CENTRAL

Abstract:Central China International Securities Co., Limited, based in Hong Kong's Central district, is a financial institution regulated by the Hong Kong Securities and Futures Commission (SFC). The company offers a comprehensive suite of financial services, including securities trading, investment banking, investment advisory, stock custody, and more. Clients can conveniently deposit and withdraw funds using various methods, including wire transfers and the Faster Payment System (FPS). Central China International Securities provides multiple customer support channels, including phone, fax, and email. However, it's important to note that their regulatory status for futures contracts has been revoked, and certain fee information is limited, with fee structures subject to change. Additionally, the “Exceeded” status for their securities license lacks clarification regarding its implications.

| Company Information | Details |

| Company Name | Central China International Securities Co., Limited |

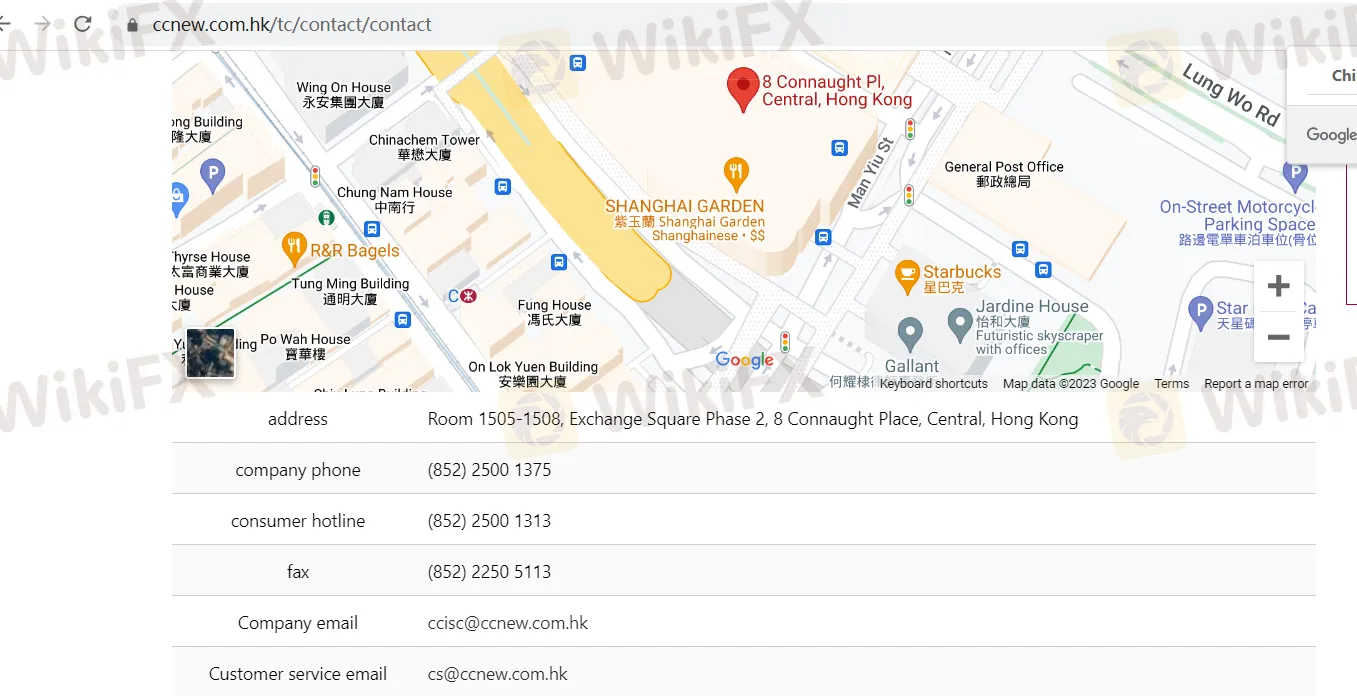

| Location | 1505-1508, 2nd Phase, Exchange Square, 8 Connaught Place, Central, Hong Kong |

