SAXO Bank: A Closer Look at Its Licenses

Abstract:Saxo Bank, a multi-asset broker, has long been recognized as a major player in the global trading landscape. Through WikiFX, we gain deeper insight into the broker’s regulatory standing, reliability, and the real experiences of traders.

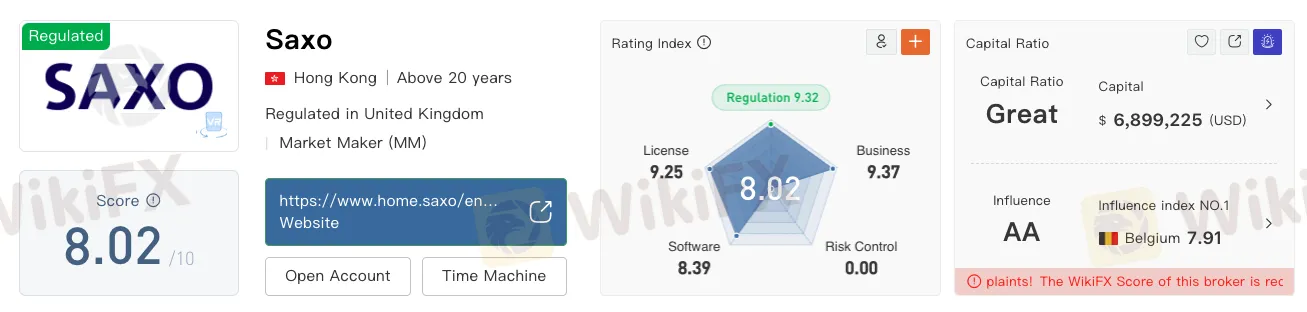

Saxo Bank, a multi-asset broker, has long been recognized as a major player in the global trading landscape. Through WikiFX, we gain deeper insight into the brokers regulatory standing, reliability, and the real experiences of traders. With a WikiScore of 8.02 out of 10, Saxo Bank stands above many peers in terms of compliance and transparency. However, the picture is not entirely positive, as the Exposure section of WikiFX highlights a number of trader complaints that potential clients should weigh carefully.

WikiScore: A Balanced Indicator

WikiFX assigns Saxo Bank a WikiScore of 8.02/10, reflecting strong regulation, global presence, and a relatively sound compliance record. This score is a composite index, calculated on the basis of licensing, business scope, risk control, and user feedback.

View WikiFXs full review on Saxo Bank here: https://www.wikifx.com/en/dealer/0001734976.html

An 8.02 score places Saxo Bank among the better-rated brokers, suggesting that it operates with a reasonable degree of trustworthiness. Yet, WikiScore is not a guarantee of flawless service. Instead, it signals that the broker has solid regulatory backing but still carries risks that prospective investors must consider.

Licensing and Global Regulatory Status

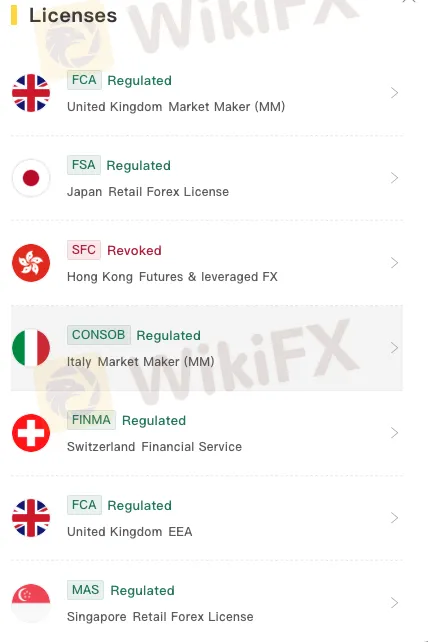

Saxo Bank operates under multiple licenses across various jurisdictions. The broker‘s regulatory structure is extensive, though some licenses have been revoked, which calls for scrutiny. Below is a breakdown of Saxo Bank’s licenses according to WikiFX data:

- United Kingdom (FCA) – Market Maker (MM), Regulated

- Japan (FSA) – Retail Forex License, Regulated

- Hong Kong (SFC) – Dealing in futures & leveraged FX, Revoked

- Italy (CONSOB) – Market Maker (MM), Regulated

- Switzerland (FINMA) – Financial Service, Regulated

- United Kingdom (FCA) – EEA Representative, Regulated

- Singapore (MAS) – Retail Forex License, Regulated

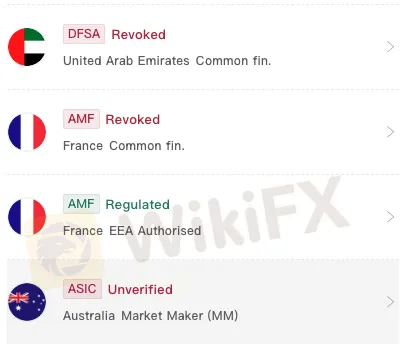

- United Arab Emirates (DFSA) – Common Financial Service License, Revoked

- France (AMF) – Common Financial Service License, Revoked

- France (AMF) – EEA Authorised, Regulated

- Australia (ASIC) – Market Maker (MM), Unverified

This diverse regulatory footprint underscores Saxo Banks ambition as a global brokerage. The presence of high-tier regulators such as the FCA (UK), MAS (Singapore), and FINMA (Switzerland) adds significant credibility. However, the revoked licenses in Hong Kong, UAE, and France highlight compliance challenges and regulatory pressures faced in certain markets.

For traders, the message is twofold: Saxo Bank remains a well-regulated broker in several top jurisdictions, but its withdrawal or loss of licensing in others may affect service availability and credibility in those regions.

