MEXn

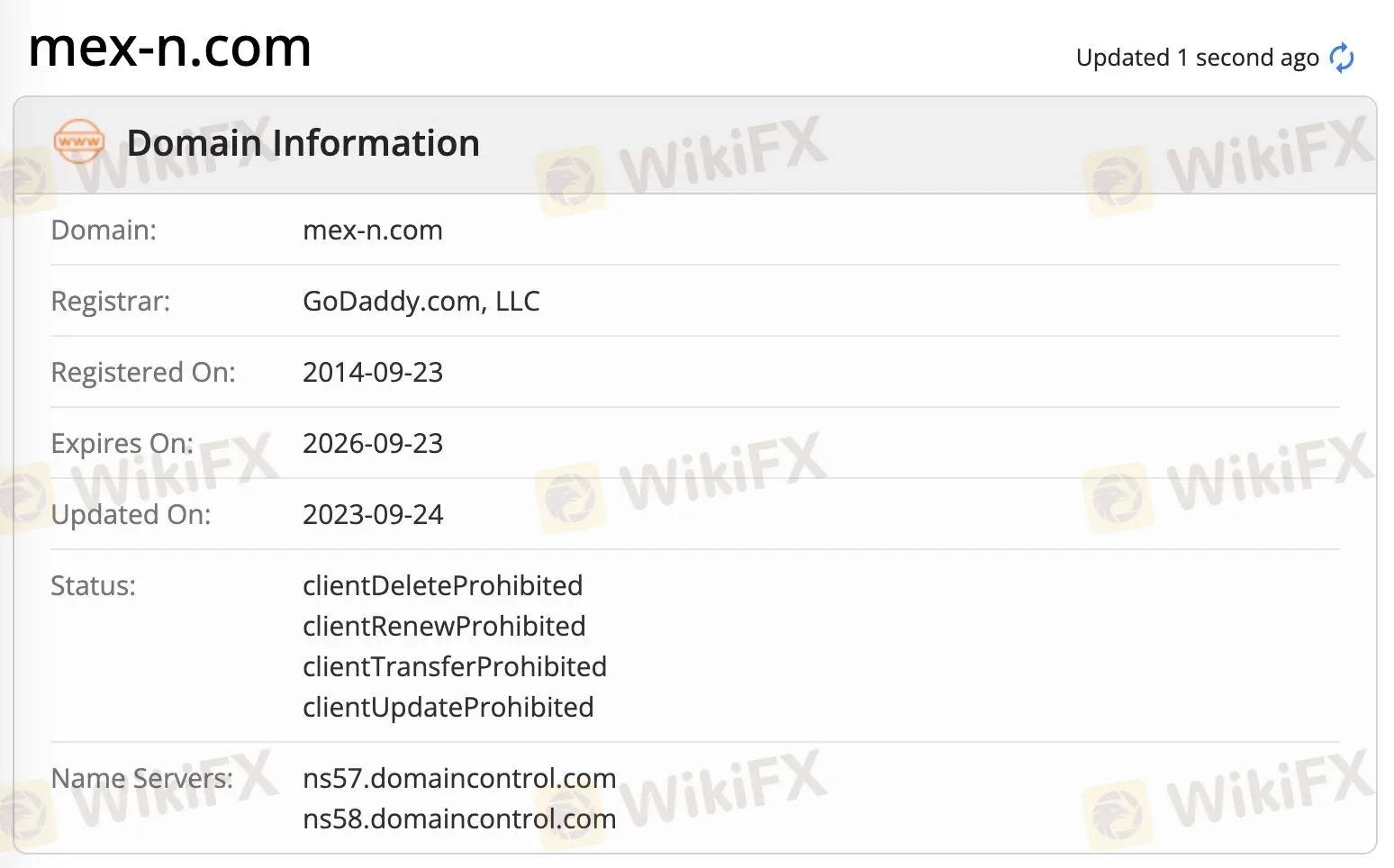

Abstract:Founded in 2014, MEXn is an unregulated broker registered in Hong Kong, offering products and services on AI financial robots, self-study guides, revenue sharing from transaction fees, IB and White Label consulting, mobile trading platform, and professional AI robots for asset management.

Note: MEXn's official website - https://www.mex-n.com/ is currently inaccessible normally.

| MEXn Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Hong Kong |

| Regulation | No regulation |

| Products & Services | AI financial robots, self-study guides, revenue sharing from transaction fees, IB and White Label consulting, mobile trading platform, professional AI robots for asset management |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 1.8 pips |

| Trading Platform | MT4 |

| Min Deposit | $100 |

| Customer Support | Tel: +852 6653 2060 |

| Email: support@mex-n.com | |

| Address: RM 1506, 15/F GOLDEN GATE COMM BLDG, 136-138 AUSTIN RD, TST, KLN HONG KONG | |

MEXn Information

Founded in 2014, MEXn is an unregulated broker registered in Hong Kong, offering products and services on AI financial robots, self-study guides, revenue sharing from transaction fees, IB and White Label consulting, mobile trading platform, and professional AI robots for asset management.

Pros and Cons

| Pros | Cons |

| Demo accounts | Inaccessible website |

| Various products and services | No regulation |

| MT4 platform | Unknown payment options |

Is MEXn Legit?

No. MEXn currently has no valid regulations. Please be aware of the risk!