| Main Line | (852) 2500 1375 |

| Customer Service Phone | (852) 2500 1313 |

| Fax | (852) 2250 5113 |

| Company Email | ccisc@ccnew.com.hk |

| Customer Service Email | cs@ccnew.com.hk |

| Regulatory Authority | Hong Kong Securities and Futures Commission (SFC) |

| Services | Securities Trading, Investment Banking, Investment Services, Stock Custody, Stock Transfers, Agent Services, Corporate Actions |

| Deposit Methods | Overseas Wire Transfer, Hong Kong Same-Name Transfer (FPS), Transfer (ATM / Phone Banking / Online Banking), Bank Deposit |

| Withdrawal Methods | Contact Account Manager or Fill Out Withdrawal Form |

| Pros | - Comprehensive range of financial services - Convenient fund deposit and withdrawal options - Established presence in the financial industry - Multiple customer support channels |

| Cons | - Regulatory status for dealing in futures contracts revoked - Limited fee information for certain services - “Exceeded” status for securities license unclear - Fee structures subject to change |

Overview

Central China International Securities Co., Limited, based in Hong Kong's Central district, is a financial institution regulated by the Hong Kong Securities and Futures Commission (SFC). The company offers a comprehensive suite of financial services, including securities trading, investment banking, investment advisory, stock custody, and more. Clients can conveniently deposit and withdraw funds using various methods, including wire transfers and the Faster Payment System (FPS). Central China International Securities provides multiple customer support channels, including phone, fax, and email. However, it's important to note that their regulatory status for futures contracts has been revoked, and certain fee information is limited, with fee structures subject to change. Additionally, the “Exceeded” status for their securities license lacks clarification regarding its implications.

Regulation

Central China International is a financial institution with two distinct licenses, one for dealing in futures contracts and the other for dealing in securities, both regulated by the Hong Kong Securities and Futures Commission. However, their regulatory status differs significantly. The license for dealing in futures contracts has been revoked, indicating that Central China International Futures Company Limited is no longer permitted to engage in futures contract trading in Hong Kong. On the other hand, the license for dealing in securities is marked as “Exceeded,” which is an unusual status term and requires further context to understand its implications. It could imply that Central China International Securities Co., Limited may have exceeded certain regulatory limits or requirements, but the specific details of this status are not provided in the provided information. Both entities are located at the same address in Hong Kong's Central district, suggesting they share a physical location, but their regulatory statuses are quite different.

Pros and Cons

Central China International Securities Co., Limited offers a range of financial services, including securities trading, investment banking, and investment advisory services. However, there are certain advantages and disadvantages associated with their services and fees.

| Pros | Cons |

|

|

|

|

|

|

|

|

Central China International Securities Co., Limited offers a diverse set of financial services, making it a versatile choice for clients. They provide convenient options for fund transactions and maintain an established presence in the financial sector. However, it's essential to note that their regulatory status for futures contracts is revoked, and some fee details require more comprehensive information. The status term “Exceeded” in their securities license is also in need of further clarification. Nevertheless, the institution offers multiple avenues for customer support to assist clients effectively.

Services and Fees

entral China International Securities Co., Limited (中州國際證券有限公司) offers a range of financial services, including brokerage services, investment banking, and investment services. Here's a breakdown of some of its services and associated fees:

Securities Trading Services:

Brokerage Commission: The commission for securities trading varies based on the channel used. For phone trading, it starts at 0.15% of the transaction amount, while for online/mobile applications, it starts at 0.1%.

Minimum Charge: There is a minimum charge of HKD 30 or the equivalent in other currencies for securities trading.

Government Stamp Duty: 0.13% of the transaction amount, with a minimum charge of HKD 1 for each side of the trade.

SFC Transaction Levy: 0.0027% of the transaction amount for each side of the trade.

HKEX Trading Fee: 0.00565% of the transaction amount for each side of the trade.