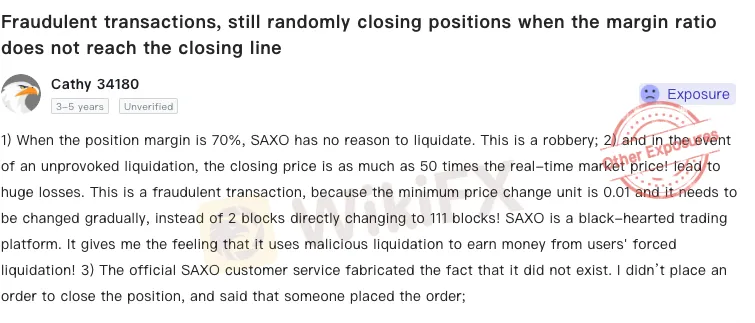

Exposure Page: Complaints from Traders

While regulatory credentials suggest strength, user feedback on WikiFX‘s Exposure page paints a more complex picture. Several traders have filed complaints regarding Saxo Bank’s services. Common themes include:

- High Fees and Hidden Charges

- Clients complained about unexpectedly high fees for currency conversion, overnight financing, and inactivity.

- Several noted that these charges significantly reduced their profits.

- Customer Support Concerns

- Multiple users expressed dissatisfaction with Saxo Banks customer support, describing slow response times and inadequate solutions to urgent issues.

These complaints should not overshadow the broker‘s strengths but serve reminders. They suggest that despite Saxo Bank’s regulatory compliance, service quality and customer experience could occasionally remain contentious points for some users.

Strengths of Saxo Bank

- Robust Regulation: Supervision under FCA, MAS, FINMA, and CONSOB ensures high compliance standards.

- Reputation and Longevity: With decades in operation, Saxo Bank has established itself as a global brokerage leader.

- Product Range: Offers access to a wide variety of asset classes including forex, equities, commodities, bonds, ETFs, and CFDs.

- Technology: Proprietary platforms (SaxoTraderGO and SaxoTraderPRO) provide advanced charting and trading tools, appealing to professional traders.

Weaknesses and Risks

- Revoked Licenses: Regulatory withdrawals in Hong Kong, the UAE, and France indicate potential compliance issues.

- User Complaints: Repeated allegations of withdrawal delays, high fees, and poor customer support cannot be ignored.

- Unverified License (ASIC): The unverified status in Australia reduces credibility for traders in that market.

- Complex Pricing Structure: High minimum deposits and tiered fee systems make Saxo Bank less accessible to casual or beginner traders.

Conclusion: Should You Trust Saxo Bank?

Saxo Bank earns a strong WikiScore of 8.02/10, backed by multiple high-level regulatory licenses and a global footprint. For experienced traders who prioritize access to a wide range of markets and advanced trading platforms, Saxo Bank remains an attractive option. Its regulatory oversight under the FCA, MAS, and FINMA is relatively reassuring.

However, the broker is not without shortcomings. Revoked licenses in several jurisdictions raise concerns, while trader complaints on WikiFXs Exposure page highlight issues with withdrawals, fees, and customer support. These reports suggest that while Saxo Bank is not a scam, it may not always deliver a seamless trading experience for all clients.

Final Verdict: Saxo Bank is a legitimate and well-regulated broker, but prospective clients should remain cautious. Traders are advised to carefully review fee structures, start with small deposits, and monitor withdrawal processes before committing large funds. As always, doing independent due diligence alongside WikiFXs resources can help mitigate risks.

Read more

JP Markets Review: High Spread & Commission, Fake Bonus Lure & Withdrawal Hassles Frustrate Traders

Have you been lured into opening a JP Markets Forex Trading Account with a high bonus offer that never existed? Have you found the spread and commission charges higher on JP Markets Login than what’s advertised on the broker’s website? Wondering why you are not able to withdraw funds from your trading account? Well, all of these hint at a potential forex investment scam. Many traders have expressed their disappointment while sharing the JP Markets Review online. In this article, we have shared certain complaints. Take a look at them.

Angel one 2025 Review & Complaints

Angel One is a well-known name in the forex market. People are familiar with the name , but is this broker really worth your interest? What do real users say about Angel One, and what complaints have they shared? In this Angel One 2025 review, you will explore all these details.

Exclusive Markets Under the Scanner: Traders Report High Swap Charges, Deposit Discrepancies & More

Is your forex trading account experience at Exclusive Markets far from good? Do you witness high swap fees and daily charges? Does the deposit fail to reflect in your Exclusive Markets Login? Don’t receive adequate response from the customer support official on your trading queries? You are not alone! Traders have already alleged that the forex broker is involved in these activities. In this Exclusive Markets WikiFX review article, we shared some traders’ comments. Read on to know about them.

Interactive Brokers Fined for FINRA Market Data Lapses

Interactive Brokers fined $150,000 by FINRA over Vendor Display Rule violations and supervisory gaps; firm adds real-time consolidated data displays.

WikiFX Broker

Latest News

Angel one 2025 Review & Complaints

Latest FCA Daily Alerts and Consumer Warnings for 2025

Webull Widens Crypto Futures with Coinbase Derivatives

Is Nash Markets Regulated or Risk? Truth About Nash Markets’ License & Withdrawal Issues

CySEC Blocks Certification Access to Combat Advisor Impersonation

Exclusive Markets Under the Scanner: Traders Report High Swap Charges, Deposit Discrepancies & More

Pinched By Penny Shortage, US Retailers Beg Congress To Step In

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Saxo Bank Japan Expands European Stock Portfolio with UBS, Ferrari, and Other Major Names

Amillex Broker Affiliate Program: A Complete Guide to Earning with Referrals

Rate Calc