Charles Schwab Forex Review 2025: What Traders Should Know

Abstract:An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Profile Overview

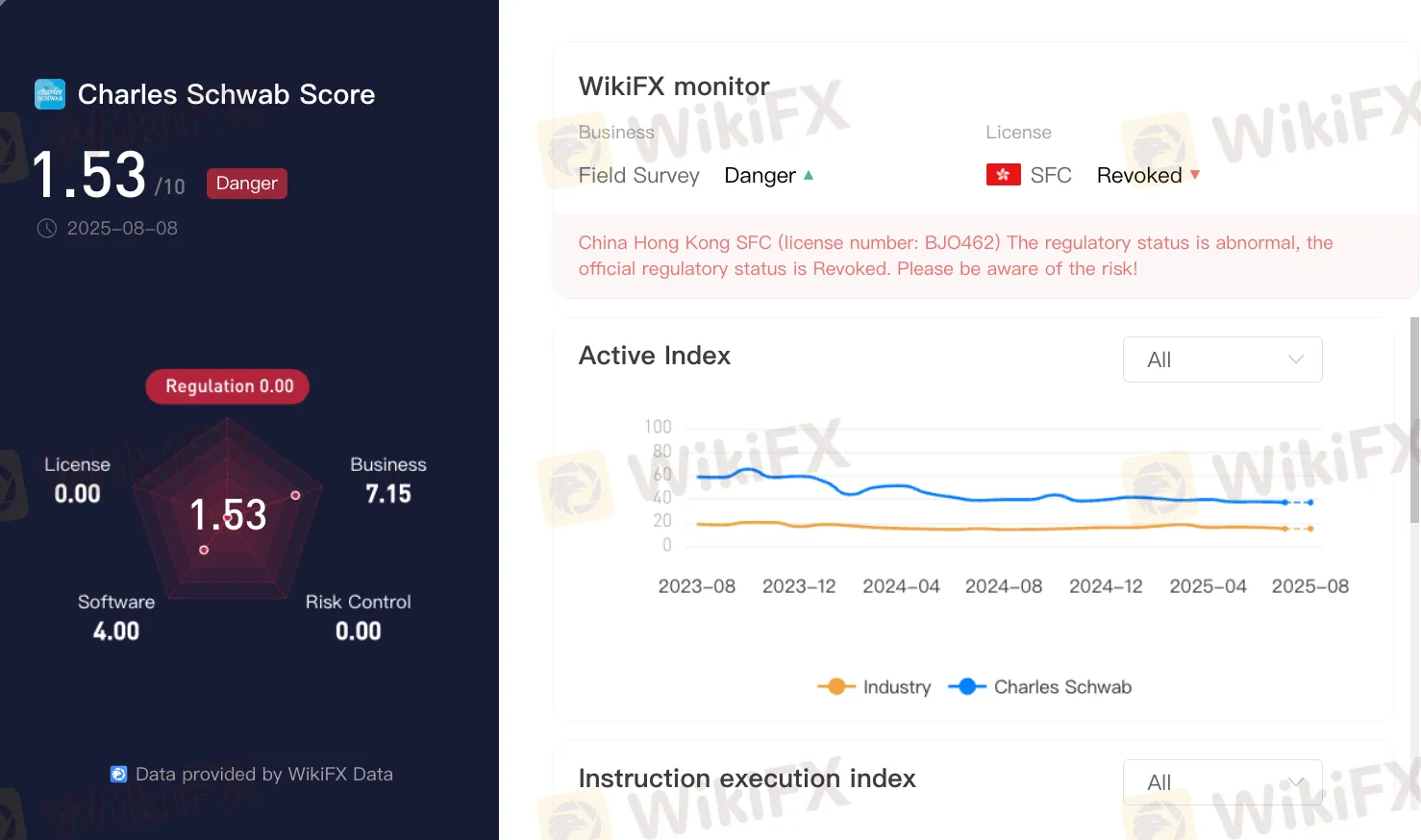

Charles Schwab is widely known as a major U.S. brokerage brand, but its presence in the forex market is limited. According to its broker profile, the company holds a rating of 1.53/10 with clear risk alerts and no active forex regulation displayed. Historical records also show a revoked Hong Kong futures licence connected to a previously affiliated entity.

Regulation and Historical Licensing

The profile data shows no current forex-specific regulatory licence. The revoked licence on record pertains to a Hong Kong futures authorisation, which is no longer active. While Charles Schwab operates in highly regulated U.S. securities and futures markets, these frameworks do not substitute for dedicated retail forex oversight in jurisdictions where such licensing is required.

Trading Services and Platform Offering

Schwab offers foreign exchange access primarily through Charles Schwab Futures and Forex LLC, focusing on select clients who meet eligibility requirements. This service is integrated within the companys proprietary trading systems rather than popular retail platforms like MT4 or MT5. For traders accustomed to retail-oriented FX environments with flexible account options and high-frequency execution, the structure may feel restrictive.

Geographic and Client Limitations

The forex service is not universally available. Access depends on client residency, account type, and meeting specific eligibility criteria. In some regions, Schwab does not provide retail forex trading at all, aligning more with its institutional and professional focus.

Assessment for Retail Traders

From a forex-only perspective, the combination of a low profile rating, absence of active FX regulation on record, and limited retail access makes Charles Schwab an unsuitable choice for traders seeking a dedicated, retail-focused forex broker. While the brand remains reputable in equities, ETFs, and wealth management, its role in the forex market is specialised and not designed for broad retail participation.

Conclusion

Charles Schwabs strength lies in its traditional brokerage and investment services, not in providing a wide-access retail forex platform. For traders whose primary interest is forex, especially on MT4/MT5 with competitive retail terms, alternative brokers with active forex regulation and higher FX-focused ratings should be considered.

Read more

Biggest 2025 FX surprise: USD/JPY

It has been a bearish year for the US dollar, but the biggest surprise has been the USD/JPY pair for me in the FX space. By Christmas eve, the Dollar Index (DXY) was down 9.6% year-to-date, trading around 98.00, its weakest level since 2022.

Common Questions About Exnova: Safety, Fees, and Risks (2025)

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

Common Questions About MIFX: Safety, Fees, and Risks (2025)

If you are looking into the Indonesian forex market, you have likely crossed paths with MIFX (Monex Investindo Futures). They are significantly influential in Southeast Asia, particularly Indonesia, with a footprint expanding into Malaysia and Vietnam. But popularity doesn't always equal safety.

VenturyFX Review 2025: Safety, Features, and Reliability

VenturyFX is a relatively new brokerage established in 2023 with its headquarters located in Mauritius. While the broker serves clients internationally, notably in regions such as Brazil/Colombia/Spain/Mexico, it currently operates without valid regulatory oversight. The broker holds a WikiFX Score of 1.37, which is considered low and indicates a high-risk environment for traders.

WikiFX Broker

Latest News

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Fake Government Aid Scams Are Wiping Out Elderly Savings

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Rate Calc