Top 5 Unnoticed Risks of Fusion Trade You Shouldn't Ignore

Abstract:Fusion Trade is a broker based in the Netherlands that you should avoid. If you're not careful, you could lose your money in a scam run by this fake broker. This article will expose the scam of the broker and make you Fraud Alert. Read this article and stay away from Fusion Trade .

Fusion Trade is a broker based in the Netherlands that you should avoid. If you're not careful, you could lose your money in a scam run by this fake broker. This article will expose the scam of the broker and make you Fraud Alert. Read this article and stay away from Fusion Trade .

1. Non Functional Website - One of the first red flags is when you search for the broker's website and it doesn‘t open or even appear properly in search results. A non-functional website is a major warning sign. A legitimate broker will always have a fully operational, professional-looking website that is accessible and regularly updated. If the website is broken, offline, or missing key pages, it raises serious concerns about the company’s legitimacy.

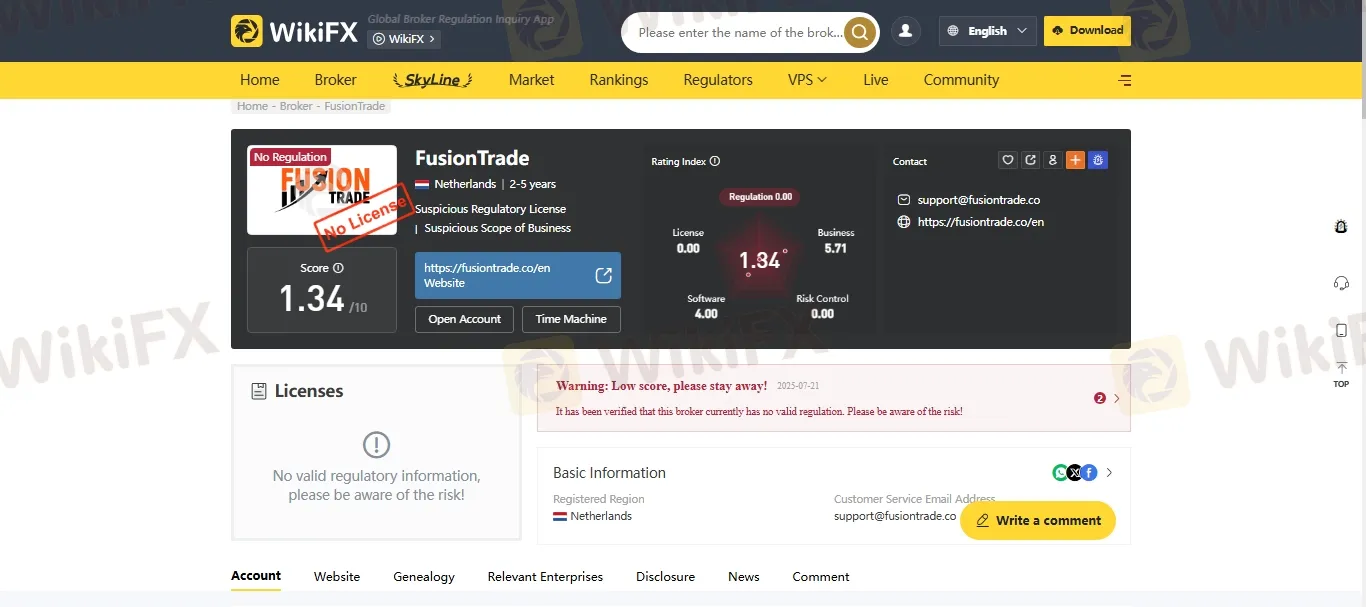

2. Lack of Regulation – When you choose a broker for forex trading, regulation is the top criteria to consider. This broker is not regulated, which is a major red flag you should not ignore which means there is no legal oversight of its operations. This significantly increases your risk of falling victim to fraud, unfair trading practices, or even losing your funds entirely.

3. Extremely Low Score- A brokers score is important when picking a trading platform. A high score builds trust and makes clients feel confident to invest. But a low score causes doubt and makes people less likely to trust the broker. Primarkets has a low score of 1.34 out of 10 on WikiFX.

