Gold Pulls Back From Highs: FOMO or Just a Pause Before Another Rally?

Abstract:According to the FedWatch Tool, markets still price in a high probability of three rate cuts this year, with a 25 bps cut in September unchanged. This suggests optimism around the U.S. labor market re

According to the FedWatch Tool, markets still price in a high probability of three rate cuts this year, with a 25 bps cut in September unchanged. This suggests optimism around the U.S. labor market remains intact—whereas our view is notably more cautious.

Gold briefly touched $3,673.72/oz yesterday before reversing lower. The question now: does optimism over rate cuts point to a temporary pullback before gold resumes its rally, or has the irrational chase of a FOMO rally finally ended?

Our view: this is still a FOMO rally.

Yesterday‘s release of preliminary revisions to nonfarm payrolls (Apr 2024–Mar 2025) indicated a weaker labor market. Bloomberg’s Chief Economist Anna Wong argued that the labor market may face another downturn in the first half of 2025. According to Wong, the U.S. economy is “either still in recession or just entering a new business cycle.”

She highlighted the link between payroll data and the Fed‘s pivot to rate cuts. While the labor market remained weak through much of 2024—contradicting the market’s view that the Fed was “behind the curve”—the Feds decisive 50 bps rate cut in September 2024 supported a rebound. Payrolls picked up, with the three-month moving average reaching 133,000 in December. However, when the Fed paused cuts in early 2025, job growth quickly stalled again.

From our perspective, this is a flawed but appealing narrative.

Indeed, rate cuts have undeniable positive effects:

Lower borrowing costs for households (mortgages, auto loans, credit loans).

Cheaper financing for businesses (bank loans, bond issuance).

Support for equities, housing, and bond prices.

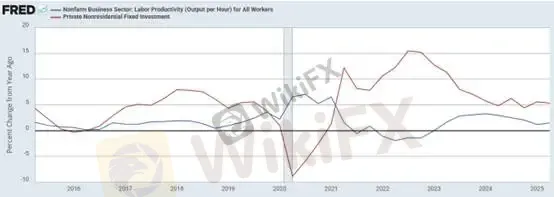

The red line represents private capital investment, while the blue line shows unit labor productivity. The widest gap appeared in Q4 2022 before converging steadily, driven largely by layoffs improving output per worker.

Private investment and productivity both sustain economic momentum. Yet, since Q1 2024, labor productivity has declined while capital expenditure remained stable—helped by AI adoption and the U.S. manufacturing renaissance narrative. Structurally, business investment is unlikely to collapse.

The greater risk lies in productivity. Initially, firms respond to softer demand by slowing hiring—a common first step when profits remain intact. But once profit margins are squeezed (via tariffs or weaker sales), layoffs become unavoidable. AI may boost efficiency, but cutting labor costs remains the most immediate way to preserve earnings.

If this cycle echoes 2022, we foresee a “cash is king” environment, where both risk assets and gold may suffer until the Fed halts balance sheet reduction—likely the trigger for the next broad rally.

This reflects our medium-term market outlook, which we will unpack in further detail in upcoming reports.

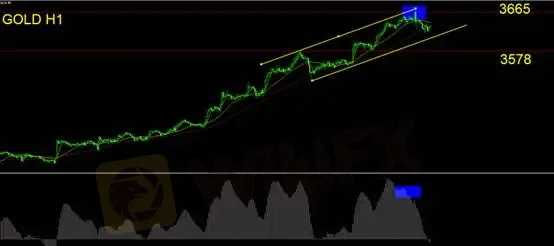

Gold Technical Outlook

Using MACD, the current pullback reflects a second bearish divergence. We believe the correction is still unfolding. The daily candlestick chart has turned lower, signaling a reversal. Short-term traders may consider tactical shorts, with stop-losses at $3,675.

Over the past several sessions, we advised staying sidelined until a reversal confirmed. With the setup now materialized, we recommend active positioning—while avoiding late-cycle chasing of longs.

Support: 3,578

Resistance: 3,665

Risk Disclaimer: The views, analysis, research, and price levels above are for general market commentary only and do not represent the stance of this platform. Readers assume full responsibility for their trading decisions. Please exercise caution.

WikiFX Broker

Latest News

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc