Promised Recession... So Where Is It?

Abstract:Over the past three years, the economic conversation has been a If you read the headlines, tracked e

Over the past three years, the economic conversation has been a If you read the headlines, tracked economist surveys, or even listened to Wall Street strategists, you would have assumed a downturn was imminent. Many investors, bloggers, and YouTubers have had a promising a recession is just on the horizon.The logic was simple enough. The Federal Reserve aggressively hiked rates from near zero, inflation spiked to four-decade highs, the yield curve inverted for the longest stretch on record, manufacturing surveys collapsed, and stocks entered a bear market in 2022. Historically, those conditions have been reliable precursors to economic pain.

And yet, here we are, late into 2025, and the U.S. economy is still standing. Not only standing, but GDP remains broadly positive, unemployment is relatively low, and equity markets sit at record highs. If the were near, none of that would be the case, and for many investors, the has been one of the great surprises of this cycle.

But does that mean weve escaped it altogether? Or is the downturn still lurking, delayed by policy distortions and fiscal largesse?

I want to tackle that question today because how we answer it matters for portfolio strategy. Both the and the cases have merit. Each has its own probabilities, risks, and market implications.

Why a Recession Still Looks Plausible

Lets start with the bear case.

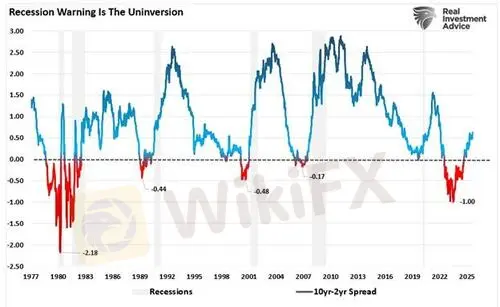

History tells us that a recession almost always follows when the yield curve inverts, well, technically, it is when it UN-inverts. Nonetheless, since the 1960s, every sustained inversion has been followed by an economic contraction, sometimes quickly, sometimes with a lag. The inversion that began in 2022 was the deepest and longest weve ever experienced. If that signal still carries weight, it is logical that we should expect economic weakness to emerge.

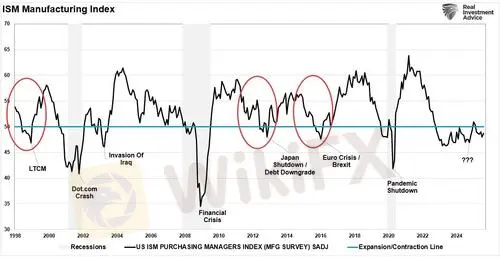

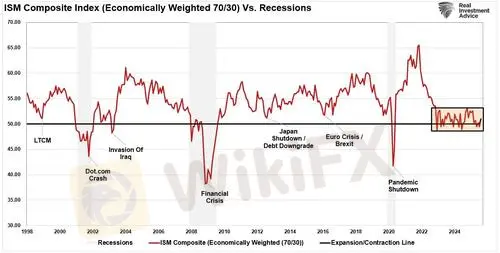

Further, manufacturing activity has been in contraction territory for most of the past three years. The ISM Manufacturing Index, long viewed as a leading indicator, recorded 26 straight months below 50 through early 2025, briefly perked up, and then rolled back into contraction again. Historically, that kind of persistent weakness doesnt happen in a vacuum. It usually shows up in corporate earnings, hiring, and consumer confidence.

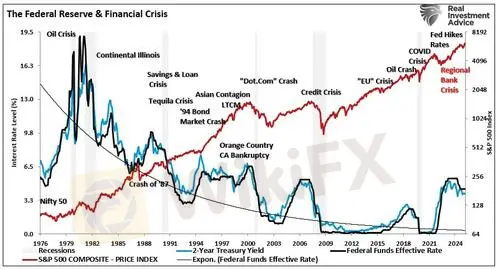

In addition, the role of Fed tightening has been added. Monetary policy famously operates with The most aggressive hiking cycle in four decades would always take time to filter through credit markets, household spending, and corporate balance sheets. Post-pandemic distortions and massive fiscal deficits may have extended the lag, but we should expect that the effect hasnt been repealed.

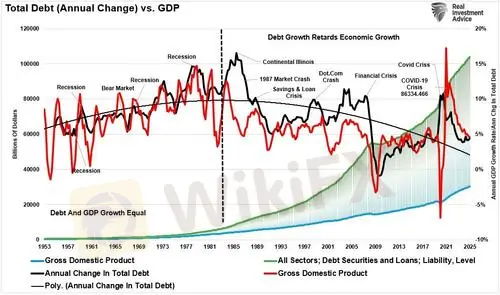

And speaking of deficits, that‘s another issue. Washington has effectively been running crisis-level stimulus despite a growing economy. Federal spending has helped mask underlying weakness. But it’s also raised debt-to-GDP ratios to levels that will eventually constrain fiscal policy. The from deficit-financed growth is not permanent, particularly since debt detracts from economic growth in the long term.

Finally, valuations, as we discussed recently.Equity markets are priced for perfection, with mega-cap tech leading the charge. That means if growth does falter, even modestly, the downside could be amplified by the simple reality of stretched multiples.

Taken together, these factors suggest the recession call wasn‘t wrong so much as early. The patient looks healthy today, but the test results show underlying conditions that can’t be ignored.

