WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2016, Lirunex Limited (Lirunex) operates as an online brokerage specializing in the trading of exchange-traded CFDs, distinguishing itself through a commitment to competitive spreads.

Lirunex offers a diverse range of tradable assets, including currency pairs, share CFDs, cryptocurrency CFDs, energies, commodities, metals, and global indices.

Additionally, the company provides social trading services designed to help money managers and traders enhance efficiency, boost profitability, and generate passive income through copy trading, PAMM, MAM, and portfolio management.

Furthermore, Lirunex features an Introducing Broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the platform.

It is important to note that, at present, Lirunex does not extend its services to the United States, North Korea, Congo, Libya, Afghanistan, Cuba, Maldives, Mali, Syria, Sudan, South Sudan, Yemen, Somalia, Belarus and Venezuela.

Types of Accounts:

Lirunex offers four account options: the LX-Standard Account, LX-Prime Account, LX-Pro Account, and LX-Cent Account. Please refer to the attached image below for detailed information on each account.

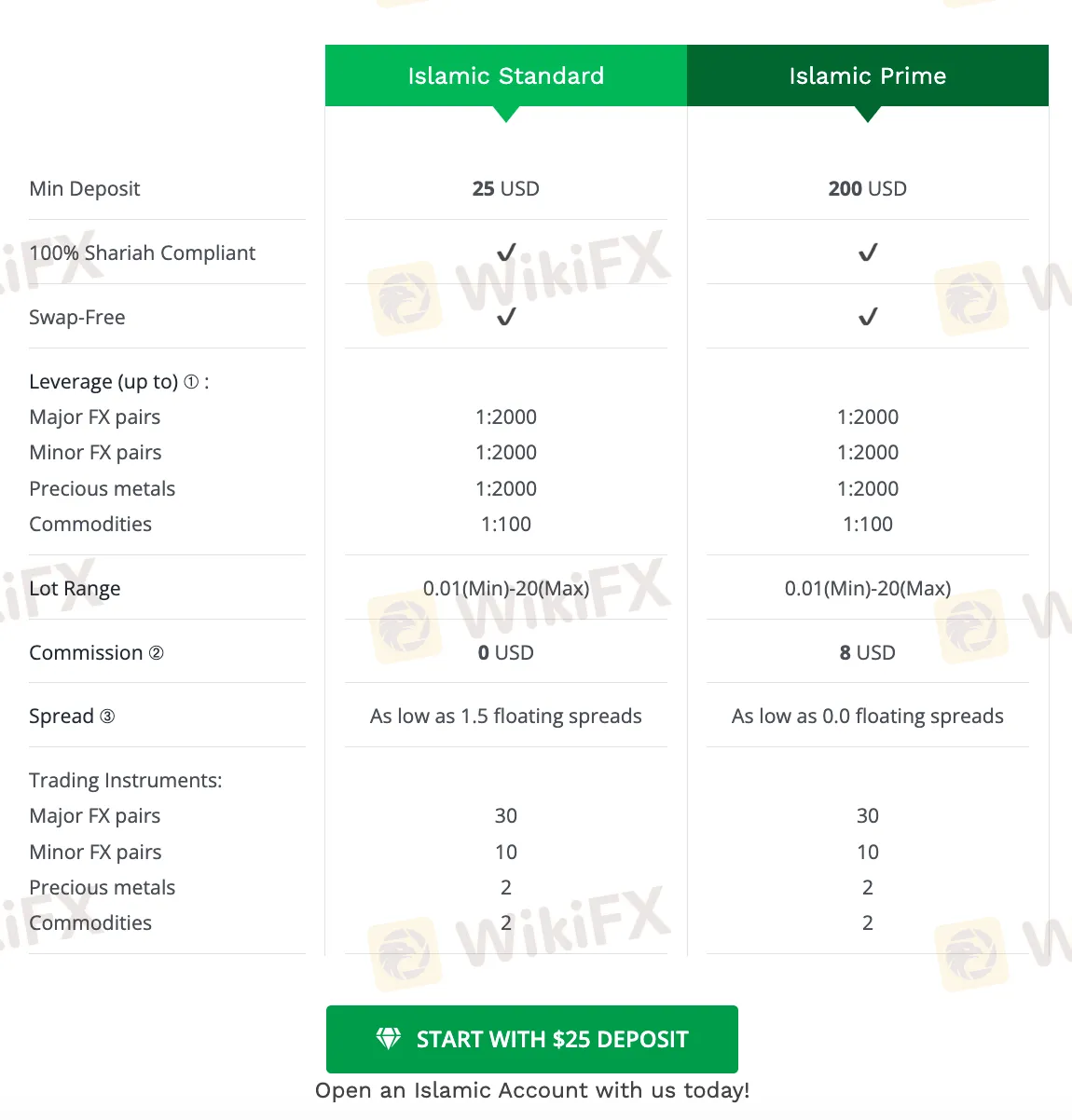

Additionally, there are two types of Islamic swap-free accounts available for Muslim clients, as illustrated in the image below.

Deposits and Withdrawals:

Lirunex offers a variety of payment options, including bank transfers, credit cards (Visa and Mastercard), AliPay, Perfect Money, cryptocurrencies, and other methods. While Lirunex states that it does not impose any commissions or fees for deposits and withdrawals, it is important to note that any charges applied by third-party providers are the responsibility of the trading client.

The company is committed to processing all requests within 24 hours from Monday to Friday, 9:00 AM to 3:00 PM (GMT+8). Transactions initiated during the weekend will be processed on the next working day.

The time required for funds to reflect in the account depends on the chosen withdrawal method. Detailed specifications for each deposit and withdrawal method can be found in the images below:

Trading Platforms:

Lirunex provides three trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macro-economic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

- The Lirunex Trading Application is a mobile platform designed to facilitate trading activities. It includes features such as forex signal copying, a real-time economic calendar, and a range of trading tools. The app provides access to global trading opportunities and enables users to monitor their trading performance.

Research and Education:

Lirunex offers free educational resources to support traders on its Lirunex Forex Education page.

Customer Service:

Lirunex provides customer service support in multiple languages, including Chinese, Vietnamese, and Bahasa Indonesia. Clients can reach out Lirunex through email at support@lirunex.com or by submitting an inquiry via the broker's question form.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Lirunex a WikiScore of 8.12 out of 10.

Upon examining Lirunex‘s licenses, WikiFX found that the broker is regulated by France’s Autorité des Marchés Financiers, Cyprus‘ Securities and Exchange Commission, Malaysia’s Labuan Financial Services Authority, and Spains Comisión Nacional del Mercado de Valores.

WikiFX has also verified the legitimacy of these licenses.

Read more

Top 6 Shocking Truths Behind Pocket Option – Avoid this Trap

Before You Invest, Read This Important Article About Pocket Option. Protect Your Money from Scam! This article exposes 6 hidden truths about the broker that you need to know before making any investment.

Investors Call Growline a FRAUD Broker - Check Out Their Comments

Dreamt of massive returns on your forex investments through Growline but didn’t receive profit withdrawals? You are not alone! In this article, you will get to know about the problems faced by its investors. Read out their comments and share your reviews on our platform. We will highlight your issue.

The Easiest Way to Learn Forex Trading for Complete Beginners

Unlock the secrets of forex trading as a complete beginner. Explore essential tools, proven strategies, major mistakes to avoid, and more in this comprehensive guide.

Exposing Profit Trade: Profit Only Exists in Its Name, Not During Trade

If there was ever a forex scammer to be alert of, Profit Trade emerges as the first one. The Bulgaria-based forex broker has been annoying investors by denying their withdrawal requests, suspending their account without any reason, and unfulfilled promises.

WikiFX Broker

Latest News

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Sharing Trading Mistakes and Growth

Trading Market Profile: A Clear and Practical Guide

Eyeing Significant Returns from Forex Investments? Be Updated with These Charts

CNBC Daily Open: The silver lining of positive earnings could be too blinding

CNBC Daily Open: Solid earnings beats might mask tariff volatility these two weeks

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

Jeep-maker Stellantis expects first-half net loss of $2.7 billion as tariffs bite

Rate Calc