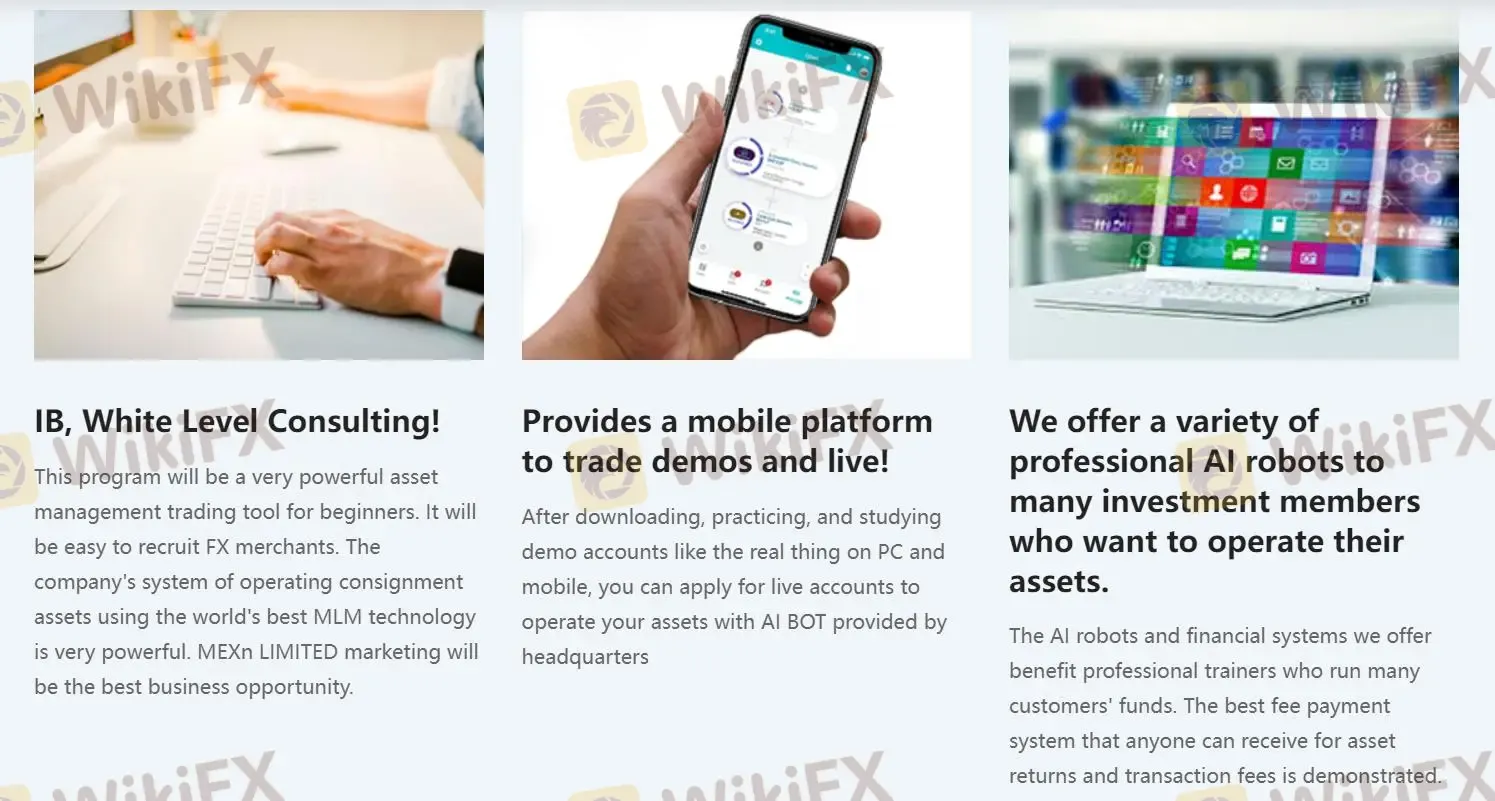

Products and Services

MEXn provides AI financial robots, self-study guides for quick learning, revenue sharing from transaction fees, IB and White Label consulting, a mobile trading platform, and professional AI robots for asset management.

Account Type

| Account Type | Min Deposit |

| Standard | $100 |

| Business |

Leverage

MEXn offers maximum leverage of 1:400. It's important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses.

Spread

MEXn offers spread from 1.8 pips.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC | Beginners |

| MT5 | ❌ | / | Experienced traders |

Read more

Interactive Brokers Review 2025: Pros and Cons Revealed

Interactive Brokers is a well-established stock broker compared to many of its peers like Wellbull and offering a large selection of tradable securities, and it offers $0 per share on stock and ETFs (for U.S residents only) with its IBKR Lite plan. Besides, it also offers the most advanced platforms to foster superb trading experience. In this way, Interactive Brokers features the largest clientele compared to its competitors, like Robinhood, Fidelity and Charles Schwab, over 2.6 million institutional and individual brokerage customers.

Webull Review 2025: Pros and Cons Revealed

Webull was founded in 2017, quite newer to the brokerage industry than traditional players like Charles Schwab, Fidelity, Interactive Brokers and Robinhood. However, it stands tall when it comes to products offerings: Stocks, Options, cryptos, Index Options, Futures, ETFs, OTC, Margin, Fractional Shares. Webull applies no commission on stock, options and ETFs trading listed on U.S. Exchanges.

VPFX Secures UAE SCA License, Expands FX and CFDs Services

VPFX obtains UAE SCA Category Five license, enabling FX and CFDs promotion. Learn about its expansion and broker services at vpfx.net.

WikiFX Review: Can you give credit to a broker named HERO?

In today’s article, WikiFX made a comprehension review about HERO to help you better understand this broker. We will analyze the reliability of this broker from specific information, regulation, exposure, etc. Let’s get into it.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

Rate Calc