MHMarkets:A debt crisis is coming! The "debt king" warns that the United States will enter an economic recession next year.

Abstract:At the end of the Asian market on Thursday (November 9), Jeff Gundlach, the "debt king", said in an interview yesterday that the US $33 trillion debt mountain is becoming increasingly worrisome.

At the end of the Asian market on Thursday (November 9), Jeff Gundlach, the “debt king”, said in an interview yesterday that the US $33 trillion debt mountain is becoming increasingly worrisome. The US economy may fall into recession sometime next year. As high interest rates have pushed up the borrowing costs of the US government, the annual interest expenditure on US debt last month has soared to more than $1 trillion. The US dollar index rose first yesterday and then fell. Today, there was a slight fluctuation and consolidation in the Asian market, with the current price around 105.60. Spot gold, affected by the weakening of fundamental support, remains weak and continued to decline yesterday. Today, it rose first and then fell in the Asian market. The current price is near yesterday's low point, with a quotation of around 1949.73. Crude oil continued to decline yesterday due to the impact of fundamentals and EIA data from oil producing countries, with US crude oil falling below $75 to around 74.9. Today, there was a slight fluctuation in the Asian market, with the current quotation around 75.5. Brent crude oil fell below $80, reaching a low of around 79.2, with the current quotation of 79.71. Due to high interest rates and sustained external shocks, people's predictions of the European economic outlook are relatively pessimistic.

On Wednesday, former ECB President Draghi directly highlighted this concern. Draghi stated that the European economy is likely to experience a recession by the end of 2023, and it is almost certain that data from the first two quarters of next year will prove this. After receiving support from below yesterday, EURUSD prices rose rapidly, with a slight fluctuation in the Asian market today, with the current quotation around 1.0703. Earlier today, Bank of Japan Governor Kazuo Ueda stated that the sequence of normalization processes for yield curve control and negative interest rate policies has not been determined. The Bank of Japan will maintain loose policies until the inflation target is achieved, and once interest rates rise, the valuation losses on holding bonds will increase. For the central bank, the temporary deterioration of the financial environment will not harm its ability to implement monetary policy. The central bank can improve its financial situation by issuing paper currency and utilizing the so-called seigniorage. USDJPY continued to rise yesterday and closed near its intraday high. In the Asian market today, USDJPY broke through its previous high and is currently quoted at 151.01.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 9, Beijing time.

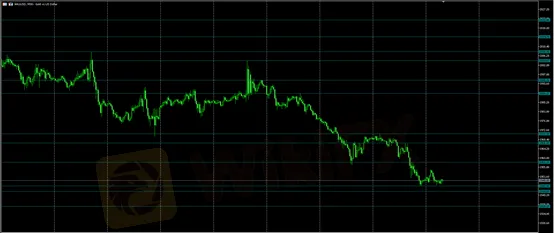

Gold XAUUSD· | |

Resistance | 1958.11 – 1966.80 – 1970.98 |

Support | 1947.41 – 1977.89 – 1938.17 |

The above figure shows the 30 minute chart of gold. The chart shows that the recent upward resistance of gold has been around 1958.11 – 1966.80 – 1970.98, and the downward support has been around 1947.41 – 1977.89 – 1938.17. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time. | |

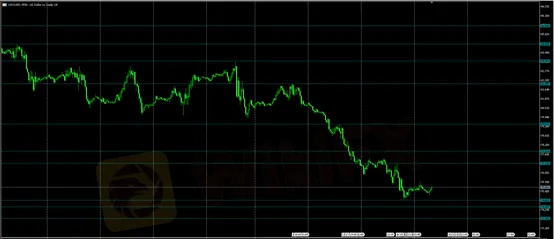

Crude Oil USOUSD· | |

Resistance | 77.13 – 77.89 – 79.51 |

Support | 74.86 – 74.47 – 73.76 |

The above chart shows the 30 minute chart of US crude oil. The chart shows that the recent upward resistance of US crude oil is around 77.13 – 77.89 – 79.51, and the downward support is around 74.86 – 74.47 – 73.76. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time. | |

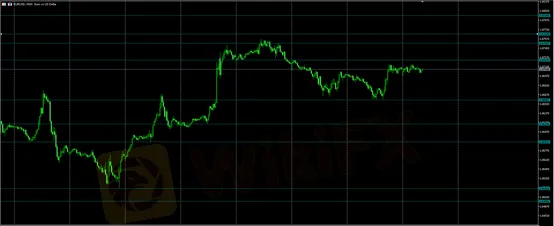

EURUSD· | |

Resistance | 1.0723 - 1.0749 - 1.0764 |

Support | 1.0658 - 1.0619 - 1.0591 |

The above figure shows the 30 minute chart of EURUSD. The chart shows that the recent upward resistance of EURUSD is around 1.0723 - 1.0749 - 1.0764, and the downward support is around 1.0658 - 1.0619 - 1.0591. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time. | |

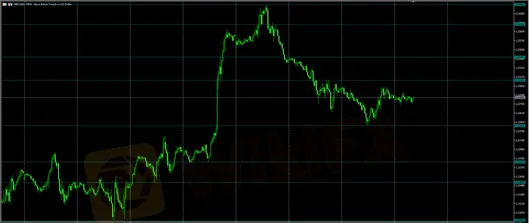

GBPUSD· | |

Resistance | 1.2302 – 1.2347 – 1.2398 |

Support | 1.2241 - 1.2185 – 1.2154 |

The above figure shows the 30 minute chart of GBPUSD. The chart shows that the recent upward resistance of GBPUSD is around 1.2302 – 1.2347 – 1.2398, and the downward support is around 1.2241 - 1.2185 – 1.2154. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time. | |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc