MHMarkets:Yellen: Market expectations can be a policy complement to the Fed.

Abstract:At the end of the Asian market on Thursday (December 7), US Treasury Secretary Janet Yellen stated on Wednesday that the bond market's expectations for the Fed's rate hikes or cuts may be a "beneficial supplement" to monetary policy, provided that participants are careful when interpreting the upcoming data.

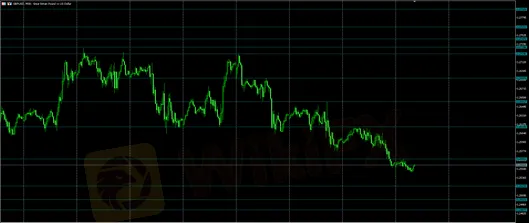

69.87.EURUSD continued to decline yesterday and broke below the support below, ultimately closing near the intraday low. At the opening of the Asian market today, EURUSD fell below yesterday's low and is currently priced around 1.0764. Earlier today, Bank of Japan Governor Kazuo Ueda stated in parliament that the inflation data is far higher than the Bank of Japan's 2% target, but the inflation trend has not yet been anchored above that level. Therefore, the central bank needs to continue to maintain monetary easing policies, and it is still too early to conduct exit simulations. The Bank of Japan plans to provide information before exiting to achieve a smooth transition. USDJPY accelerated its downward trend at the opening today and continuously broke through multiple supports below, with a current price around 146.35.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on December 7, Beijing time.

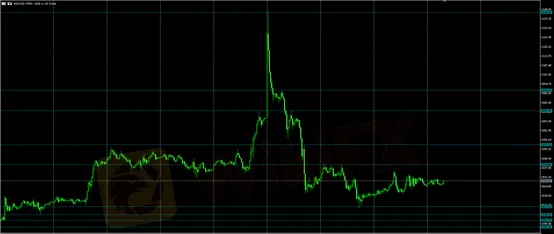

Gold XAUUSD· | |

Resistance | 2039.66 – 2053.33 – 2076.42 |

Support | 2011.15 – 2005.55 – 2001.79 |

The above figure shows the 30 minute chart of gold. The chart shows that the recent upward resistance of gold has been around 2039.66-2053.33-2076.42, and the downward support has been around 2011.15-2005.55-2001.79. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 7. This policy is a daytime policy. Please pay attention to the policy release time. | |

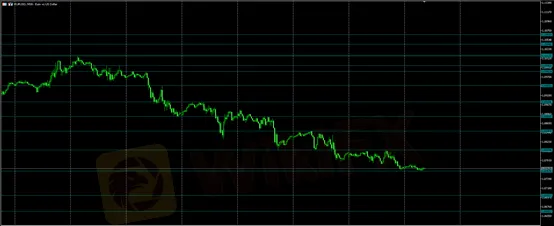

Crude Oil USOUSD· | |

Resistance | 72.73 – 74.24 – 74.81 |

Support | 69.29 – 69 – 67.11 |

The above chart shows the 30 minute chart of US crude oil. The chart shows that the recent upward resistance of US crude oil is around 72.73-74.24-74.81, and the downward support is around 69.29-69-67.11. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 7. This policy is a daytime policy. Please pay attention to the policy release time. | |

EURUSD· | |

Resistance | 1.0804 - 1.0847 - 1.0880 |

Support | 1.0757 - 1.0701 - 1.0665 |

The above figure shows the 30 minute chart of EURUSD. The chart shows that the recent upward resistance of EURUSD is around 1.0804-1.0847-1.0880, and the downward support is around 1.0757-1.0701-1.0665. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 7. This policy is a daytime policy. Please pay attention to the policy release time. | |

GBPUSD· | |

Resistance | 1.2565 – 1.2613 – 1.2651 |

Support | 1.2523 - 1.2503 – 1.2487 |

| |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

PayPal reports slow growth in key margin figure even as earnings top estimates

5 Best Forex Brokers in Singapore for 2025

Trump's tariffs could soon bring higher food prices for some Americans, analysis finds

iFourX: So Many Red Flags You Can’t Ignore

Tom Lee's Granny Shots ETF rakes in $2 billion in AUM just 9 months after inception

Starbucks same-store sales fall again, but CEO Niccol says turnaround is ahead of schedule

Singapore holds monetary policy, flags slowdown in second half of the year

Top Forex Chart Patterns Every Trader Must Know

Adidas to raise prices as US tariffs cost €200m

Top 4 Forex Scam Tactics Fake Brokers Use to Trap Investors

Rate Calc