indicating tightening supply; the sudden geopolitical situation in Russia eased over the weekend as Wagner mercenary group personnel were evacuated from two southern Russian states and tensions eased, oil prices opened with little volatility on Monday, but this week also needs to be wary of the risk of geopolitical uncertainty on The impact of oil prices.

There are no significant economic data released this trading day. Please pay attention to the speeches of officials from the BoE and the SNB, the European Central Banking Forum, and the market's expectations for the US June PCE data (released this Friday).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on June 26, Beijing time.

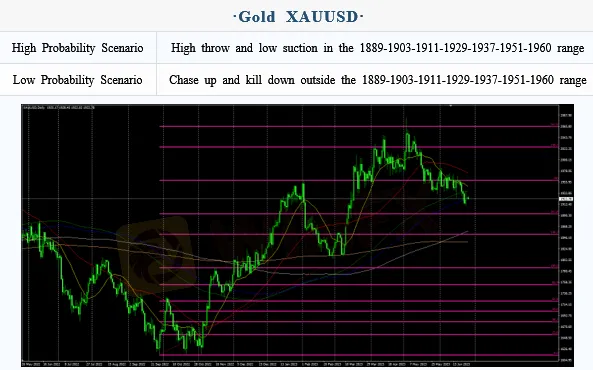

Intraday Oscillation Range: 1889-1903-1911-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1889-1903-1911-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 26. This policy is a daytime policy. Please pay attention to the policy release time.

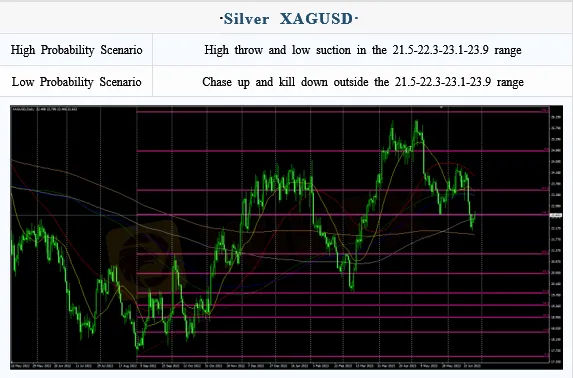

Intraday Oscillation Range: 21.5-22.3-23.1-23.9

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 26. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1 In the subsequent period of Crude Oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 26. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 26. This policy is a daytime policy. Please pay attention to the policy release time.

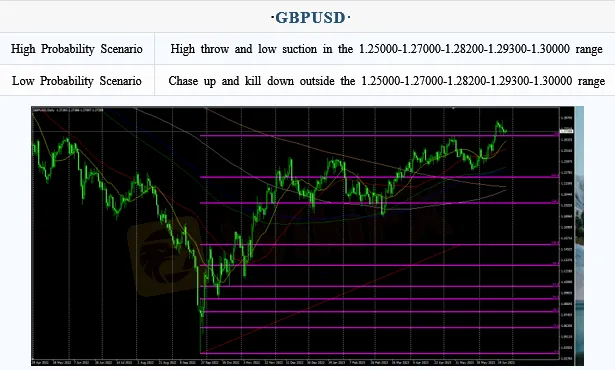

Intraday Oscillation Range: 1.25000-1.27000-1.28200-1.29300-1.30000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25000-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.25000-1.27000-1.28200-1.29300-1.30000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 26. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Dollar Under Siege: Fiscal Gridlock and Foreign Divestment Weigh on Greenback

Rate Calc