Investec

Abstract:Investec was created in 1995 and is headquartered in South Africa. It provides banking, investing, and insurance services to both individual and institutional clients. It has been designated as unverified by South Africa's FSCA for misusing a genuine licence (No. 11750) issued to Investec Bank Limited that it is not authorised to use.

| Investec Review Summary | |

| Founded | 1995 |

| Registered Country/Region | South Africa |

| Regulation | FSCA (Unverified) |

| Services | Banking, Investments, Insurance, Risk Management |

| Trading Platform | / |

| Minimum Deposit | R100,000 |

| Customer Support | Phone: +27 (11) 286 7000 |

Investec Information

Investec was created in 1995 and is headquartered in South Africa. It provides banking, investing, and insurance services to both individual and institutional clients. It has been designated as unverified by South Africa's FSCA for misusing a genuine licence (No. 11750) issued to Investec Bank Limited that it is not authorised to use.

Pros and Cons

| Pros | Cons |

| Long history and well-known financial brand | Unverified FSCA license |

| Wide range of savings and investment products | Unclear fee structure |

| No deposit or monthly fees on many accounts | High minimum deposit requirement (R100,000) for savings account |

Is Investec Legit?

No, Investec is unregulated. The claimed Financial Sector Conduct Authority (FSCA) license is unverified. Please be aware of the risk!

| Regulatory Authority | Financial Sector Conduct Authority (FSCA) |

| Current Status | Unverified |

| Regulated by | South Africa |

| Licensed Institution | Investec Bank Limited |

| Licensed Type | Retail Forex License |

| Licensed Number | 11750 |

Services

Investec provides a comprehensive range of financial services to a diverse client base, including individuals, businesses, corporations, institutions, and intermediaries. The services include banking, investing, insurance, and risk management solutions.

| Category | Key Services |

| Individuals | Private banking, Savings accounts, Personal finance, Wealth management, Investments, Life insurance |

| Business | Business banking, Business financing, Cash investments, Forex & risk management, Import/logistics |

| Corporates | Advisory, Equity Capital Markets, Debt financing |

| Institutions | Commodities, Bonds, Derivatives, Rates/Credit structuring, Currencies, Equities, Multi-asset solutions |

| Intermediaries | Cash management, Investment management, Foreign exchange, Life insurance, Charities & trusts |

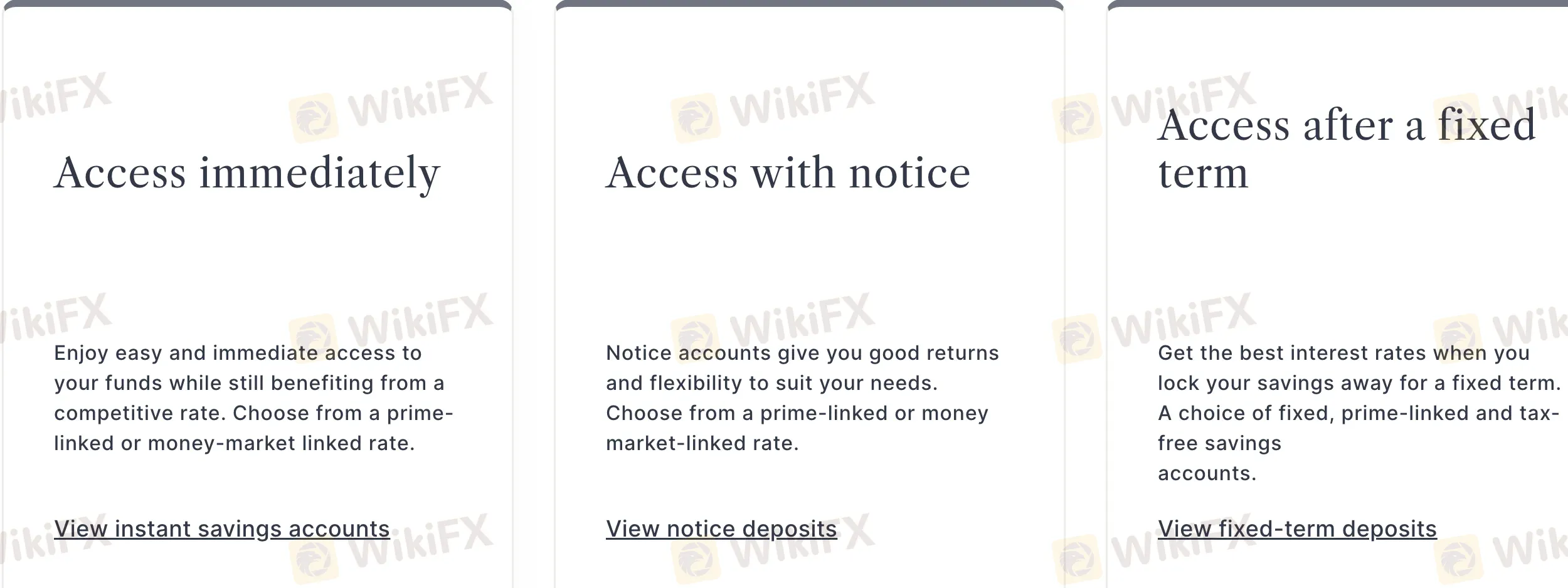

Account Type

Investec provides individual savings solutions based on access preferences and includes an online selection tool.

| Account Type | Access Type | Interest Rate Type | Minimum Deposit |

| Instant Savings | Immediate | Prime-linked / Money market | R100,000 |

| Notice Deposits | With notice (e.g. 32 days) | ||

| Fixed-Term Deposits | After fixed term | Fixed / Prime-linked / Tax-free |

Read more

Binarycent’s Traders are Hopeless and Hapless as Withdrawal Denials, Login Issues & More

Being made to do a lot of back and forth for withdrawal access endlessly at Binarycent without any success? Receiving unsatisfactory replies from the forex broker officials on withdrawals? Is the bonus unremovable from your forex trade? Have you witnessed capital losses due to manipulative trades by the broker? All these clearly indicate scams at Binarycent, a Marshall Islands-based forex broker. Many have accused the broker of serious fraud allegations online. In this article, we have put their comments. Read on to find out.

IG Group Acquires Independent Reserve for £86.8M

IG Group buys Australian crypto exchange Independent Reserve for A$178M, expanding digital asset trading into Asia Pacific markets with regulatory approval pending.

VT Markets Extends Newcastle United Partnership Into Second Year

VT Markets celebrates second year of Newcastle United partnership with new brand film "Together, Into Tomorrow," highlighting shared values in trading and football success.

IQ Option Scam Alert: Withdrawal Issues and Fraud

IQ Option faces fraud allegations for blocking withdrawals, manipulating prices, and operating with weak regulatory oversight despite CySEC licensing claims.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interviews:Stanislav Bublik Building Market Integrity and Product Innovation

Germany's Machinery Industry Faces Catastrophic Collapse

IQ Option Scam Alert: Withdrawal Issues and Fraud

How a Facebook Investment Scam Cost a Retiree RM76,740

IG Group Acquires Independent Reserve for £86.8M

JP Markets Review: Is This FX Broker Really Worth Investing? Know the Truth!

Defcofx Review – Is This Platform Right for Investing in Forex?

Binarycent’s Traders are Hopeless and Hapless as Withdrawal Denials, Login Issues & More

GST: Modi\s tax cuts will give India a festive spending boost

Invitation to WikiEXPO 2025 Cyprus, One of the World’s Largest Fintech Expos

Rate Calc