Central Clearing Fee: 0.002% of the transaction amount, with a minimum charge of HKD 2 and a maximum charge of HKD 100 for each side of the trade.

Securities Services:

Central China International Securities provides services related to stock custody, stock transfers, agent services, and corporate actions.

Fees for services such as stock deposit, stock withdrawal, dividend collection, handling rights issues, and share registration may vary, and specific amounts are mentioned in the provided information.

Investment Banking Services:

Central China International offers investment banking services, including acting as a sponsor for listed companies, providing advice on mergers and acquisitions, and assisting with corporate finance transactions. The fees for these services may vary depending on the scope and complexity of the transaction and are typically negotiated with the client on a case-by-case basis.

Investment Services:

The company may assist clients with investment planning, financial analysis, and strategic investment decisions. Fees for these services may depend on the specific services rendered and are not detailed in the provided information.

It's important to note that the fee structures and pricing mentioned above are subject to change and may vary based on the specific terms negotiated with clients. Additionally, the information provided does not specify fees for all services offered by Central China International Securities, and clients should consult the institution directly for comprehensive and up-to-date fee schedules.

Deposit & Withdrawal

Deposit Methods:

Overseas Wire Transfer: Clients located outside of Hong Kong can use overseas bank channels (e.g., online banking, counter services) to make wire transfers. It is essential to specify the account name and number at Central China International Securities Co., Limited on the remittance form.

Hong Kong Same-Name Transfer (FPS - Faster Payment System): Clients can transfer funds from their Hong Kong bank accounts to Central China International Securities Co., Limited using the Faster Payment System (FPS). They need to ensure their Hong Kong bank account is enabled for FPS, select the FPS option when making the transfer, input the identification code, and verify the recipient's name before confirming the amount.

Transfer (ATM / Phone Banking / Online Banking): Clients can make transfers from their bank accounts to Central China International Securities Co., Limited through various banking channels. It is recommended to include the securities account name and number in the remarks field.

Bank Deposit: Clients can deposit checks or bank drafts into any of the company's bank accounts. If depositing a crossed check in person, the securities account number must be indicated on the back, and the deposit should be made before 3:00 PM.

Confirmation of Deposits:

Clients are required to confirm their deposits by following these steps:

Specify the account number and account name on the deposit receipt.

Sign the deposit receipt and send it via fax to +852 2250 5113 or email it to cs@ccnew.com.hk.

Alternatively, clients can contact their account manager or the company's customer service team at +852 2500 1313 (Hong Kong) or 4008 411 118 (Mainland China) and provide the deposit receipt for confirmation.

Withdrawal Methods:

Clients have multiple options for issuing withdrawal instructions:

For clients who have added bank account information, they can contact their account manager or company customer service personnel to provide withdrawal details.

For clients who have not added bank account information, they can download and fill out a withdrawal form from the website. After signing the form to match their bank record, they can fax it to +852 2250 5113 or email it to cs@ccnew.com.hk.

Withdrawal Fees:

Withdrawal fees depend on the chosen method and are as follows:

Check Payment: No fee, and funds are available on the next business day.

Local Transfer (Hong Kong): Same-day processing, with fees determined by the bank and an additional HKD 50 fee.

Overseas Wire Transfer: Funds are available approximately 1-2 business days after the withdrawal request is made. Fees are determined by the bank and include an additional HKD 100 fee.

Clients are advised to refer to the specific bank account information provided to initiate withdrawals accurately. It's essential to ensure that withdrawal instructions are submitted before noon (12:00 PM) on weekdays for same-day processing, with any late requests being processed on the next business day.

Customer Support

Central China International Securities Co., Limited offers robust customer support through multiple channels:

Address: Located at 1505-1508, 2nd Phase, Exchange Square, 8 Connaught Place, Central, Hong Kong.

Company Phone: Main line at (852) 2500 1375 for general inquiries and business matters.