If we were to assign a probability of a recession in the next 12-18 months, it is likely somewhere around 55%.

Why the Economy Might Dodge It

Now, lets give the bulls their due and explain why they were right to dismiss the

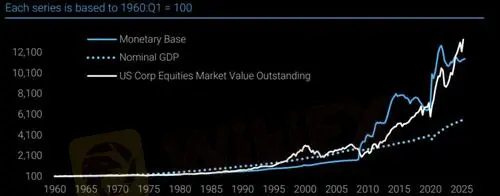

The biggest reason we havent fallen into recession is simple: spending. Both consumers and the government have been more resilient than expected, and the massive amount of liquidity injected into the economy following the pandemic has created enormous distortions to economic data. The huge surge in the monetary base has not fueled the in the economy, but has sustained activity.

Despite higher interest rates, households benefited from excess savings built up during the pandemic, increased wealth from housing and markets, and a historically tight labor market kept nominal wages elevated. As such, people kept spending and went further into debt, which kept GDP afloat.

Meanwhile, government deficits have poured unprecedented amounts of cash into the system outside of a crisis period. Infrastructure projects, industrial policy initiatives, and enment spending have all provided ongoing support. In effect, Washington has been running permanently, which has kept normal recessionary factors from occurring.

Second, the nature of the economy itself has shifted. The U.S. is far more services-driven today than in past cycles. Manufacturing weakness is notable, but it only represents about 30% of the economy today versus nearly 70% in the 70s. Given that it is a much smaller factor in the economy, it is services that we should focus on, and while weak, they have not been in recessionary territory. The chart below, an economically weighted composite of ISM Services and Manufacturing, shows that recession risks are elevated, but no recession is likely at the moment.

Third, corporate America has adapted remarkably well. Companies took advantage of ultra-low rates in 2020–2021 to refinance debt. Their balance sheets are stronger overall, and many firms have locked in cheap financing for years. That reduced the immediate pressure of higher Fed funds rates. However, such is not likely the case for smaller and mid-capitalization companies, and the risk of a rise in bankruptcies is not zero when they must refinance their debt. That could weaken economic growth but is not necessarily a guaranteed recessionary outcome.

Finally, the Federal Reserve itself has shown a willingness to pivot quickly. After hiking aggressively, the Fed began cutting in September, signaling that and preventing unnecessary economic damage were priorities. Whether you agree with it or not, that backstop has provided psychological support to markets and businesses alike.

The bulls argue that these structural and policy supports could allow the U.S. to avoid a traditional recession altogether. Growth may slow, productivity gains may cushion margins, and the expansion could grind on longer than skeptics expect.

But that is also not a guarantee, and the assigned probability of in the next 12-18 months at 45%.

What This Means for Markets

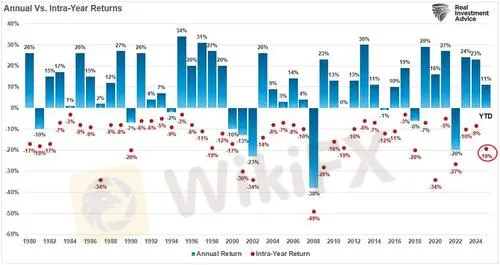

For investors, the probabilities matter less than the preparation. Whether the economy slips into recession or not, the implication is that volatility will remain elevated, and risk management is essential. It also does not mean the financial markets cant experience a 5, 10, or 20% correctionoutside the

If the recession scenario plays out, equity valuations will likely compress, earnings estimates will fall, and risk assets will reprice lower. Defensive sectors, like utilities, staples, and healthcare, could outperform. Treasury bonds, ironically left for dead in 2022, would likely provide ballast as yields decline in a flight to safety.

If the no-recession scenario materializes, markets may not be either. Corrections occur annually and can impact portfolio performance and investor psychology. With much of the narrative already priced in, the risk of correction is elevated. The S&P 500 is trading at multiples historically reserved for periods of strong, broad-based growth, leaving little margin of safety. Even modest disappointments could trigger corrections.

I always return to risk management here. As Ive written many times, investing is not about making bold predictions but instead aligning portfolios to probabilities, protecting against the downside, and participating in the upside when it comes.

Today, that means remaining cautious even as markets cheer new highs. It means trimming exposure where valuations are stretched, holding a healthy allocation to cash and fixed income, and being selective in equity exposure. It means acknowledging that both outcomes—recession and no recession—are plausible and positioning accordingly.

Lets also step back and acknowledge the broader lesson. Economists have a terrible track record at calling recessions.

Both times, they were wrong. Why? Because the economy is not a machine that spits out predictable results. Its a complex, adaptive system shaped by human behavior, policy distortions, and unforeseen shocks. Models can tell us what happen, but a or not, reality often finds a way to surprise us.

That doesnt mean we ignore the indicators. Yield curves, manufacturing surveys, and credit spreads all have information content. But it does mean we treat them as part of a broader mosaic, not as gospel.

As an investor, humility is key. The market doesnt owe us clarity. The job is not to know the future with certainty, but to navigate the uncertainty with discipline.

So forget about a and focus on what matters.

WikiFX Broker

Latest News

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

HEADWAY: The Fast Track to Financial Dead-Ends?

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

Delta Fx Review: Are Technical Glitches and Scam-Like Practices Draining Trader Profits?

Deriv Review and Global Regulation Explained

Rate Calc