ADMIS

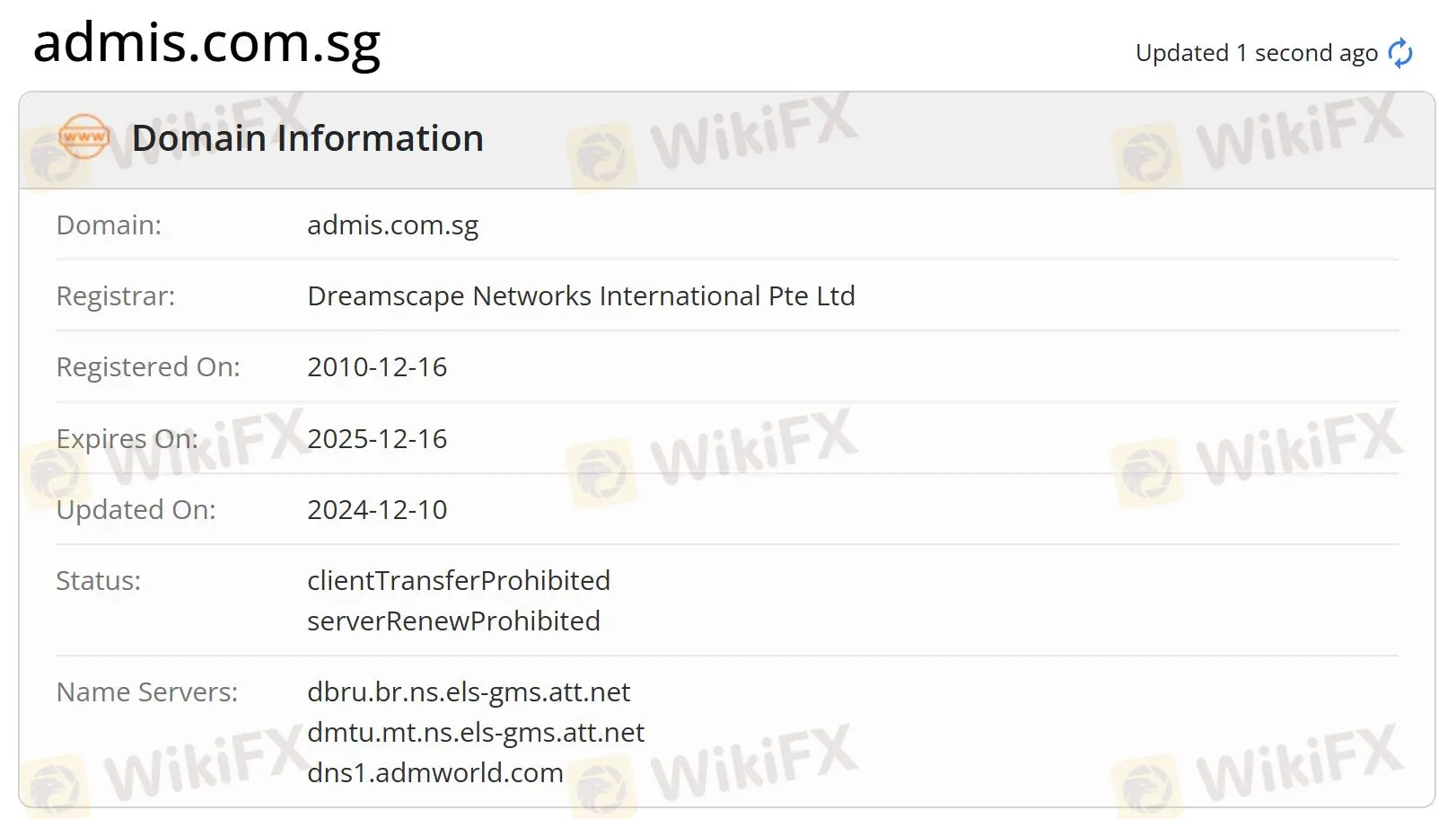

Abstract:ADMIS was registered in 2010 in Hong Kong, which is a broker specializing in futures trading. It uses CQG and TT as its trading platforms, and it is regulated by SFC. However, it does not reveal much information about account and trading details.

| ADMIS Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Futures on grains, metals, softs, and forex |

| Demo Account | / |

| Leverage | / |

| Trading Platform | CQG, TT |

| Min Deposit | / |

| Customer Support | Tel: +65-6632-3000 |

| Email: sales@admis.com.sg | |

| Address: 230 Victoria Street Bugis Junction Towers #11-06 Singapore 188024 | |

ADMIS was registered in 2010 in Hong Kong, which is a broker specializing in futures trading. It uses CQG and TT as its trading platforms, and it is regulated by SFC. However, it does not reveal much information about account and trading details.

Pros and Cons

| Pros | Cons |

| Long operation time | No physical office |

| Unclear fee structure | |

| No MT4 or MT5 | |

| Unknown payment options |

Is ADMIS Legit?

Yes, ADMIS is regulated by Securities and Futures Commission of Hong Kong (SFC).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | ADMIS Hong Kong Limited | Dealing in futures contracts | ACP509 |

WikiFX Field Survey

WikiFX field survey team visited ADMIS's regulatory address in Hong Kong, but we did not find its physical office.

What Can I Trade on ADMIS?

ADMIS provides a wide range of futures products. Besides, it offers market information related to grains, metals, softs, and forex.

Trading Platform

ADMIS uses CQG and Trading Technologies (TT) as its trading platforms, and it does not suppot MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| CQG | ✔ | PC, web | / |

| Trading Technologies | ✔ | PC, web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Read more

Darwinex Accounts & Darwinex Demo Accounts to Explore

Darwinex is a UK-based regulated online trading platform and broker that offers a unique approach to trading and investment. Darwinex goes beyond traditional brokerage by integrating innovative technology with trading, offering proprietary tools unavailable elsewhere. Its“Darwins”, investable algorithms, enable users to mirror successful traders' strategies. Traders can execute their own trades and also invest in other traders' strategies through these Darwins. The platform operates under FCA regulation and provides access to various markets, including forex, stocks, indices, commodities, and cryptocurrencies. Rather than a pure broker, Darwinex would be more like a community-focused platform.

MultiBank Group Launches UAE CFD Shares on MultiBank-Plus App and MT5

MultiBank Group introduces UAE CFD shares on MultiBank-Plus App & MT5, enabling global investors to trade DFM & ADX shares seamlessly.

Interactive Brokers Review 2025: Pros and Cons Revealed

Interactive Brokers is a well-established stock broker compared to many of its peers like Wellbull and offering a large selection of tradable securities, and it offers $0 per share on stock and ETFs (for U.S residents only) with its IBKR Lite plan. Besides, it also offers the most advanced platforms to foster superb trading experience. In this way, Interactive Brokers features the largest clientele compared to its competitors, like Robinhood, Fidelity and Charles Schwab, over 2.6 million institutional and individual brokerage customers.

Webull Review 2025: Pros and Cons Revealed

Webull was founded in 2017, quite newer to the brokerage industry than traditional players like Charles Schwab, Fidelity, Interactive Brokers and Robinhood. However, it stands tall when it comes to products offerings: Stocks, Options, cryptos, Index Options, Futures, ETFs, OTC, Margin, Fractional Shares. Webull applies no commission on stock, options and ETFs trading listed on U.S. Exchanges.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

Rate Calc