Customer Service Phone: Reach the dedicated customer service team at (852) 2500 1313 for account-specific queries and transactions.

Fax: Contact the company via fax at (852) 2250 5113 for document submissions.

Company Email: Send emails to ccisc@ccnew.com.hk for general inquiries and corporate communication.

Customer Service Email: For customer service needs, email cs@ccnew.com.hk for account-related assistance.

This comprehensive support infrastructure ensures clients have efficient ways to get assistance and resolve inquiries promptly.

Summary

Central China International Securities Co., Limited is a financial institution based in Hong Kong, offering a range of services including securities trading, investment banking, and investment services. They are regulated by the Hong Kong Securities and Futures Commission. Notably, their license for dealing in futures contracts has been revoked, while their license for dealing in securities is marked as “Exceeded,” although the implications of this status are unclear. The company provides various services with associated fees, including securities trading, stock custody, and investment banking. Clients can deposit funds through methods such as overseas wire transfer and Hong Kong same-name transfers, with different withdrawal options available. Robust customer support is offered through multiple channels, ensuring efficient assistance for clients.

FAQs

Q1: What services does Central China International Securities Co., Limited offer?

A1: Central China International Securities Co., Limited provides a range of financial services, including securities trading, investment banking, and investment advisory services.

Q2: How can I deposit funds into my account with Central China International Securities?

A2: You can deposit funds through methods such as overseas wire transfer, Hong Kong same-name transfers (FPS), transfer via ATM/phone banking/online banking, and bank deposits. Ensure you include your securities account name and number for reference.

Q3: What fees are associated with securities trading through Central China International?

A3: Fees for securities trading include brokerage commission, government stamp duty, SFC transaction levy, HKEX trading fee, and central clearing fee. Specific rates may vary based on the trading channel and transaction amount.

Q4: How can I contact customer support at Central China International Securities?

A4: You can reach their customer support team at (852) 2500 1313 for account-specific queries and transactions, or via email at cs@ccnew.com.hk for account-related assistance.

Q5: Where is Central China International Securities Co., Limited located?

A5: The company is located at 1505-1508, 2nd Phase, Exchange Square, 8 Connaught Place, Central, Hong Kong.

Read more

Saxo Bank vs. Fusion Markets: A Straightforward Broker Comparison

When it comes to choosing a forex and CFD broker, traders often face a key question: do you go with a trusted, global institution like Saxo Bank, or a low-cost, flexible option like Fusion Markets? Both brokers offer unique advantages, but they’re built for very different types of users.

Dukascopy Enhances Forex Trading Platform with 303 New Instruments

Dukascopy adds 303 trading instruments to JForex, offering diverse forex, crypto, and precious metal pairs for enhanced trading.

FXGT.com: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FXGT.com and its licenses.

What WikiFX Found When It Looked Into M4Markets

In the world of forex trading, choosing a reliable broker is one of the most important decisions a trader can make. With scams and fake companies becoming more common, many traders turn to WikiFX, a global platform that checks and lists the details of over 60,000 brokers. In this article, we will be taking a closer look at a broker named M4Markets.

WikiFX Broker

Latest News

Inside MBI: The Billion-Dollar Ponzi Scheme That Shook Malaysia

ZFX: A Closer Look at Its Licences

Should you buy or sell US dollars in the next three to six months?

Tradehall Broker Review 2025: Read Before Trade

XM Rolls Out New Forex Trading Competition Platform for 2025

Tether Freezes $12.3 Million in USDT Over Money Laundering Concerns

MiCA Unlocks EU Crypto Market, but National Tensions Rise as Gemini and Coinbase Near Approval

Retirement Dreams Shattered: Don't Do This To Yourself!

Philippines Sets Southeast Asia’s First Crypto Regulatory Framework

EU Regulators Imposed Over €71M in Sanctions in 2024, ESMA Calls for Enforcement Convergence

Rate Calc