WikiFX Broker Assessment Series | Is GVD Markets Reliable?

Abstract:Recently GVD Markets has become a trending topic in forex markets. WikiFX made a comprehension review to help you better understand this broker. we will analyze the reliability of this broker from specific information, regulations, etc. Let’s get into it.

Recently GVD Markets has become a trending topic in forex markets. WikiFX made a comprehension review to help you better understand this broker. we will analyze the reliability of this broker from specific information, regulations, etc. Lets get into it.

To understand GVD Markets better, we explore GVD Markets by analyzing the main perspectives:

A. General Info of GVD Markets

B. Regulatory Status

A. General Info of GVD Markets

GVD Markets s general info has been shown below:

About GVD Markets:

Market Instruments

GVD Markets offers a variety of market instruments, including Forex, Indices, Metals, and Energies.

Account Types

GVD Markets offers three kinds of accounts. They are the STD account, STP account, and ECN account. The minimum deposit for investing in an STD account and an STP account is $500. If you want to invest in its ECN account, you need to deposit at least $2000.

Trading Platform

GVD Markets uses Meta Trader 5 (MT5) as its main trading platform. MT5 is one of the most widely used platforms in the industry.

Deposits/Withdrawals

GVD Markets constantly strives to provide traders with fast and secure ways to fund their accounts and make withdrawals. This broker accepts USD and EUR, and there are no deposit fees. Besides, this broker claimed that it does not charge any commissions.

Funds Protection

“GVD Markets are members of the investors' compensation fund.”

Customer Support

Our Customer Support officers are here to help you through the funding or withdrawal process. Contact them at support@gvdmarkets.eu.

B. Regulatory Status

The legitimate license of GVD Markets

GVD Markets is a regulated broker. It is regulated by the Cyprus Securities and Exchange Commission with license number 411/22. It also holds the Seychelles Financial Services Authority with a license number SD061.

Conclusion

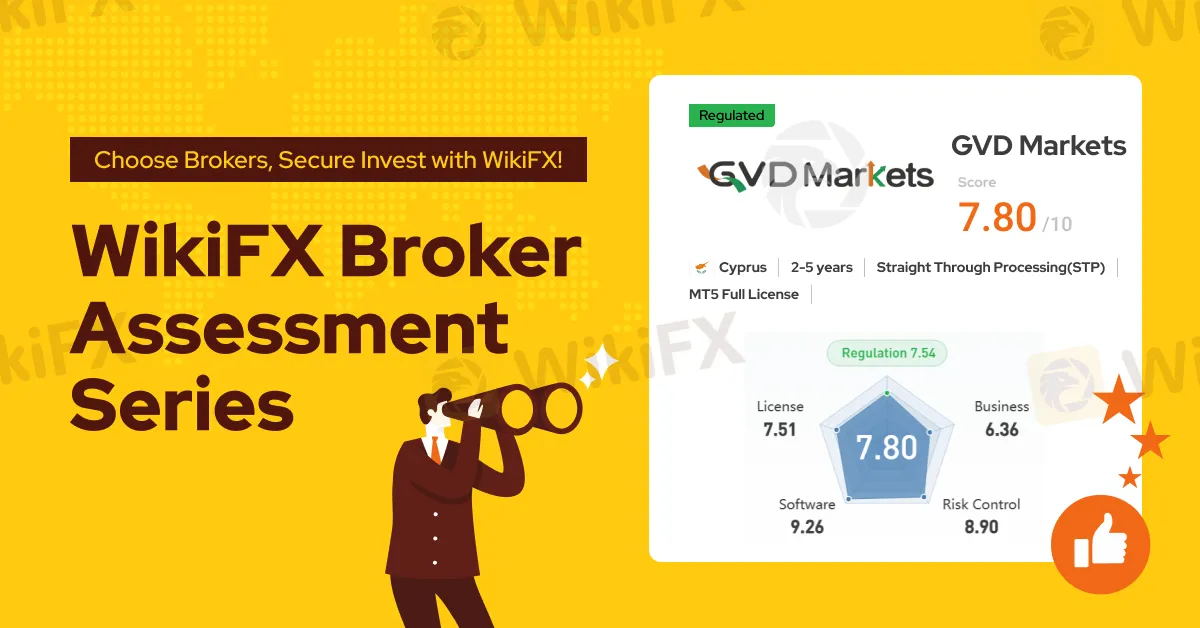

WikiFX has given this broker a decent score of 7.80/10, which shows that this broker is relatively reliable. Investing in a regulated broker is always a wise choice and your assets have been protected to some extent. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX App to find the most trusted broker for yourself.

Read more

Interactive Brokers Review 2024: Is Is This AAA-Rated Broker Safe?

Interactive Brokers (also known as 盈透证券) is a prominent brokerage with significant global influence, holding an AAA Influence Rank and a WikiFX score of 8.29. Established in 2002 and headquartered in Hong Kong, the broker serves clients across major markets including Australia, the US, China, and the UK.

Capital.com Review: Is This Broker Safe or a Scam?

Capital.com is a well-known brokerage established in 2017 with a significant global presence. Headquartered in the Bahamas, the broker has expanded its influence across regions such as the UAE, Australia, and parts of Europe, achieving an "AA" Influence Rank. On the surface, Capital.com presents a robust regulatory framework and a high WikiFX Score of 7.84.

SDstar FX Exposed: Withdrawal Delays and Questionable Deposit Demands

Have you been witnessing long fund withdrawal delays by SDstar FX, a Comoros-based forex broker? Does the broker disallow you from withdrawing either principal or profit? Are you made to deposit every time you demand a withdrawal? Does the SDstar FX customer support team fail to address your queries? This has reportedly become the case of many traders here. In this SDstar FX review article, we have highlighted these complaints. Read on!

Is WisunoFX Trustworthy? A Complete 2025 Review for Traders

Picking a reliable forex broker is the most important decision any trader will make. It's like choosing the foundation for your house - everything else depends on it. With so many brokers out there, WisunoFX often catches traders' attention, making them wonder: "Is WisunoFX trustworthy?" and "Is WisunoFX reliable?" To answer these questions properly, you need more than just a quick look at its website - you need a complete, fact-based review. This detailed 2025 review will provide you with the clarity you need. We'll take an honest look at WisunoFX by examining the key factors that make a broker reliable. We'll verify its licenses and regulations, examine its actual trading conditions, compare its various account types, assess its platform performance, and review what other traders are saying. Our goal is to give you all the information you need to make a smart decision.

WikiFX Broker

Latest News

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

EZINVEST Exposure: When a "Personal Advisor" Becomes Your Portfolio’s Worst Enemy

Deriv Review: Is This Popular Broker Legit or Risky?

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

A Collapse In Germany's Chemical Sector Is A Bad Omen

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

Why Smart People Still Get Scammed | The Danger of Hope and Greed

Inside the Elite Committee: Talk with Ayu Nur Permana

LQH Markets Broker and Regulation Review

Rate Calc