Lack of Internet Access Hindering Your Cashless Payments? Embrace RBI’s Offline Digital Rupee

Abstract:The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country’s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country‘s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

Access Digital Payments Without Internet

Contrary to UPI and other online payment systems requiring Internet connectivity and linked bank accounts, the new initiative facilitates direct transfers within wallets, a financially defining moment for rural and remote locations with limited banking infrastructure or network access. With no reliance on online networks for payments, millions of unbanked and underbanked citizens can enjoy secure digital transactions.

Technologies Behind the Financial Masterpiece

The new initiative, i.e., e₹, incorporates two transformative technologies for seamless offline digital payments - Near Field Communication (NFC) and Telecom-Assisted Payments. While NFC allows instant fund transfers within NFC-enabled devices using a simple tap, telecom-assisted payments facilitate transactions even under the least network availability. All these ensure simple, seamless, and universal digital transactions.

15 Participating Banks for e₹

Users can seamlessly access e₹ through the digital wallets of 15 participating banks. The bank list includes the State Bank of India (SBI), ICICI Bank, and HDFC Bank. Here are the salient features of this initiative.

- No need for a minimum balance

- Daily transaction up to ₹50,000 or 20 transfers

- Maximum wallet balance - Up to ₹1 lakh

- Protection for user funds amid device loss or theft with secure recovery mechanisms

Users can access wallets through official banking apps.

Programmable Money for Targeted Use

The new initiative comes with a new dimension - Programmable Money - by which funds can be geofenced for use within certain areas, remain time-bound for usage within a set period, or be limited to specific needs. These features make the e₹ especially beneficial for government welfare schemes, benefit reimbursements, and corporate payrolls. This ensures that funds are utilized as intended, boosting accountability and transparency.

What Does the RBI Governor Have to Say on e₹?

RBI Governor Sanjay Malhotra hailed e₹ as a transformative step in India‘s digital evolution. He stated that the Offline Digital Rupee enhances India’s digital public infrastructure by providing a secure, reliable, and inclusive payment solution to citizens across the country. The initiative helps India enter into a select group of countries having witnessed a successful Central Bank Digital Currency (CBDC) with offline functionality.

Financial Inclusion to Strengthen Further

According to experts, this RBI initiative will aid in financial inclusion, especially among rural and low-income populations with network or banking barriers. Other likely benefits include reduced reliance on cash, improved payment experience, and smart government transfers and corporate settlements.

Summing Up

The launch of the Offline Digital Rupee (e₹) marks a significant milestone in Indias digital finance revolution. By enabling seamless payments without Internet or mobile connectivity, the RBI has addressed one of the most critical barriers to financial inclusion. With advanced technologies like NFC and telecom-assisted payments, and features such as programmable money, the e₹ stands as a forward-looking solution that bridges the digital divide. As the initiative expands through leading banks and gains public adoption, it is poised to redefine the way India transacts—empowering every citizen to be part of a truly cashless and connected economy.

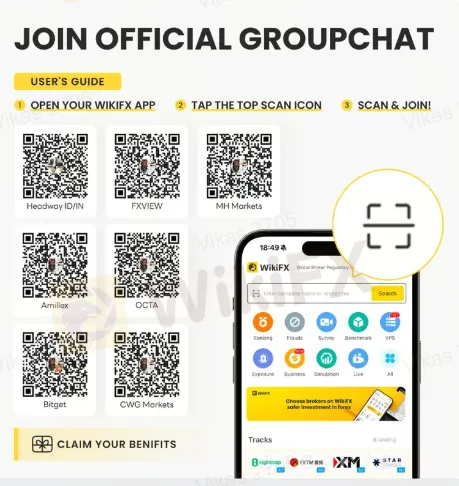

For more insights on forex brokers, trader ratings, and key market updates, join our official chat groups — your gateway to a remarkable forex trading journey - through any of the below QR codes or ID:EODL15W5IH.

Read more

What Does Pip Mean in Forex Trading?

In forex trading, a pip is the smallest unit of price movement between two currencies. It’s used to measure changes in exchange rates, calculate profits or losses, and manage trading strategies effectively.

What Is a Forex Expert Advisor and How Does It Work?

A forex expert advisor is an automated trading tool that executes strategies in the forex market. Learn how it works, its benefits, risks, and future trends.

What Is a Liquid Broker and How Does It Work?

A liquid broker connects traders to deep forex liquidity from banks and institutions, offering faster execution, tighter spreads, and transparent real-market pricing.

Geopolitical Risk: Israel Sets New "Missile Red Line" for Iran

Global markets are on alert for potential supply-side shocks in energy markets as tensions between Israel and Iran escalate significantly. Israeli officials have signaled a lower threshold for preemptive military action, shifting their "red line" from nuclear development to the reconstitution of Iran’s conventional ballistic missile arsenal.

WikiFX Broker

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

What Is a Forex Expert Advisor and How Does It Work?

Rate Calc