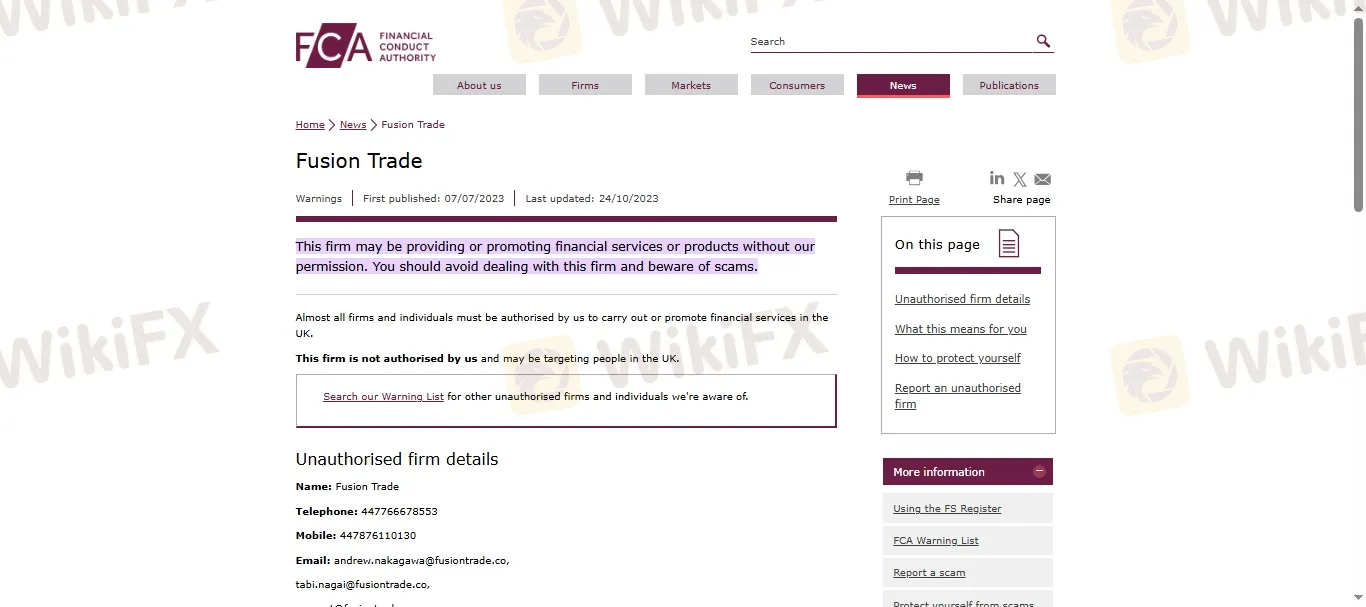

4. FCA Warning –In 2023, The well-known financial regulator FCA (Financial Conduct Authority) recently issued a public warning against Fusion Trade, stating that the firm is unregulated and operating without a proper license.

5. French Regulator Warning – In 2023, The French financial market regulator, the Autorité des Marchés Financiers (AMF), has issued warnings against Fusion Trade, indicating they are operating without authorization to offer financial products or services in France.

How to Protect your Money?

1. Choose a Regulated Broker

2. Avoid Unrealistic Promises

3. Educate Yourself Continuously

4. Secure Your Trading Accounts

5. Never Risk More Than You Can Afford to Lose

Join WikiFX Community & Get the Latest Updates

Investment scams have become a reality in the Forex market. While trading forex, you can avoid these scams by staying informed and alert. Therefore, be attentive and stay updated with fraud alerts. With WikiFX, you can get all the information you need about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR Code at the bottom.

Steps to Join?

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

ZFX User Reputation: Is ZFX Safe or a Scam? A Complete Review

When traders research a broker, they always ask the same important question: Will my capital be safe? When looking into ZFX, this question becomes complicated because there are serious scam accusations floating around. This review aims to give you a clear, fact-based answer. Read on!

Is ZFX Safe? A Trader's Guide to ZFX Regulation and License Verification

When checking if a broker is safe, the first and most important step is to look at its regulatory credentials. For traders researching ZFX in 2026, the answer is not simply yes or no. ZFX, a brand under the Zeal Group, which commenced its operations in 2017, works through a complex, dual-license structure. This means the broker is controlled by two separate legal entities under two very different regulators: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. This dual framework has major effects on a trader's security, available leverage, and overall account terms. Understanding the entity you are dealing with is extremely important for accurately assessing your risk. This guide will break down this structure, providing the clarity needed to make an informed decision.

OneRoyal Regulation: A Simple Guide

OneRoyal has been around since 2006 and has a complicated setup when it comes to regulation. They have licenses from different places around the world - Europe, Australia, and the Caribbean. This setup can give them global reach and different trading options, but it also means you need to look closely at what protection you actually get. This article will break down OneRoyal Regulation step by step. We will look at its top licenses like CySEC and ASIC, check out its offshore companies, and explain what this complex setup really means for your capital's safety. Our goal is to give you clear, honest information so that you can make a smart choice.

OneRoyal Trust Score: A Complete Look at Whether It's Real or Fake

When traders ask, "Is OneRoyal legit or a scam?" The answer isn't simply yes or no. OneRoyal is a trading company that has been running for almost twenty years and has important licenses from top financial authorities. This background puts it far away from typical quick scam operations. However, questions about whether it's trustworthy are reasonable and often come from its complicated business structure, the use of overseas companies, and a pattern of specific, serious complaints from users. This article aims to go beyond marketing claims and provide a fact-based analysis of OneRoyal's trustworthiness.

WikiFX Broker

Latest News

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Precious Metals Surge: Central Banks and Fed Outlook Fuel 'Bare-Knuckle' Bull Market

RIFAN FINANCINDO BERJANGKA Review (2025): Is it Safe or a Scam?

Fed’s Paulson Douses Rate Cut Hopes, Strengthening 'Higher for Longer' Case

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Is BotBro Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc