Hantec Financial: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Hantec Financial and its licenses.

Hantec Financial is a forex broker operating under multiple regulatory licenses. It holds a WikiScore of 8.61 out of 10 on WikiFX, a global platform that assesses brokers based on regulatory status, platform performance, and user feedback.

Hantec Financial is licensed in several jurisdictions, including both tier-one and offshore regulatory environments.

In Australia, the broker is regulated by the Australian Securities and Investments Commission (ASIC) under License No. 000326907. ASIC is considered a major financial regulator that oversees financial service providers in Australia.

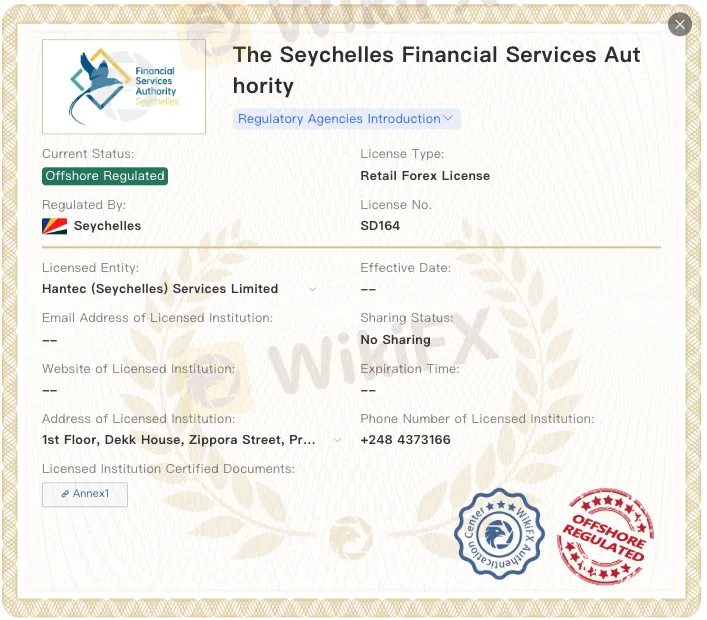

The broker also holds a Retail Forex License issued by the Seychelles Financial Services Authority (FSA), under License No. SD164. The FSA provides regulatory oversight for non-bank financial institutions operating in Seychelles.

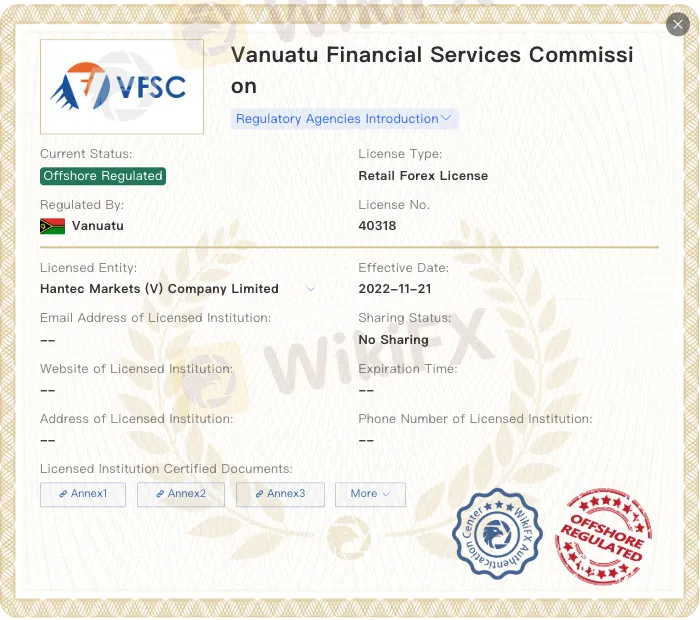

Additionally, Hantec is licensed by the Vanuatu Financial Services Commission (VFSC) under License No. 40318. Like Seychelles, Vanuatu is classified as an offshore jurisdiction and imposes a formal set of requirements for licensed entities.

With both tier-one and offshore licenses, Hantec Financial is positioned to serve a broad international client base. Its ASIC license enables it to operate in highly regulated markets, while its offshore licenses support access to other regions where regulatory requirements may differ.

The brokers WikiFX score of 8.61 is based on factors such as trading environment, platform stability, customer service, and regulatory compliance. The score reflects publicly available information and third-party evaluations.

Conducting due diligence carefully before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

WikiFX Invitation Rewards Program

Mentari Mulia Review : Is This BAPPEBTI-Regulated Indonesian Forex Broker Right for You?

Energy Crisis Deepens: Hormuz Blockade Risks Physical Supply Shock

ECB Watch: Energy Shock Won't Derail Policy Path, Says Nomura

Oil War Shock: Diesel Futures Surge 34% as White House Pledges Military Escort for Tankers

Middle East conflict poses fresh test to central banks as oil shock fuels inflation

AUD & NZD Slip as Mixed China PMI Data Clouds Recovery Signal

Nigeria: Tinubu Overhauls Fiscal Team Amid Fuel Price Hike and Inflationary Pressures

Global Divergence: Eurozone Inflation Fears vs. China's "Value" Play

Geopolitical Shock: Reports of Iranian Drone Strike on U.S. Embassy in Riyadh

Rate Calc