Memory Market Enters Super Cycle of Price Hikes, With Limited Impact on Consumer Inflation

Abstract:Equity markets continue to benefit from the AI arms race, which is driving strong growth in corporate revenues. Memory demand has surged sharply, fueling risk-on sentiment. The rally in DRAM pricing s

Equity markets continue to benefit from the AI arms race, which is driving strong growth in corporate revenues. Memory demand has surged sharply, fueling risk-on sentiment. The rally in DRAM pricing stems from production reallocation toward AI servers, widening the supply gap for standard DRAM (DDR4) and niche DRAM (DDR3). As a result, corporate investment momentum and household consumption are diverging.

Typically, commodity price upcycles spill over into higher inflation. However, the current memory price surge has yet to fully pass through to consumer electronics such as TVs, IoT devices, and smartphones. Given the longer procurement cycles, most end-users are unlikely to notice price hikes tied to memory costs. As a result, the inflationary impact on consumer goods remains muted.

Micron, Samsung, SK hynix, and Chinas CXMT are ramping up production in response to surging demand for HBM and DDR5. Training large-scale AI models such as GPT and LLaMA requires massive volumes of high-bandwidth, low-power memory, making HBM essential for GPUs and AI accelerators. Major players like NVIDIA, AMD, and Google (TPU) are securing large HBM orders. AI servers also require significantly more DDR5 capacity, commanding far higher average selling prices compared to traditional PCs or smartphones.

Whereas memory demand used to be driven mainly by PCs and smartphones, AI servers now deploy far greater memory per unit, pushing overall contract pricing up nearly threefold.

(Chart 1. Standard DRAM Contract Prices; Source: MacroMicro)

This divergence—booming corporate investment vs. subdued consumer spending—underscores how the U.S. economy is increasingly being driven by investment rather than household demand. Such an overreliance on AI-related capex leaves the broader economy vulnerable: while IT and software investment surge, labor market weakness and sluggish activity outside the AI sector highlight uneven fundamentals.

For this reason, we remain cautious toward the current exuberance in capital markets. Seasonal consumer demand remains conservative, suggesting that corporate earnings may not keep pace with elevated equity valuations. Valuation risk therefore remains a key concern for investors.

(Chart 2. Blue – U.S. IT Equipment Investment; Green – Software Investment; Brown – Private Consumption; Source: FRED)

Meanwhile, beyond equities, precious metals continue to rally as risk assets attract speculative inflows. Our stance remains unchanged: the “head” and “body” of the gold rally represent sustainable long-term opportunities, but the “tail” should be approached cautiously, with patience for a pullback before re-entering positions.

Gold Technical Analysis

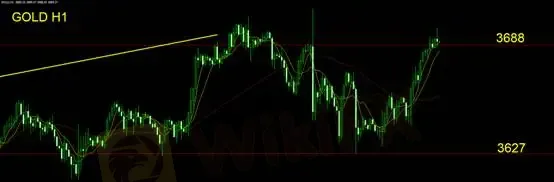

On the daily chart, gold rebounded after dipping below the 5- and 10-day moving averages, retesting the prior high at $3,688/oz, which now serves as short-term resistance (based on closing levels). Historically, a breach of short-term moving averages signals either trend reversals or range-bound trading.

For intraday strategies, investors may consider range trading between $3,627 and $3,688—selling near resistance and buying near support. Alternatively, a wait-and-see approach is reasonable until clearer momentum emerges.

Bias: Neutral-to-bearish

Stop-loss suggestion: $15

Support: $3,627

Resistance: $3,688

Risk Disclaimer: The views, analyses, research, prices, and other information presented herein are provided solely as general market commentary and do not represent the official stance of this platform. All readers should evaluate their own risk tolerance before making trading decisions.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc