What WikiFX Found When It Looked Into Vestrado

Abstract:When evaluating a forex broker, regulation and transparency are crucial indicators of trustworthiness. Unfortunately, not all brokers meet these essential standards. Vestrado, a trading platform currently operating in the global forex market, presents several concerning issues that traders should not ignore.

Vestrado claims to operate under the license of South Africas Financial Sector Conduct Authority (FSCA). While it does hold License Number 51891, its regulatory status is flagged as “Exceeded”, which means Vestrado operates beyond the authorized business scope of this license. This type of status often signals potential misuse or misrepresentation of licensing, which should immediately raise caution among traders. The FSCA is generally known for enforcing rigorous standards in the financial sector, but exceeding the licensed scope undermines that protection and calls into question the broker's integrity.

In addition to the FSCA, Vestrado is registered in Saint Vincent and the Grenadines (SVG), that is a jurisdiction well known for lax or virtually nonexistent oversight of forex and CFD brokers. SVG allows businesses to register with minimal regulatory hurdles, making it a hotspot for firms looking to avoid the scrutiny imposed by more serious financial authorities. While legal, this registration provides no meaningful protection to traders. When combined with the exceeded scope of the South African license, this dual-status points to a relatively higher-risk broker profile.

Operating from SVG with a questionable licensing status aligns with patterns seen in scams, where brokers present a facade of legitimacy while avoiding actual accountability. Without a credible regulatory body to hold the company responsible, users risk falling into traps such as withdrawal denials, account deactivation, or sudden changes in trading terms.

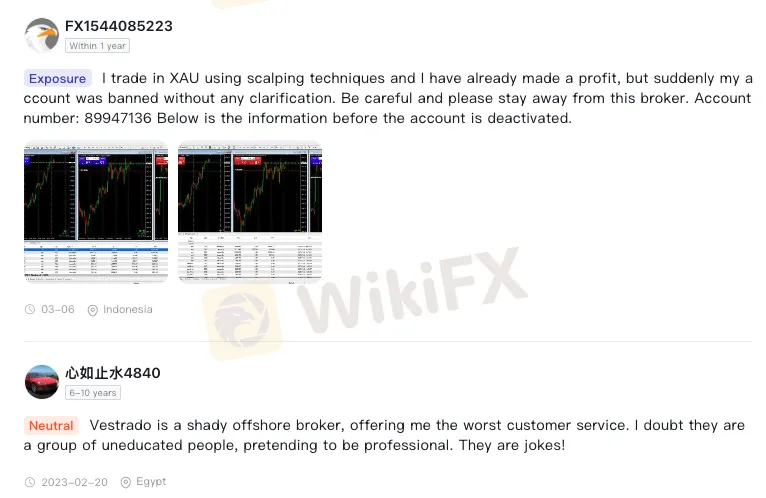

In addition to the regulatory gap, Vestrado has also received a few complaints from users. These unresolved issues can create trust concerns and may indicate weaknesses in customer support or ethical business operations.

The 2.19/10 WikiScore confirms the operational red flags surrounding Vestrado. This score reflects a poor overall evaluation of the brokers infrastructure, including software performance, customer support, business transparency, and most importantly, regulatory adherence.

Traders are strongly advised to exercise caution when selecting a broker. Always perform independent verification of a brokers regulatory status and licensing history. With the growing prevalence of forex scams, staying informed is your first line of defense.

Read more

Top 5 Forex Trading Risks Every Trader Must Handle Smartly

Forex trading is a dynamic market with fast-changing investor sentiments due to several economic, political and technical factors. So, while the profit avenues are massive, there is no denying the forex trading risks that can erode your capital value if not strategized properly. In this article, we will let you know of the top five forex trading risks you should handle effectively. Let’s begin!

Weekly Scam Alert: Avoid These Brokers & Protect Your Money!

If you haven’t seen the latest warnings, now’s the time. This article highlights brokers that have been reported as fraudulent. Stay updated and secure your investments.

Top Reasons Why You Should Avoid Trading with B Investor

Are you trading with B Investor and annoyed with poor withdrawal experiences? Have you been constantly made to deposit in the lure of high returns proposed by the broker officials despite results showing otherwise? Do you have to deal with unresponsive behavior from customer support executives? Wake up before it goes all wrong for you! Read on to know more.

SogoTrade Review 2025: Discover its Red Flags Now!

Forex trading is a risky space where scams happen every day. The best way to stay protected is by staying informed. This is another important article you shouldn't skip; it reveals the key warning signs of SogoTrade.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview Spyros Ierides:Asset management and investor resilience

US Deficit Explodes In August Despite Rising Tariff Revenues As Government Spending Soars

MultiBank Group — recent exposures, complaints, and who runs the firm

Glancing at the Top 5 Forex Risk Management Tools

Warning: UProfit Shows 5 Serious Red Flags- Stay Away!

Featuring Europe’s Premium Service Provider of the Year – Dynamic Works Syntellicore

Fibo Markets Officially Withdraws CySEC License

Axi Select Expands to MT5, Boosting Funded Trading

TradeStation Exposed: Investors Defrauded Over Hidden Fees, Complicated Spreads & Other Issues

5 takeaways from the producer price inflation report with another key reading on tap

Rate Calc