Can cryptocurrencies be regarded as mortgage collateral?

Abstract:The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The move marks a potential turning point for crypto adoption in the U.S. housing market and reflects the federal governments evolving stance on digital assets.

A Boost for Crypto-Holding Borrowers

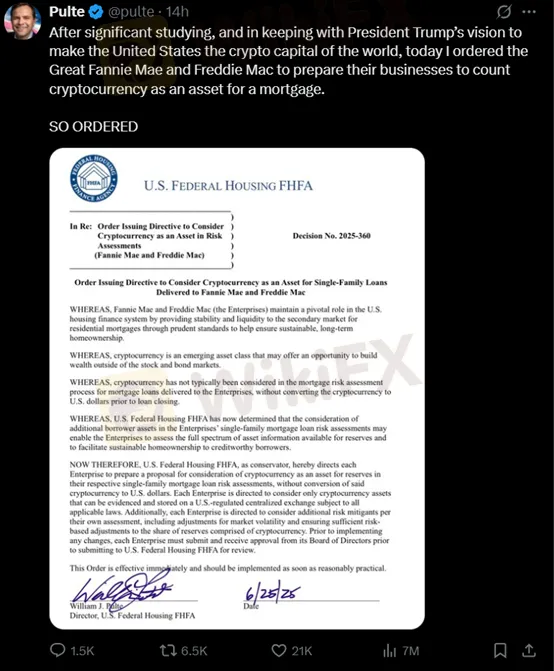

The directive, announced Wednesday by FHFA Director William Pulte via social media, signals an effort to make mortgage financing more accessible for homebuyers who hold digital assets.

“After extensive research and in line with President Trump‘s vision to make America the ’crypto capital of the world, I have directed Fannie Mae and Freddie Mac to prepare for the inclusion of cryptocurrency holdings as recognized assets in mortgage applications,” Pulte posted.

While some smaller lenders in the U.S. have previously accepted crypto as collateral, this is the first time a federal housing authority has formally acknowledged digital assets in mortgage underwriting standards.

The FHFA's move comes at a time when mortgage application volumes remain sluggish, weighed down by high interest rates and affordability challenges. By expanding the definition of eligible assets, the agency is not only increasing accessibility but also potentially stimulating loan activity in a stagnating housing market.

Analysts note that this change could unlock lending opportunities for a growing segment of digitally native borrowers who may not hold significant traditional assets but possess meaningful crypto wealth.

Unanswered Questions Remain

However, the directive stopped short of specifying which cryptocurrencies will be eligible for consideration. This lack of clarity raises questions around volatility, valuation methods, and regulatory consistency, particularly as crypto markets remain highly fluid and decentralized.

Industry experts stress the importance of clear guidelines to prevent abuse and ensure that lenders can accurately assess risk.

“This is a bold step, but the details will matter. Without standardized rules on acceptable coins, pricing models, and custody requirements, implementation will be complex,” said a senior analyst at a Washington-based financial policy think tank.

Aligning with the Trump Administration's Crypto Agenda

The FHFA‘s move aligns closely with the Trump administration’s broader agenda to promote cryptocurrency adoption across financial sectors. Since returning to the political spotlight, former President Trump has repeatedly voiced support for blockchain innovation and digital finance infrastructure in the U.S.

The decision also hints at a larger regulatory shift, where federal agencies may begin integrating crypto considerations into other forms of financial oversight and risk modeling.

Conclusion

By instructing Fannie Mae and Freddie Mac to prepare for crypto asset integration, the FHFA is signaling a historic shift in U.S. housing finance policy. While challenges around implementation, regulation, and market volatility remain, the move opens new doors for crypto-savvy homebuyers and brings the U.S. one step closer to mainstreaming digital assets.

As the details unfold, all eyes will be on how the mortgage industry responds — and whether the FHFAs bold step will usher in a new era of crypto-backed home ownership.

Read more

Harsh Truths About ATC Brokers Every Trader Must Know

Many regulated brokers hide the risks associated with them. They never talk about these risks and try to attract customers with appealing offers. Later on, customers discover these hidden risks and feel disappointed. Before you come across a similar situation, we want to let you know the risks involved with ATC Broker. Check out the article to discover the harsh truth about it.

8 Golden Rules to Rule in the Forex market

These are important rules that most people won’t tell you. Whether you’re new to Forex beginner or have been trading for a while, these tips can help improve your trading journey. Read this article to learn the key rules every trader should keep in mind.

Top Reasons Why Prime FX CFD is Not Worth Your Investment

Prime FX CFD is constantly grabbing headlines, but not for the right reasons. It has become an infamous name in the forex market, which, otherwise, has become the reason for many becoming financially independent globally. Investors have been taken for granted as scams keep happening. We have found some red flags with this scam forex broker. In this article, we will let you know about them. Keep reading!

5 Clear Reasons Why Ultima Markets Is Smart Investment?

The Right Investment is hard to find these days. The Forex market is full of scam brokers, and it's a tough task to find the trusted ones. However, you can check out this article to discover 5 specific reasons why Ultima Markets stands out as a reliable choice.

WikiFX Broker

Latest News

PrimeXBT Launches MT5 PRO Account for Active Traders

eToro Expands into Singapore with MAS CMS Licence

Renault shares plunge 16% after French carmaker lowers guidance, appoints new interim CEO

Darwinex Launches INDX: A Revolutionary Investment Strategy for Traders

Top Forex Trading Scams to Watch Out for in 2025

Real Risk Factors with Admiral Markets ! Explained

5 Reasons to Know Why INFINOX Is a Standout Broker?

5 things to know before the stock market opens Wednesday

Trump's big beautiful bill' caps student loans. Here's what it means for borrowers

Weekly mortgage demand plummets 10%, as rates and economic concerns rise

Rate Calc